1998 Black Cadillac Eldorado Etc Coupe 120k Miles Northstar Moon Roof No Reserve on 2040-cars

Wichita, Kansas, United States

Body Type:Coupe

Engine:4.6L 281Cu. In. V8 GAS DOHC Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Interior Color: Black

Make: Cadillac

Number of Cylinders: 8

Model: Eldorado

Trim: ETC Coupe 2-Door

Drive Type: FWD

Options: Sunroof, Leather Seats, CD Player

Mileage: 120,000

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Sub Model: ETC

Exterior Color: Black

1998 Cadillac Eldorado

Black on Black on Black

Power everything! heated seats - Moon Roof - New AC

Great Brakes and Tires

selling for a friend so if you have questions just call 3163127665

Cadillac Eldorado for Sale

1985 cadillac eldorado touring coupe 2-door 4.1l(US $5,500.00)

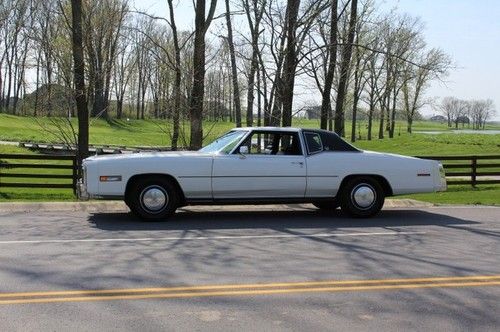

1985 cadillac eldorado touring coupe 2-door 4.1l(US $5,500.00) 1977 cadillac elderado a/t ice cold a/c white leather 57k actual miles very nice

1977 cadillac elderado a/t ice cold a/c white leather 57k actual miles very nice 1999 cadillac eldorado esc coupe 2-door 4.6l

1999 cadillac eldorado esc coupe 2-door 4.6l 1983 cadillac eldorado coupe 2-door 4.1l with 46k miles and factory carrage top

1983 cadillac eldorado coupe 2-door 4.1l with 46k miles and factory carrage top 1973 cadillac eldorado base hardtop 2-door 8.2l(US $13,900.00)

1973 cadillac eldorado base hardtop 2-door 8.2l(US $13,900.00) 56,000 miles~crimson~chrome~carriage roof~abs~traction~gorgeous~00 01 02(US $7,450.00)

56,000 miles~crimson~chrome~carriage roof~abs~traction~gorgeous~00 01 02(US $7,450.00)

Auto Services in Kansas

Westlink Auto Service ★★★★★

Weissel Auto Sales ★★★★★

Unique Auto Trim ★★★★★

Summit Collision Center ★★★★★

State Line Nissan ★★★★★

Southwest Body Shop ★★★★★

Auto blog

GM earnings rise 1% as buyers pay more for popular pickups

Thu, Aug 1 2019DETROIT ó General Motors said Thursday that higher prices for popular pickup trucks and SUVs helped overcome slowing global sales and profit rose by 1% in the second quarter. The Detroit automaker said it made $2.42 billion, or $1.66 per share, from April through June. Adjusting for restructuring costs, GM made $1.64 per share, blowing by analyst estimates of $1.44. Quarterly revenue fell 2% to $36.06 billion, but still beat estimates. Analysts polled by FactSet expected $35.97 billion. Global sales fell 6% to 1.94 million vehicles led by declines in North America and Asia Pacific, Middle East and Africa. The company says sales in China were weak, and it expects that to continue through the year. In the United States, customers paid an average of $41,461 for a GM vehicle during the quarter, an increase of 2.2%, as buyers went for loaded-out pickups and SUVs, according to the Edmunds.com auto pricing site. The U.S. is GM's most profitable market. Chief Financial Officer Dhivya Suryadevara said she expects the strong pricing to continue, especially as GM rolls out a diesel pickup and new heavy-duty trucks in the second half of the year. "We think the fundamentals do remain strong, especially in the truck market," she said, adding that strength in the overall economy and aging trucks now on the road should help keep the trend going. Light trucks accounted for 83.1% of GM's sales in the quarter, and pickup truck sales rose 8.5% as GM transitioned to new models of the Chevrolet Silverado and GMC Sierra, according to Edmunds, which provides content to The Associated Press. As usual, GM made most of its money in North America, reporting $3 billion in pretax earnings. International operations including China broke even, while the company spent $300 million on its GM Cruise automated vehicle unit. Its financial arm made $500 million in pretax income. Suryadevara said GM saw $700 million in savings during the quarter from restructuring actions announced late last year that included cutting about 8,000 white-collar workers through layoffs, buyouts and early retirements. The company also announced plans to close five North American factories, shedding another 6,000 jobs. About 3,000 factory workers in the U.S. whose jobs were eliminated at four plants will be placed at other factories, but they could have to relocate. GM expects the restructuring to generate $2 billion to $2.5 billion in annual cost savings by the end of this year.

