1967 Cadillac Fleetwood Brougham on 2040-cars

San Diego, California, United States

Engine:7.0L 7031CC 429Cu. In. V8 GAS OHV Naturally Aspirated

Vehicle Title:Clear

Body Type:U/K

Fuel Type:GAS

For Sale By:Private Seller

Sub Model: Fleetwood Brougham

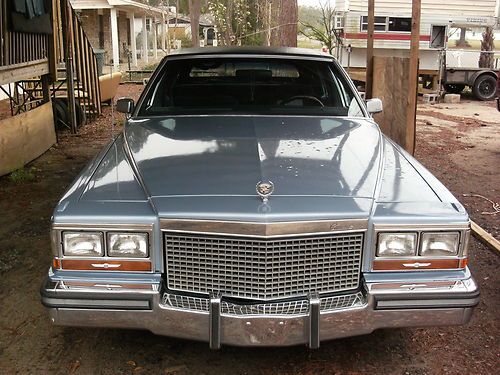

Make: Cadillac

Exterior Color: Blue

Model: Fleetwood

Interior Color: Black

Trim: 60 Special

Warranty: Vehicle does NOT have an existing warranty

Drive Type: U/K

Number of Cylinders: 8

Options: Leather Seats, CD Player

Power Options: Power Locks, Power Windows, Power Seats

Disability Equipped: No

Mileage: 76,000

Cadillac Fleetwood for Sale

1984 cadillac fleetwood formal limousine 4-door 6.0l(US $12,500.00)

1984 cadillac fleetwood formal limousine 4-door 6.0l(US $12,500.00) 1964 cadillac 6 window hardtop(US $3,800.00)

1964 cadillac 6 window hardtop(US $3,800.00) 1987 fleetwood brogham with 307 engine

1987 fleetwood brogham with 307 engine 1969 cadillac fleetwood 75 limousine 4-door 7.7l(US $8,000.00)

1969 cadillac fleetwood 75 limousine 4-door 7.7l(US $8,000.00) 1996 cadillac fleetwood brougham sedan 4-door 5.7l(US $6,200.00)

1996 cadillac fleetwood brougham sedan 4-door 5.7l(US $6,200.00) Look!!! 1947 cadillac 4dr. fleetwood restore or rockabilly barn find

Look!!! 1947 cadillac 4dr. fleetwood restore or rockabilly barn find

Auto Services in California

Yuki Import Service ★★★★★

Your Car Specialists ★★★★★

Xpress Auto Service ★★★★★

Xpress Auto Leasing & Sales ★★★★★

Wynns Motors ★★★★★

Wright & Knight Service Center ★★★★★

Auto blog

Cadillac to vie for Secret Service armored car contract, new Beast?

Wed, 03 Jul 2013President Obama has used the same armored limo since his inauguration in 2008. Known by many as The Beast, the Presidential Limo was provided by Cadillac and earned its nickname in large part because of its massive size, which isn't surprising considering that its Caddy-shaped bodywork is said to sit atop a heavy-duty truck chassis.

It seems the Secret Service may be in the market for a Beast replacement, having issued a request for proposals for a new armored limo. According to Motor Trend, Obama's backup limo is a leftover from the Bush Administration, so it will be interesting to see if this new machine will serve as a replacement for The Beast or for its backup. The contract is to be awarded by September 29, 2013.

The boys from MT contacted Cadillac, Lincoln and Chrysler, and Chrysler is the only one that would confirm that it is not pursuing the contract. Cadillac may have the inside track, as it has provided Presidential limos since 1993, but Lincoln also has a long and storied history of chauffeuring the President.

Cadillac CT6 hybrid likely to appear in Shanghai

Fri, Apr 3 2015Cadillac is poised to reveal a hybrid version of the CT6 sedan later this month at the Shanghai Motor Show. Rumors have swirled of the sedan's pending reveal, and General Motors product chief Mark Reuss reportedly confirmed its existence last fall during an investor conference. On Wednesday, Reuss again said that GM is working on the hybrid CT6, and when asked by Autoblog, he hinted at the pending debut. "We've really got to wait until we finish rounding out the portfolio," he said. "The Shanghai show is where you should look for all of it. So stay tuned." A Cadillac spokesman declined to comment, but confirmed "we will add variants." The brand has already announced two V6 engines and is looking to expand the line. Reuss also said GM has considered a V-Series model for the CT6, but it's focusing on launching the four-cylinder and V6-powered sedans first and promoting V-Series versions of the CTS and ATS that arrive this year. "The [CT6] architecture is certainly capable of doing it," he said. "The question is who's going to buy the CT6? What kind of person? And do we need a V-Series off of that is the question we haven't answered yet. It's certainly capable of doing it ... we've certainly thought about it." Details of the hybrid powertrain aren't known, but it could use plug-in technology. Chevrolet announced the 2016 Malibu will get a hybrid model that employs electric powertrain features from the new generation of the Volt. For the CT6, electric-vehicle technologies would likely be used to extend range and aid the performance of the conventional engine. Related Video:

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.