2003 Cadillac Escalade Base Sport Utility 4-door 6.0l Black 22" Rims on 2040-cars

Spruce Pine, North Carolina, United States

Engine:6.0L 5967CC 364Cu. In. V8 GAS OHV Naturally Aspirated

Vehicle Title:Clear

Body Type:Sport Utility

Fuel Type:GAS

For Sale By:Private Seller

Exterior Color: Black

Make: Cadillac

Interior Color: Gray

Model: Escalade

Trim: Base Sport Utility 4-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: AWD

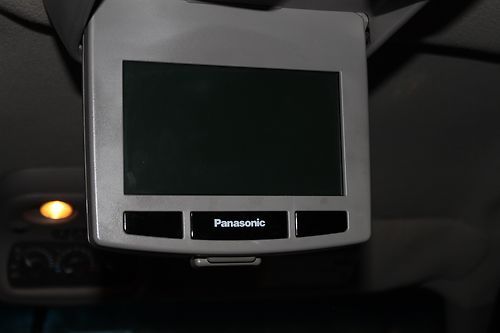

Options: Cassette Player, Leather Seats, CD Player, Rear Entertainment Center, Heated Seats, 3rd Row Seats, Towing Package, Running Boards, Roof Rack, Tinted Windows

Number of Cylinders: 8

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 109,452

109,000 miles- leather seats in excellent condition (no tears)- Rear DVD entertainment center- 6 disc CD player and single disc CD player- Heated front and 2nd row seating- 2nd row bucket seating and 3rd row bench seating- New brakes & rotors- New A/C blower motor- 6.0L AWD- Tinted windows- 22" black rims with almost new tires- Towing package (hitch not included)- Running boards- Roof rack- A few dings/scratches that come with normal wear and tear.

Cadillac Escalade for Sale

We finance 07 awd nav dvd back-up cam heated/cooled seats 3rd row tow hitch bose(US $20,800.00)

We finance 07 awd nav dvd back-up cam heated/cooled seats 3rd row tow hitch bose(US $20,800.00) 2008 cadillac escalade sunroof nav rear cam dvd 64k mi texas direct auto(US $33,980.00)

2008 cadillac escalade sunroof nav rear cam dvd 64k mi texas direct auto(US $33,980.00) 2008 cadillac escalade esv awd sunroof nav dvd 22's 75k texas direct auto(US $30,980.00)

2008 cadillac escalade esv awd sunroof nav dvd 22's 75k texas direct auto(US $30,980.00) Navigation - rear dvd - parking sensors - chrome wheels - 3rd row -(US $13,490.00)

Navigation - rear dvd - parking sensors - chrome wheels - 3rd row -(US $13,490.00) 2009 cadillac escalade ext awd// bose audio// navigation system//rear entertain(US $39,880.00)

2009 cadillac escalade ext awd// bose audio// navigation system//rear entertain(US $39,880.00) 03 cadillac escalade(US $8,500.00)

03 cadillac escalade(US $8,500.00)

Auto Services in North Carolina

Ward`s Automotive Ctr ★★★★★

Usa Auto Body ★★★★★

Unique Auto Sales ★★★★★

True2Form Collision Repair Centers ★★★★★

Triple A Automotive Towing & Recovery Services Inc. ★★★★★

Triangle Automotive Repair, Inc ★★★★★

Auto blog

Weekly Recap: Car-pedestrian crashes remained elevated in 2014

Sat, Feb 28 2015The death of American Horror Story: Freak Show star Ben Woolf served as a reminder this week that car crashes involving pedestrians remain a problem, and a new study issued on Thursday reinforced that the situation isn't really getting better. The Governors Highway Safety Association found a slight decline, 2.8 percent, in the number of pedestrian deaths in the first six months of 2014. Fatalities dropped from 2,141 to 2,125 compared with the same period in 2013, though the association says it's a statistical wash when factoring in undercounting. Deaths are still 15-percent higher than in 2009. "The number of deaths remains relatively high and is cause for concern," wrote Allan Williams, who compiled the report and is the former chief scientist at the Insurance Institute for Highway Safety. This is the first look at data from last year, and the National Highway Traffic Safety Administration will issue its full-year results later. The GHSA found some progress on the roadways, as 24 states and the District of Columbia reported drops in pedestrian deaths. In some states, the problem isn't even a problem at all: Nebraska and Wyoming reported one fatality apiece, though large population centers in urban areas are where most accidents occur. "This is a clearly a good news, bad news scenario," Jonathan Adkins, GHSA executive director, said in a statement. "While we're encouraged that pedestrian fatalities haven't increased over the past two years, progress has been slow." Other News & Notes Cadillac previews CT6 during Oscars Cadillac previewed its upcoming flagship sedan, the CT6, in commercials that aired Sunday during the Oscars. As expected, the creased sedan carries on Cadillac's recent design language, and the car in the commercial looks like a larger version of the CTS and ATS sedans. The CT6 will be revealed this spring at the New York Auto Show and launch late this year. It will be assembled at General Motors' Detroit-Hamtramck factory on a rear-wheel-drive chassis, and the CT6 is the first car to use Cadillac's revised alpha-numeric naming scheme. The commercials also kicked off Cadillac's "Dare Greatly" campaign, which is the first with its new advertising agency, Publicis Worldwide. Honda unexpectedly changes CEOs Honda unexpectedly announced this week that it will change CEOs. Current chief Takanobu Ito will step down in June and be replaced by company veteran Takahiro Hachigo.

