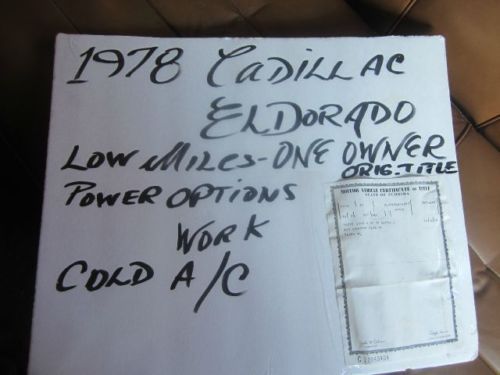

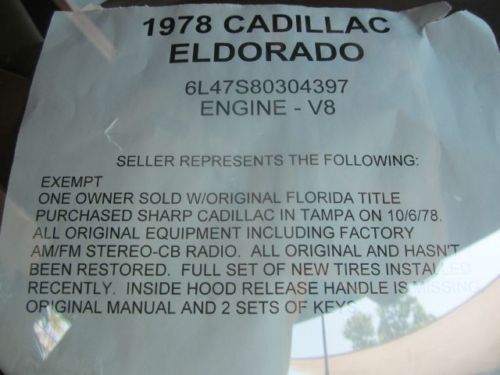

1978 Cadillac Eldorado 1 Owner Florida Car With Original Fl Title No Reserve on 2040-cars

Fort Lauderdale, Florida, United States

Cadillac Eldorado for Sale

1993 cadillac eldorado touring coupe 2-door 4.6l

1993 cadillac eldorado touring coupe 2-door 4.6l 2002 cadillac eldorado etc coupe 2-door 4.6l(US $9,500.00)

2002 cadillac eldorado etc coupe 2-door 4.6l(US $9,500.00) 1957 cadillac eldorado 4 doors hardtop

1957 cadillac eldorado 4 doors hardtop 1964 cadillac eldorado biarritz convertible storage building find!

1964 cadillac eldorado biarritz convertible storage building find! Super clean "00 cadillac etc touring eldorado coupe, diamond white, clean carfax(US $7,995.00)

Super clean "00 cadillac etc touring eldorado coupe, diamond white, clean carfax(US $7,995.00) 1957 cadillac eldorado seville barn find stored 29 years

1957 cadillac eldorado seville barn find stored 29 years

Auto Services in Florida

Wildwood Tire Co. ★★★★★

Wholesale Performance Transmission Inc ★★★★★

Wally`s Garage ★★★★★

Universal Body Co ★★★★★

Tony On Wheels Inc ★★★★★

Tom`s Upholstery ★★★★★

Auto blog

Cadillac president Johan de Nysschen expands on brand's future

Tue, Mar 13 2018Cadillac president Johan de Nysschen chatted with journalists at a recent roundtable, expounding on everything from domestic racing to Chinese manufacturing. The brand's been doing a slow burn on rolling out new products and increasing sales, but admittedly, there was a lot of work to do. After closing out last year 0.8 percent down in the U.S., the domestic luxury brand is more than 5 percent up so far this year, thanks to healthy double-digit bumps for the ATS and Escalade, and increased fleet sales. Globally, the brand's doing 21 percent better. The XT5 still outsells everything, though. Asked about slow sedan sales, de Nysschen cited a few reasons, one of them "energy prices," which are low enough to fuel the crossover craze. You can also read that as another admission that Cadillac doesn't have enough crossovers to please the crowds, a fact the XT4 will soon address. Yet de Nysschen also pegged the sedan malaise on "younger consumers who really are less tuned into dynamics and handling and all of those things that used to excite enthusiasts. It's more about the way cars complement and enable their lifestyle now." He topped that with a take on U.S. roads, saying, "I also have to say it may also be influenced a little bit by the decay of America's infrastructure. When roads no longer support high-performance sport sedans and ultra-low-profile rubber, people are going to respond to it." Those latter takes seem wide of the mark. Yes, BMW is the established leader, but the Munich carmaker sold 8,806 3 Series' so far this year in all variants, compared to 2,543 ATS coupes and sedans. Mercedes-Benz has sold 8,366 C-Class models so far in all variants. As for infrastructure, yes, it's a mess, but AMG sales rocketed up nearly 50 percent in the U.S. last year, nearly 10 percent of overall Mercedes sales, and the Three-Pointed Star expects that to rise again this year. People are buying sedans and performance models. They simply aren't buying enough of them with Cadillac badges. Cadillac has no plans to go racing in Europe since the brand doesn't have the kind of presence there to justify the investment. De Nysschen said they'll stick with the Daytona Prototype International formula in the U.S. domestic scene, and continue with the tech transfer from race to road.

