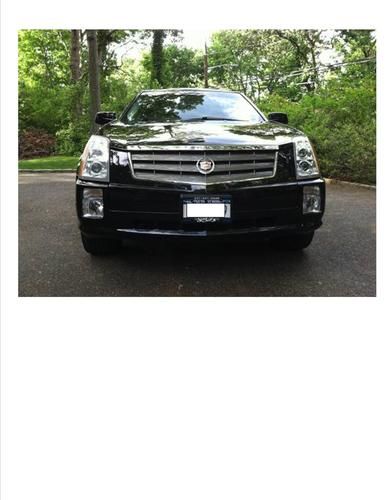

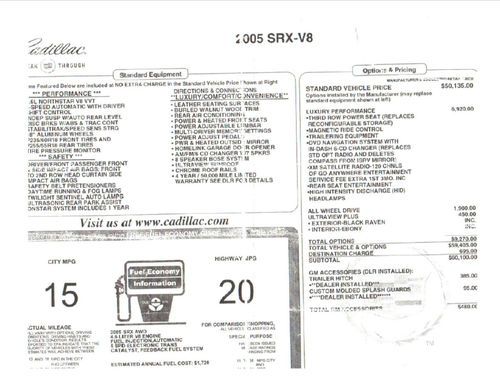

2005 Cadillac Srx Black Fully Loaded Awd Low Mileage 3rd Row Great Car! on 2040-cars

Greenlawn, New York, United States

Body Type:Sport Utility

Vehicle Title:Clear

Fuel Type:GAS

Engine:4.6L 281Cu. In. V8 GAS DOHC Naturally Aspirated

For Sale By:Private Seller

Make: Cadillac

Model: SRX

Trim: Base Sport Utility 4-Door

Drive Type: AWD

Mileage: 68,000

Exterior Color: Black

Sub Model: SRX

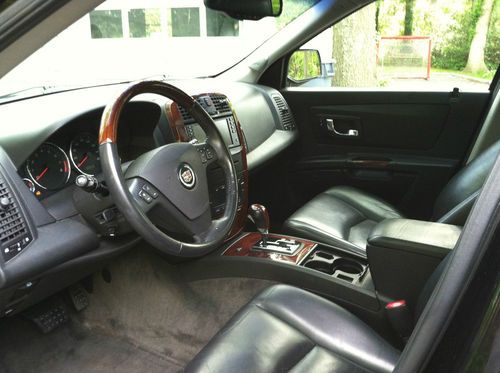

Interior Color: Black

Options: Sunroof, 4-Wheel Drive, Leather Seats, CD Player

Number of Cylinders: 8

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Cadillac SRX for Sale

2008 cadillac srx4 all wheel drive panoramic roof pearl white super clean a++++(US $16,900.00)

2008 cadillac srx4 all wheel drive panoramic roof pearl white super clean a++++(US $16,900.00) Leather panoramic roof push button start back up camera off lease only(US $25,999.00)

Leather panoramic roof push button start back up camera off lease only(US $25,999.00) Leather factory warranty cruise control cd player all power off lease only(US $23,999.00)

Leather factory warranty cruise control cd player all power off lease only(US $23,999.00) Leather panoramic roof cd player bluetooth push button start off lease only(US $23,999.00)

Leather panoramic roof cd player bluetooth push button start off lease only(US $23,999.00) 2007 cadillac srx base sport utility 4-door 3.6l(US $11,900.00)

2007 cadillac srx base sport utility 4-door 3.6l(US $11,900.00) Navigation, rearview camera, heated seats, sunroof, satellite radio(US $31,100.00)

Navigation, rearview camera, heated seats, sunroof, satellite radio(US $31,100.00)

Auto Services in New York

Witchcraft Body & Paint ★★★★★

Will`s Wheels ★★★★★

West Herr Chevrolet Of Williamsville ★★★★★

Wayne`s Radiator ★★★★★

Valley Cadillac Corp ★★★★★

Tydings Automotive Svc Station ★★★★★

Auto blog

2015 Cadillac ATS, CTS recalled over brake issue

Tue, Jun 23 2015A problem with the brakes on the 2015 ATS and CTS has prompted Cadillac to issue a recall. According to the notice below from the National Highway Traffic Safety Administration, the issue revolves around the bracket that connects the brake pedal assembly and the rod that actuates the brakes. Even under normal operation, that bracket could fracture, impeding the ability to slow or stop the vehicle. That, as you're surely aware, could increase the risk of a crash. The issue affects a reported 2,163 vehicles in the United States. Owners will need to be bring their vehicles in to their local dealership to have those brackets replaced starting on August 1. See the complete recall notice below. RECALL Subject : Brake Pedal Bracket may Fracture Report Receipt Date: JUN 09, 2015 NHTSA Campaign Number: 15V358000 Component(s): SERVICE BRAKES, HYDRAULIC Potential Number of Units Affected: 2,163 Manufacturer: General Motors LLC SUMMARY: General Motors LLC (GM) is recalling certain model year 2015 Cadillac ATS and CTS vehicles. The affected vehicles have a bracket between the brake pedal assembly and the rod that actuates the brakes that may fracture during normal brake pedal operation. CONSEQUENCE: If the bracket fractures, the driver would not be able to apply the brakes, increasing the risk of a crash. REMEDY: GM will notify owners, and dealers will inspect the vehicle and replace any affected bracket, free of charge. The recall is expected to begin August 1, 2015. Owners may contact Cadillac customer service at 1-800-458-8006. GM's number for this recall is 15352. NOTES: Owners may also contact the National Highway Traffic Safety Administration Vehicle Safety Hotline at 1-888-327-4236 (TTY 1-800-424-9153), or go to www.safercar.gov.

Why Cadillac thinks it needs to succeed in Europe to sell cars elsewhere

Tue, 26 Feb 2013Ward's Auto has taken an interesting look at the renewed focus General Motors is showing towards Cadillac in Europe. Susan Docherty, president and managing director of Chevrolet and Cadillac in Europe (pictured), says in order for the luxury brand to thrive in China, it first needs to succeed in the old country. The reason? Chinese buyers look to Europe for cues as to what's deemed worthy of the term "luxury." There are hurdles to the plan, however. In addition to the fact that the EU is flooded with high-end nameplates, GM doesn't necessarily have the distribution network in place to put buyers behind the wheel.

Combine that with persistent economic woes and Cadillac's checkered past marred by a lack of diesel engine options and a bankrupt distributor, and the road ahead for the brand looks like less of an uphill climb and more like a straight-up cliff face. But Docherty is optimistic and says she has a plan for the brand. We recommend heading over to Ward's for a closer look at the full read.

First Cadillac ELR rolls off the line

Thu, 30 May 2013Gearing up for the Belle Isle Grand Prix this weekend, General Motors invited some of the Chevrolet and Cadillac racecar drivers out to its Detroit-Hamtramck assembly plant. While there, the racers - including IndyCar Driver and Chevrolet Volt owner, Simona De Silvestro - witnessed the very first 2014 Cadillac ELR to roll off the assembly line.

These vehicles are not destined for customers, however, but instead pre-production units will be used by engineers for testing purposes. Actual production of ELR consumer models is expected to commence closer to the end of this year. As a refresher, this range-extended electric Cadillac shares much of its powertrain with the Volt but will have a sportier coupe design inspired by the Converj Concept. De Silvestro manged to snap a few images of here own, which you can see in the gallery below.