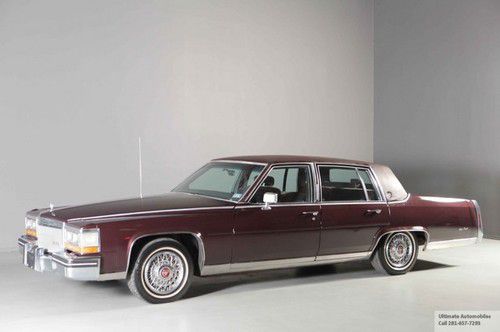

1986 Cadillac Fleetwood Brougham 53k Miles Wood Carriage Top ! on 2040-cars

Houston, Texas, United States

Engine:8

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Body Type:Other

Cab Type (For Trucks Only): Other

Make: Cadillac

Warranty: Vehicle does NOT have an existing warranty

Model: Fleetwood

Mileage: 53,607

Exterior Color: Burgundy

Disability Equipped: No

Interior Color: Red

Doors: 4

Drive Train: Rear Wheel Drive

Cadillac Fleetwood for Sale

1996 5.7l auto black(US $6,500.00)

1996 5.7l auto black(US $6,500.00) 1956 cadillac fleetwood 60 special

1956 cadillac fleetwood 60 special 1996 cadillac fleetwood brougham sedan 4-door 5.7l limosine(US $7,999.00)

1996 cadillac fleetwood brougham sedan 4-door 5.7l limosine(US $7,999.00) 1956 cadillac 60s fleetwood(US $29,500.00)

1956 cadillac 60s fleetwood(US $29,500.00) 1949 cadillac fleetwood 60s -- no reserve -- bottom line pricing!(US $10,800.00)

1949 cadillac fleetwood 60s -- no reserve -- bottom line pricing!(US $10,800.00) 1993 cadillac fleetwood brougham edition, this baby is in stunning condition!(US $8,900.00)

1993 cadillac fleetwood brougham edition, this baby is in stunning condition!(US $8,900.00)

Auto Services in Texas

Z Rated Automotive Sales & Service ★★★★★

Xtreme Tinting & Alarms ★★★★★

Wayne`s World of Cars ★★★★★

Vaughan`s Auto Glass ★★★★★

Vandergriff Honda ★★★★★

Trade Lane Motors ★★★★★

Auto blog

Junkyard Gem: 1973 Cadillac Eldorado

Mon, Jun 13 2016The 1971-1978 Cadillac Eldorado was a gloriously ridiculous personal luxury coupe, packing a monstrous 500-cubic-inch V8 (that's 8.2 liters for you freedom-hating metric types) under its acre-sized hood for the first five years of production. Fuel economy was comfortably into single-digit territory, which meant you had to be a real high roller to be able to feed a new Eldo after OPEC turned off the oil spigot. I found this '73 in a Denver wrecking yard earlier this spring. View 18 Photos This car appears to have been sold new in Denver, and the extensive bodywork and sanded areas indicate that it was someone's project car prior to coming to the end of the line. The front-wheel-drive system used in the Cadillac Eldorados and Oldsmobile Toronados of this era was known as the Unified Powerplant Package, and it used a longitudinally-mounted engine feeding a chain-drive setup that proved to be amazingly sturdy and reliable. So sturdy, in fact, that it was used in gigantic front-wheel-drive GMC motorhomes. Everyone agrees that these cars are cool, but few are willing to rescue a rough example and take on the difficult and expensive job of a full restoration. This one isn't rusty, but that wasn't enough to save it. Related Video:

Cadillac confirms new flagship to be built in Detroit next year

Fri, 19 Sep 2014

"The objective for this upcoming model is to lift the Cadillac range by entering the elite class of top-level luxury cars." - Johan de Nysschen

Cadillac confirmed Friday morning it will build its new flagship sedan, expected to be called the LTS, starting in late in 2015 in Detroit.

Combine a self-driving car with V2V, and here's what happens

Sat, Dec 12 2015Transportation engineers have started laying the groundwork for a traffic world in which cars communicate with other cars and infrastructure like bridges and traffic lights. How about an environment in which cars talk to pretty much everything and everyone? In a preview of its offerings at the upcoming Consumer Electronics Show, Delphi Automotive will deploy just such a concept. Engineers have designed a system that communicates with traffic signals, street signs, pedestrians, cyclists, even to fry pits and parking garages along a driver's route. To date, engineers and researchers across the auto industry have focused on the technical and safety-oriented foundation of future vehicle-to-vehicle communications, which could help cars share information about everything from traffic tie-ups to upcoming road hazards. Beyond those building blocks, many have projected that V2V could also include more consumer-focused features. Delphi's system, dubbed V2Everything, might be the first that combines those sorts of features in a tangible package. At CES in Las Vegas, scheduled to begin the first week of January, company officials say they'll demonstrate in real-world conditions how V2V technology can be used in an autonomous vehicle to provide a range of critical safety information and leisure and convenience options for riders. The first V2V technology installed on a production car is slated to appear on the 2017 Cadillac CTS. "We imagine a world with zero traffic accidents," said Jeff Owens, Delphi's chief technology officer. "To get there, we will need a convergence of active safety, sensor fusion, connectivity platforms and advanced software." Such software might allow a vehicle to start searching for and reserving parking spots at a programmed destination long before arriving. It could allow riders to place their McDonald's drive-through order from the road and have the food ready for pickup along the route. For the drive itself, the Delphi-equipped car can stay updated on the status of traffic lights around Las Vegas, and can anticipate yellow and red lights. Using smart-phone technology, the car can detect pedestrians and cyclists that may otherwise be hard to see. It can send messages to friends or family to notify them of a driver's location. Some of those features have been available on third-party apps or individually developed by automakers. But this system marries them together in a single system that is tailored for use in self-driving cars.