2014 Cadillac Xts Luxury on 2040-cars

9921 US HWY 19, Port Richey, Florida, United States

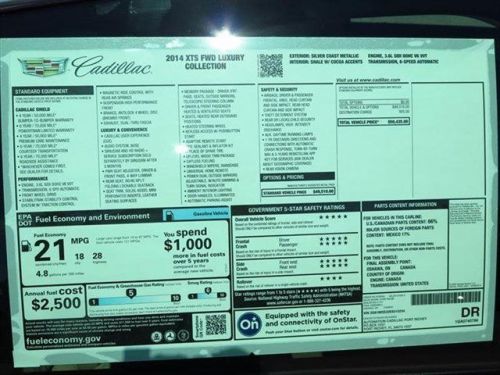

Engine:3.6L V6 24V GDI DOHC

Transmission:6-Speed Automatic

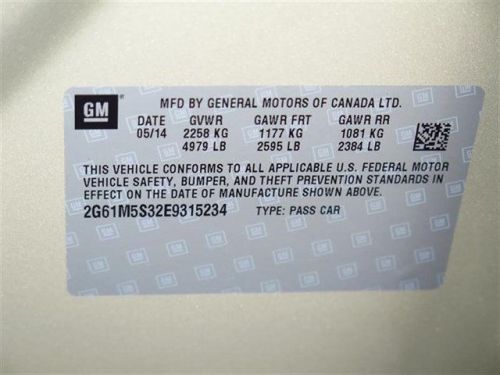

VIN (Vehicle Identification Number): 2G61M5S32E9315234

Stock Num: E9315234

Make: Cadillac

Model: XTS Luxury

Year: 2014

Exterior Color: Silver Coast Metallic

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 6

Call our Internet Sales Department and Save an additional $200 off the Internet Price listed above.

Cadillac SRX for Sale

2014 cadillac xts base(US $42,685.00)

2014 cadillac xts base(US $42,685.00) 2014 cadillac srx performance collection(US $45,090.00)

2014 cadillac srx performance collection(US $45,090.00) 2014 cadillac xts premium(US $55,100.00)

2014 cadillac xts premium(US $55,100.00) 2014 cadillac xts base(US $41,540.00)

2014 cadillac xts base(US $41,540.00) 2014 cadillac srx luxury collection(US $42,810.00)

2014 cadillac srx luxury collection(US $42,810.00) 2014 cadillac srx luxury collection(US $44,055.00)

2014 cadillac srx luxury collection(US $44,055.00)

Auto Services in Florida

Zip Automotive ★★★★★

X-Lent Auto Body, Inc. ★★★★★

Wilde Jaguar of Sarasota ★★★★★

Wheeler Power Products ★★★★★

Westland Motors R C P Inc ★★★★★

West Coast Collision Center ★★★★★

Auto blog

Next-gen Cadillac CTS-Vs caught in parking lot

Thu, 10 Jan 2013A pair of camouflaged Cadillac CTS prototypes were spotted, and thankfully photographed, outside a grocery store in Southern California. From the image above - there are plenty more if you click over to TotalCarScore.com - it appears these could be testers for the 2014 CTS-V, but that is just speculation. We've seen the obvious "V" motif in the grille before, and there's what could be another "V" in the design of the side mirrors.

The hood on the car in the background appears to include two bulges, but the single shot that affords a tiny peek under the hood shows reveals only the airbox. Plenty of rumors, and the sight of an engine cover inscribed with the words "Twin Turbo," have caused people to wonder if a twin-turbo V6 will live under the production car's hood instead of the V8 currently there. In back, instead of the round tailpipes found outboard on all the CTS sedans, there's a pair of integrated tips in a parallelogram shape. A new shifter with contrasting stitching was spied in the cabin.

If predictions hold up it will arrive later this year. When it does, expect the body underneath all that camo to be softer on the eye compared to the current car - less science and more art. For now, hit the link to see more spy shots of what's coming.

General Motors Recall List

Wed, Oct 22 2014It seems General Motors can't go more than a few weeks without issuing a major recall. Since the initial ignition lock recall on February 10, over 25 million vehicles have been recalled for defects. It seems General Motors can't go more than a few weeks without issuing a major recall. Since the initial ignition lock recall on February 10, over 25 million vehicles have been recalled for defects. We used the National Highway Traffic Safety Administration recall list to compile a snapshot of all the GM vehicles recalled in the last two months. NHTSA also provides a search engine that allows owners to search for recalls on their vehicle. An automotive company must do everything in their power to notify its customers when a recall is issued on a vehicle. If you own any of the following vehicles and you have questions regarding your car, you can contact Chevrolet at 1-866-694-6546, GMC at 1-866-996-9463, Buick at 1-800-521-7300 and Cadillac at 1-866-982-2339. Or check out General Motor's recall site. Owners may also contact the National Highway Traffic Safety Administration Vehicle Safety Hotline at 1-888-327-4236 (TTY 1-800-424-9153) or go to www.safercar.gov. Here's a brief summery of the other vehicles currently under recall: July 26 – 414,333 cars affected NHTSA Campaign Number: 14V447000 Models under recall: Certain model year 2011-2012 Buick LaCrosse, Regal and Chevrolet Camaro, as well as certain 2010-2012 Cadillac SRX, Chevrolet Equinox and GMC Terrain vehicles, equipped with power height adjustable driver and passenger seats. Problem: In the affected vehicles, the bolt that secures the driver's and passenger's power front seat height adjuster may fall out causing the seat to drop suddenly to the lowest vertical position. Consequence: If the driver's seat unexpectedly drops, the distraction and altered seat position may affect the drivers' control of the vehicle, increasing the risk of a crash. Solution: Dealers will replace the height adjuster shoulder bolts, free of charge. July 14 – 16,939 cars affected NHTSA Campaign Number: 14V341000 Models under recall: Certain model year 2011 Cadillac CTS vehicles manufactured October 18, 2010, to June 2, 2011. Problem: In the affected vehicles, vibrations from the drive shaft may cause the vehicle's roll over sensor to command the roof rail air bags to deploy. Consequence: If the roof rail air bags deploy unexpectedly, there is an increased risk of crash and injury to the occupants.

Cadillac ATS coupe and sedan get Midnight Editions

Sun, Jul 19 2015Horror stories and fairy tales make a mint by having the scariest things happen at midnight, but automakers make a mint by marketing midnight. Chevrolet busted out a Silverado Midnight Edition early this year, followed shortly thereafter by an Impala Midnight Edition. In between those two we got the Cadillac CTS Midnight Edition, and now comes an ATS following in the zero-dark-thirty tradition, according to GM Inside News. The ATS Midnight Edition will add $1,695 to the sedan price and $600 to the coupe. For that cash outlay you get black chrome on the grille, around the windows, and on the rear fascia, 18-inch "After Midnight" wheels, "sueded microfiber" trim on the steering wheel and shifter, plus the Cold Weather Package with a heated steering wheel and heated front seats. Just those few exterior changes make a big difference up front, increasing the appeal and aggression of the sports sedan without being ostentatious. You can't go dark with just any old ATS, though. The package is limited to rear- and all-wheel-drive versions of the Performance trim. And the color palette is reduced to four hues: Crystal White Tricoat, Red Obsession Tintcoat, Phantom Gray Metallic, and Black Raven. The three possible interior combos are Light Platinum with Jet Black accents, Morello Red with Jet Black accents, and Jet Black with Jet Black accents. Related Video: Featured Gallery 2015 Cadillac ATS Midnight Edition News Source: GM Inside News Design/Style Cadillac Coupe Luxury Special and Limited Editions Performance Sedan