GM may have teased a whole group of electric vehicles

Tue, Jan 12 2021During GM's big CES press conference, the automaker highlighted a number of its upcoming electric car-related projects from delivery vans to the upcoming flagship Cadillac Celestiq. In the middle of it all, a collection of mystery cars sat in the background behind speakers. They were in the dark, lit only with their running lights, and while it's possible they're just generic filler cars or concepts, we think they could be future products. Our best shot of the cars together is shown above, and we can pretty easily identify three of the vehicles. In the center is obviously the GMC Hummer EV. On either side of it are Cadillacs. To the left seems to be the Lyriq crossover, and to the right is the Celestiq sedan. Two of these cars have production dates, and the third has been confirmed for eventual production, just without timing. This is why we think the rest of the cars are upcoming models. The next most easily identified car is on the near right behind the Cadillac Celestiq. It very clearly has a Chevy bowtie illuminated in the running lights. And looking closely, it appears to be a pickup truck. It's difficult to make out anything more than that. The nose does look a bit more rounded and swept back than the brick-like designs of the Silverado truck line. That also squares with what seemed to be the upcoming truck that appeared in the background of yet another GM presentation. GM previously said this electric Chevy truck will be a full-size model with up to 400 miles of range. That leaves us with three more mysterious models. Over to the left behind the Cadillac Lyriq are what appear to be a pair of crossovers. The one on the far left looks low, curvy, and possibly with a fastback roof. The one on the right is taller, boxier, and probably more of a full-size people hauler. It's hard to say much more beyond that. They could be new electric Buicks, which would fit in nicely with that brand's crossover portfolio, and would likely be highly successful in China, where Buicks, crossovers and electric cars are all rather hot commodities. As for the mystery car on the far right, it's quite a puzzle. We can at least rule out Buick and Cadillac, and GMC since it's definitely a car, and a rather small one compared with the other cars on display. That leaves Chevy, and possibly the autonomous division Cruise. We're leaning toward it being a Chevy, since the first Cruise vehicle is going to be a boxy pod of sorts.

Meet the other Cadillac wagon. It's as American as ABBA

Tue, Aug 16 2022The Cadillac CTS Wagon became a cult classic the second it went on sale. We all knew that it was never going to sell in anything approaching significant numbers, and if that "we" didn't include those actually working at GM, one would have to wonder what they were smoking. Cadillac was still having a hard enough time trying to convince people that it was now a BMW-fighting sport luxury brand rather than the purveyor of Grandpa-piloted land yachts. To many, a sport sedan like the CTS seemed like a stretch. But a CTS sport wagon? It sure seemed like GM was just doing things for funzies, an impression only enhanced by the CTS-V Wagon. Forget cult classic. That thing was an instant legend.  And yet, the CTS wasn't the only Cadillac of that era offered as a wagon. It wasn't even the first. Before GM said "to hell with it, let's have some fun" on this side of the pond, over in Europe, it had already taken a page from its old badge-engineering playbook to create the 2006 Cadillac BLS Wagon. It was available as a sedan, too, but its awkward majesty is best enjoyed as the long-roof model.  There's just something off about the whole thing, right? That's probably because it also looks vaguely familiar, as if you've seen it before. So where the hell does this thing come from? Sweden! Behind that Cadillac Art and Science face is a Saab 9-3, and in the case of the BLS Wagon, the Saab 9-3 Sport Combi wagon. The roofline is the dead giveaway, as no other wagon has ever looked like that. In fact, the roof and windows were the only exterior elements to copy directly over from 9-3 to BLS. No kidding. With the Cadillac front end, doesn't the Saab-funky-boxiness make it look like a miniature hearse? The answer is yes. GM's design team, led by Ed Welburn, was quite pleased with his work. Perhaps it even egged him on to create a real Cadillac sport wagon? "The whole team was very excited to apply Cadillac's design language to a wagon for the first time," said Welburn in a press release from the time. "The V-shaped chrome-plated grille, a Cadillac hallmark, is picked up again by the shape of the rear window, and the body side character lines make it unmistakably a Cadillac." The interior is surprisingly different from the 9-3, including the ignition switch migrating from the center console up to the steering column. It also wasn't exactly in keeping with the Cadillac norm of the time.