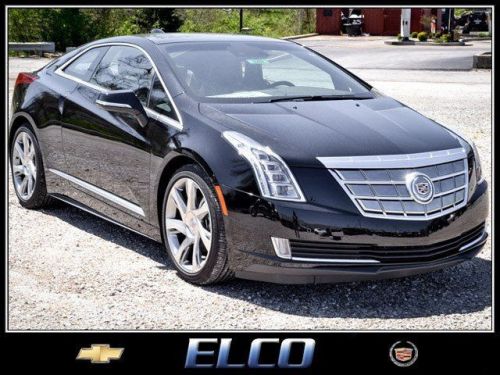

2014 Cadillac Elr on 2040-cars

15110 Manchester Rd, Ballwin, Missouri, United States

Engine:Gas/Electric 1.4L/85.3

Transmission:1-Speed Automatic

VIN (Vehicle Identification Number): 1G6RP1E44EU601290

Stock Num: C452930

Make: Cadillac

Model: ELR

Year: 2014

Exterior Color: Black Raven

Interior Color: Kona Brown with Jet Black accents

Options: Drive Type: FWD

Number of Doors: 2 Doors

Mileage: 5

You will be completely satisfied with the whole deal start to finish. Call 877-238-2164 or live chat to speak with our internet department for assistance.

Cadillac Eldorado for Sale

2014 cadillac elr(US $77,915.00)

2014 cadillac elr(US $77,915.00) 2014 cadillac elr(US $80,765.00)

2014 cadillac elr(US $80,765.00) 2014 cadillac elr(US $79,825.00)

2014 cadillac elr(US $79,825.00) 2014 cadillac elr base

2014 cadillac elr base 2014 cadillac elr base

2014 cadillac elr base 2014 cadillac elr base(US $76,295.00)

2014 cadillac elr base(US $76,295.00)

Auto Services in Missouri

Wise Auto Repair ★★★★★

Wicke Auto Service & Body Co ★★★★★

Vincel Infiniti ★★★★★

Union Tires & Wheels ★★★★★

Truck Centers Inc ★★★★★

Tri -Star Imports ★★★★★

Auto blog

GM may have teased a whole group of electric vehicles

Tue, Jan 12 2021During GM's big CES press conference, the automaker highlighted a number of its upcoming electric car-related projects from delivery vans to the upcoming flagship Cadillac Celestiq. In the middle of it all, a collection of mystery cars sat in the background behind speakers. They were in the dark, lit only with their running lights, and while it's possible they're just generic filler cars or concepts, we think they could be future products. Our best shot of the cars together is shown above, and we can pretty easily identify three of the vehicles. In the center is obviously the GMC Hummer EV. On either side of it are Cadillacs. To the left seems to be the Lyriq crossover, and to the right is the Celestiq sedan. Two of these cars have production dates, and the third has been confirmed for eventual production, just without timing. This is why we think the rest of the cars are upcoming models. The next most easily identified car is on the near right behind the Cadillac Celestiq. It very clearly has a Chevy bowtie illuminated in the running lights. And looking closely, it appears to be a pickup truck. It's difficult to make out anything more than that. The nose does look a bit more rounded and swept back than the brick-like designs of the Silverado truck line. That also squares with what seemed to be the upcoming truck that appeared in the background of yet another GM presentation. GM previously said this electric Chevy truck will be a full-size model with up to 400 miles of range. That leaves us with three more mysterious models. Over to the left behind the Cadillac Lyriq are what appear to be a pair of crossovers. The one on the far left looks low, curvy, and possibly with a fastback roof. The one on the right is taller, boxier, and probably more of a full-size people hauler. It's hard to say much more beyond that. They could be new electric Buicks, which would fit in nicely with that brand's crossover portfolio, and would likely be highly successful in China, where Buicks, crossovers and electric cars are all rather hot commodities. As for the mystery car on the far right, it's quite a puzzle. We can at least rule out Buick and Cadillac, and GMC since it's definitely a car, and a rather small one compared with the other cars on display. That leaves Chevy, and possibly the autonomous division Cruise. We're leaning toward it being a Chevy, since the first Cruise vehicle is going to be a boxy pod of sorts.

