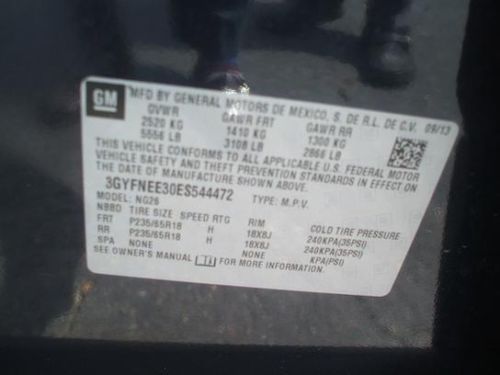

2014 Cadillac Srx Luxury Package. All Wheel Drive. on 2040-cars

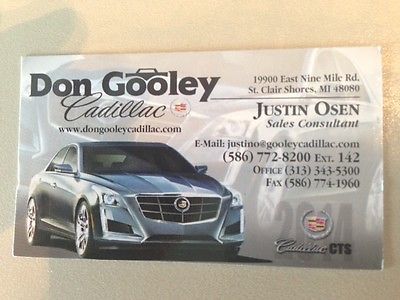

Saint Clair Shores, Michigan, United States

Cadillac SRX for Sale

2011 cadillac srx performance sport utility 4-door 3.0l

2011 cadillac srx performance sport utility 4-door 3.0l 2013 cadillac srx luxury /navigation/ panoramic roof/ rear camera/ blis

2013 cadillac srx luxury /navigation/ panoramic roof/ rear camera/ blis Premium navigation panoramic sunroof power tailgate heated and ventilated seats(US $28,928.00)

Premium navigation panoramic sunroof power tailgate heated and ventilated seats(US $28,928.00) 2011 cadillac srx awd! performance collection! navigation! pano roof! 20s! clean(US $29,900.00)

2011 cadillac srx awd! performance collection! navigation! pano roof! 20s! clean(US $29,900.00) 2012 cadillac srx/back up camera/ panoroof/ low miles/ leather/ no reserve

2012 cadillac srx/back up camera/ panoroof/ low miles/ leather/ no reserve 2013 cadillac srx performance sport utility 4-door 3.6l

2013 cadillac srx performance sport utility 4-door 3.6l

Auto Services in Michigan

Zaharion Automotive ★★★★★

Woodland-Kawkawlin Trailers ★★★★★

W L Frazier Trucking ★★★★★

Valvoline Instant Oil Change ★★★★★

Urka Auto Center ★★★★★

Tuffy Auto Service Centers ★★★★★

Auto blog

Submit your questions for Autoblog Podcast #325 LIVE!

Mon, 18 Mar 2013We're set to record Autoblog Podcast #325 tonight, and you can drop us your questions and comments via our Q&A module below. Subscribe to the Autoblog Podcast in iTunes if you haven't already done so, and if you want to take it all in live, tune in to our UStream (audio only) channel at 10:00 PM Eastern tonight.

Discussion Topics for Autoblog Podcast Episode #325

Twin-turbo Cadillac CTS coming

Almost half of US Cadillac dealers say no to ELR plug-in hybrid

Wed, Feb 19 2014If you've got $75,995 (or so) burning a hole in your pocket and a hankering for the new Cadillac ELR, you'd better call your local dealer before you burn up shoe leather and gasoline to head down there. According to a report on Edmunds, only about 56 percent of the brand's 940 dealers have signed up to carry the premium plug-in hybrid. As much as we'd like to see the more affluent among us driving on electricity, we can certainly understand the dealers' apparent lack of enthusiasm. The article cites costs of up to $15,000 for tools and training to sell the ELR. Show floor real estate is another consideration for dealers who aren't enthusiastic about sacrificing space for a for a vehicle with initial sales – just 46 units nationwide in the first two months, but that volume is expected to increase – that are as mediocre as our first drive impressions. Still, for those locations that co-habitate with Chevrolet dealers who already participate in the Volt program, the extra expenditure shouldn't be too onerous. The two vehicles share the same basic electro-mechanical drivetrain, so those dealerships should have most of the needed infrastructure already in place. The bulk of ELR sales, according to Cadillac's global marketing director Jim Vurpillat, are expected to be in along the coasts, in places like California, Miami and New York. Featured Gallery 2015 Cadillac ELR: First Drive View 25 Photos News Source: Edmunds Green Cadillac Electric cadillac elr

BMW M4 versus Audi RS5 | Autoblog Podcast #546

Fri, Jul 13 2018On this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Associate Editor Reese Counts. We debate the merits of the BMW M4 and the new Audi RS5 and our hopes for the refreshed Mercedes-AMG C63. We also discuss the state of Cadillac, the future of the Ford Fusion and the rumored Mercedes-AMG competitor to the Porsche 718 Boxster and Cayman. Autoblog Podcast #546 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown 2018 BMW M4 versus 2018 Audi RS5 Cadillac and Mercedes-AMG sport coupes The state of the luxury car industry The future of the Ford Fusion Replacement for the Mercedes-Benz SLC Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: Design/Style Podcasts Audi BMW Cadillac Ford Lexus Lincoln Mercedes-Benz Convertible Coupe Crossover SUV Luxury Performance bmw m4 mercedes-amg c63