1951 Cadillac on 2040-cars

Galt, California, United States

|

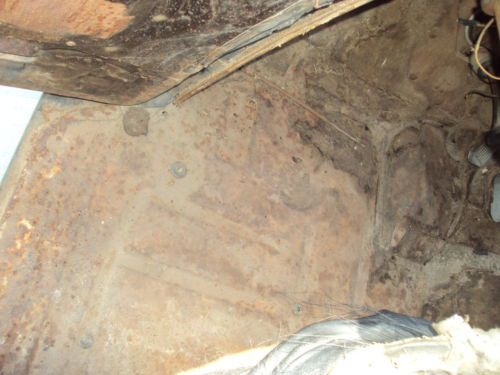

This car was in the desert in Campo.Ca. when I got it. The body has been kept in extremely good condition. Only has surface rust, no rott! Was towed down from the top of mountain with 2 mules 40 years ago. Moonshiners used it as a marker for thier mine. They would climb down thru the engine compartment! So the motor has been change to a 350 w/ trans.Have all of the rest of the parts which are shown bagged up in the back of the trunk. 3 piece split back window. front and back windows are still orig. Have never seen another one of these cars on the road or at shows. I wanted to pass this car on to my boys but I don't have time to complete it. This car will be great for restoring because you don't have to mess with body work (very minor dings only! ). Some of the pictures that I have are of the floor boards and the bottom of doors to show that there isn't any rot.

|

Cadillac Fleetwood for Sale

Auto Services in California

Zoll Inc ★★★★★

Zeller`s Auto Repair ★★★★★

Your Choice Car ★★★★★

Young`s Automotive ★★★★★

Xact Window Tinting ★★★★★

Whitaker Brake & Chassis Specialists ★★★★★

Auto blog

2015 Cadillac ATS Coupe favors cleanliness over radical lines

Tue, 14 Jan 2014Though you might not know it from looking at vehicles like the XTS and Escalade, if you take a broader look at history, you'll see that Cadillac models have gotten a lot smaller from the tail-finned highway cruisers of old. At least when it comes to coupes, anyway. The Eldorado, in particular, kept getting smaller until it disappeared, its place taken in recent years by decidedly more compact XLR, CTS Coupe and ELR hybrid. What you see here, however, is Cadillac's smallest coupe yet.

Revealed today at the Detroit Auto Show is the new 2015 Cadillac ATS Coupe, the brand's first compact two-door coupe, and the first production car to wear the brand's all-new crest. It shares the same platform and wheelbase as the existing ATS sedan, but packs a wider track and unique bodywork that's decidedly more conservative and less unique in its angular styling than the CTS Coupe that it's likely to ultimately displace in the Cadillac lineup. Styling aside, the all-American luxury marque has engineered the ATS Coupe with a focus on reducing weight to the benefit of both performance and fuel economy, giving it near 50/50 weight balance front to rear with underbody aerodynamic elements helping it cheat the wind.

Buyers will be able to choose between two engines: a 2.0-liter turbo four and a 3.6-liter V6.

Mixed sales results, but automaker stocks rise on need for cars in Houston

Fri, Sep 1 2017DETROIT — The Big Three Detroit automakers on Friday reported better-than-expected August sales and issued optimistic outlooks for demand as residents of the Houston area replace flood-damaged cars and trucks after Hurricane Harvey, sending their stocks higher. General Motors, Ford and Fiat Chrysler posted mixed August U.S. sales, with GM up 7.5 percent and Ford and Fiat Chrysler down. Japanese automaker Toyota improved sales by nearly 7 percent, while Honda fell 2.4 percent. Still, analysts focused on the potential for Detroit automakers to cut inventories and stabilize used vehicle prices as residents of Houston, the fourth largest city in the United States, are forced to replace tens of thousands, perhaps hundreds of thousands, of vehicles after the devastation from Hurricane Harvey. Mark LaNeve, Ford's U.S. sales chief, told analysts on Friday that following Hurricane Katrina in 2005 "we saw a very dramatic snapback" in demand. That said, Ford sales fell 2.1 percent in August. It sold 209,897 vehicles in the United States, compared with 214,482 a year earlier. Sales were down 1.9 percent in the Ford division and off 5.8 percent at Lincoln. Demand was down for cars, crossovers and SUVs. It was not clear how many vehicles in the Houston area will be scrapped, LaNeve said, saying he had seen estimates ranging from 200,000 to 400,000 to 1 million. Ford's Houston dealers may have lost fewer than 5,000 vehicles in inventory, he said. Ford is the No. 1 automaker in the Houston market, with 18 percent share, according to IHS Markit. The company plans to ship used vehicles to Houston dealers and has "every indication we would have to add some production" of new vehicles to meet demand, LaNeve said. Investor concerns about inventories of unsold vehicles and falling used car prices have weighed on Detroit automakers' shares most of this year. Now, automakers can anticipate a jolt of demand from a big market that is a stronghold for Detroit brand trucks and SUVs. "It's got to be a positive for the industry," LaNeve said. Investors appeared to agree. GM shares rose as much as 3.3 percent to their highest since early March. Ford increased 2.8 percent at $11.34, and Fiat Chrysler's U.S.-traded shares were up 5.2 percent $15.91, hitting their highest in more than five years. GM reported a 7.5 percent increase in U.S. auto sales in August, helped by robust sales of crossovers across its four brands.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

1980 cadillac fleetwood brougham for sale

1980 cadillac fleetwood brougham for sale 1989 cadillac fleetwood sedan

1989 cadillac fleetwood sedan 1996 cadillac fleetwood brogham - formal black over gray

1996 cadillac fleetwood brogham - formal black over gray 1942 cadillac fleetwood 75 series 7 passenger

1942 cadillac fleetwood 75 series 7 passenger 1997 cadillac funeral hearse " masterpiece"

1997 cadillac funeral hearse " masterpiece" 1986 cadillac fleetwood

1986 cadillac fleetwood