Despite De Nysschen saying it won't, Cadillac cuts struggling CTS prices

Wed, Jan 7 2015Ah, well that didn't last long. Not even two years after elevating the price of the then-new third-generation Cadillac CTS by $7,000, the company is now stepping back, telling dealers it will be slashing the price of the 2015 model by anywhere from $1,000 to $3,000. It seems that there are two reasons behind Cadillac's move. First, and most obviously, are its slumping sales, down seven percent last year. That figure is made worse, Automotive News reports, by the seven-percent gain made by the greater luxury market, not to mention gains from fellow American luxury brand Lincoln. Cadillac, meanwhile, also likely faced pressure from its dealer body, which AN reports hasn't been so keen on the price increases. The price reduction is something of a surprise following statements made by Cadillac President Johan de Nysschen shortly after he took office. In September of last year, the 54-year-old exec, who took charge of Cadillac in July of 2014, defended the company's decision to raise prices, telling Automotive News a price cut was "not going to happen." It seems current conditions contradict de Nysschen's statements, though. "We're taking what we've seen are the more desirable optional features for customers and making them more readily available," Cadillac's Dave Caldwell said of the price cut. "Once a car has been on the market for a while, it's not unusual to look at the customer behavior and try to optimize for it." In what's sure to be a pleasant surprise for anyone in the market for a CTS, the most expensive models are getting the biggest price cut, with the price on the Premium and Performance Collection sedans dropping $3,000, AN reports. The 2.0T will get a $2,000 drop, while certain optional extras will now be standard on the Luxury trim, including a panoramic sunroof, navigation and Bose stereo.

Everything new at the 2019 New York International Auto Show

Wed, Apr 24 2019Transcript: Welcome to the 2019 New York Auto Show. It's the last auto show, and so far it's my favorite of the year. We have a new buggy, compact pickup and trail ready SUV from Volkswagen. Ford brought the new Escape and a new Mustang performance variant, and we have a brand new Toyota Highlander and Subaru Outback. Let's go take a look around. We're here at the New York Auto Show with the Subaru stand. Normally the Subaru stand is just some white carpet and some show lighting. This year it's like we're in a national park. It's ... Frankly, I'm from Oregon. You're from Colorado. Yeah. It's making us feel at home. And in that way what better place and what better people to introduce this Subaru Outback which is pretty much the official car of Colorado and Oregon. Yeah. You actually have to buy a Subaru before they let you move to Colorado. Now instead of climbing up there and taking a look because we've been told we can't do that we're gonna go over there and check out another one. So the exterior, not that different. No. Looks exactly like an Outback. There's actually oddly a little more black plastic trim on the outside. A little too much for me. Right. It's interesting because it kind of slowly went away from that from the beginning because in the beginning the black plastic trim kind of made it an Outback, and now they're kind of bringing it back. I guess they needed to make it more macho. Right. Right. Now we're inside. Inside it looks pretty different. Swank. It's kind of swank for an Outback which has been pretty plain. Now this is the newly available vertically gigantic touch screen here. 11.6 inches. That is massive. This is how big it is when it's turned on ... just for the viewers. Now this is the onyx trim. So with that you get the black mirrors, the black wheels. This upholstery is special to the onyx, so it's gray and black and you also have this green stitching. Yeah, I like this accent stitching. It's kind of neat. Oh there's also a little tray there. Well this is a deep bin here. You can probably fit a phone. There we go. Almost. Yeah there are two USB ports. There's an additional two in the backseat. So this thing here you pop in the cup holder and it gives you a little more space or less space. These are really big, so if you have one of those Nalgene bottles I'm guessing it's going to fit in there. One of my complaints about my Subaru that I own now which is a naturally aspirated Crosstrek is that up in the mountains. It's slow?