Ford C-Max spot aimed squarely at Cadillac ELR 'Poolside' hubris [UPDATE]

Thu, Mar 27 2014If we had tried to predict the first video response to the controversial Poolside video for the Cadillac ELR, we would not have thought it would center on compost. But, hey, it's always nice to be reminded that the real world is sometimes better than fiction. Instead of the chic swagger of 'Poolside,' 'Anything Is Possible' is all about getting dirty. The new short in question is called Upside: Anything Is Possible and it promotes two things: Detroit Dirt and the Ford C-Max Energi. As in the ELR ad, Ford's plug-in C-Max only makes an appearance at the tail end of the spot, but instead of the chic swagger of Poolside, Anything Is Possible is all about getting dirty. The ad stars Pashon Murray, co-founder of Detroit Dirt, which takes natural waste from around Detroit, composts it into soil and then spreads that around "forgotten parcels" of Detroit to create urban farms. Detroit Dirt gets its bio-waste from a lot of sources, including the Detroit Zoological Society (all that herbivore manure has to go somewhere), Ford and General Motors, but this particular ad was the idea of Ford's PR agency, Team Detroit. It was a frenetic shoot, filmed with an LA-based director right after a big winter storm blew through Detroit, and Murray couldn't be happier with the result. "This was Ford Motor Company pushing my story, letting me tell the story that I believe in," Murray tells AutoblogGreen. "I get to help push this car and I get to tell my story." She says that the Team Detroit and Ford had to agree on the message, "from my understanding, [YouTube] is where they wanted to start, not where they wanted to finish." The ad is already getting a positive response on Twitter, so we won't be surprised if it shows up in more places soon. "It's not saying Ford is better than GM. It's telling the story of a black woman who's working hard in Detroit." As Detroit Dirt has off-screen support from both GM and Ford, it's unsurprising to hear Murray say that the video "is not a rivalry thing." She notes that the ad agency Team Detroit came to her and offered to tell the Detroit Dirt story using the framework of the GM ad. "It's a parody on this commercial, but it's not saying Ford is better than GM," she said. "It's telling the story of a black woman who's working hard in Detroit." What is that story? It's about urban farming, recovery and recycling. Murray tells us that for the last seven or eight years, she's been dedicated to sustainability.

2017 Cadillac CT6 Plug-In Hybrid Drivers' Notes Review | Seamlessly green

Fri, Jan 5 2018In many ways, the Cadillac CT6 Plug-in Hybrid is the most interesting car the brand sells. Despite having a turbocharged four-cylinder hybrid powertrain, it makes the most torque of any CT6, even the twin-turbocharged V6 model. It also has a claimed electric range of 31 miles and can still manage a combined fuel economy of 26 mpg with just the gas engine. Even its origin is interesting, since its final assembly point is China. To cap things off, it's also the second most expensive CT6 in the range. To find out if the CT6 is worth that money, and has more to offer than fun facts, we spent some time behind the wheel. Editor-in-Chief Greg Migliore: I achieved 34.1 miles per gallon for my roughly 14-mile roundtrip in the CT6 hybrid. This sedan is a rolling example of where luxury is heading in the near term: Existing models souped up with hybrid tech, and the green features will go along way toward keeping big sedans like this relevant. It's a smart play for Cadillac to add a product like this. Otherwise, it's a fairly standard-issue CT6, which is a solid car. The flashy head- and taillights look great. The design is angled, creased and nicely proportioned. The interior is comfortable and roomy. It's a nice car. Cadillac invested a lot in the CT6, and it shows. Rumors have long swirled that the brand will add a larger flagship, though in this climate, that's hard to envision. For now, the CT6 does the job as Cadillac's standard bearer. Associate Editor Joel Stocksdale: Of all the different CT6 variants available, the CT6 PHEV is the one I would pick for myself. Why? Because the hybrid powertrain finally delivers on the quiet, refined driving experience I want from a flagship luxury sedan. I was a bit surprised by this, too, since the gas engine under the hood is the 2.0-liter four-cylinder used elsewhere, which isn't the smoothest thing in the world. But assist from the electric motor helps keep the four-cylinder from having to wind up too much to move the big Caddy, and when the gas engine does rev hard, it's well muffled by whatever insulation is in the car. Besides aural refinement, the power delivery is oil-on-ice slick. The blending of electric and gas power is seamless. There's no waiting on the turbo to spool up, and there's no loss of power at higher rpms with the electric motor. They work in perfect harmony providing excellent low-down grunt and solid upper-end power. The transmission is super smooth, too allowing for happy wafting wherever you go.