Woodward Dream Cruise Photo Gallery | Classics and American muscle

Sun, Aug 21 2022The 2022 running of the Woodward Dream Cruise just went down, and we were there from morning to evening drinking in the sweet sights and pre-emissions exhaust fumes. Yes, it’s a little smelly on Woodward Ave. this time of year. Just like always, the Dream Cruise invites all comers to cruise their machines on Woodward from Ferndale, MI to Pontiac, MI. Everybody is invited, but the original intent of the Dream Cruise was to highlight classic American muscle cars. YouÂ’ll see plenty of those in our mega gallery above, but weÂ’ve sprinkled it with a bunch of other vehicle types, such as modern muscle and other intriguing American vehicles. Similar to years past, though, sometimes the classics arenÂ’t the most entertaining thing to look at on Woodward. ThatÂ’s why weÂ’ll have other mega galleries coming soon, highlighting the weird cars and (great) dogs of the Cruise, all the imports and exotics you can imagine and a special one for all the trucks of Woodward — perhaps even more so than in years past, the truck population on Dream Cruise day was quite high. Click through above to see all the classics you wouldÂ’ve seen had you been roadside on the day of the cruise. And if you missed this yearÂ’s event, make sure you check out what happens next year. You wonÂ’t be alone, as itÂ’s estimated that over 1 million people attend the Dream Cruise to either watch from the side of the road or to sit in the most glorious traffic jam in the world. Related video Featured Gallery 2022 Woodward Dream Cruise classics and American muscle View 160 Photos Design/Style Buick Cadillac Chevrolet Chrysler Dodge Ford GM GMC Hummer Jeep Pontiac RAM Classics Woodward Dream Cruise

GM Cadillac chief: New CT5 will replace 3 sedans; EVs coming

Fri, Jul 28 2017DETROIT - The head of General Motors' Cadillac luxury division said on Thursday the brand will shrink its lineup of sedans and expand its offerings of sport utility vehicles and hybrid and electric vehicles in response to market shifts. Expanding Cadillac's global sales is central to GM's overall profit strategy, and Cadillac has reported a 27 percent increase in worldwide sales through the first half of the year. However, in the United States, now the brand's second largest market behind China, Cadillac sales are down 1.6 percent and combined sales of the brand's four sedan models have plummeted 16.3 percent through the first half of the year. That has forced GM to order layoffs at two Michigan factories that build Cadillac cars, and raised questions about the long term future of the plants. "We have to rebalance our sedan portfolio," Johan de Nysschen told Reuters in interview, offering new details about the strategy. Cadillac will not directly replace the current XTS, CTS or ATS sedans when they end their life cycles in 2019, he said. Instead, Cadillac will use a single new car called the CT5 to appeal to consumers shopping for sedans priced between $35,000 and $45,000. New versions of the CT6 sedan will be offered to customers who want a larger car starting at $50,000. Sources had told Reuters last week that GM was considering ending production on six cars including the CT6 and XTS and models from Chevrolet and Buick. That report now appears only half-right as far as Cadillac is concerned. The new CT5 will be built at a factory near Lansing, Michigan, that currently builds the slow-selling Cadillac ATS and CTS models. A small luxury sedan to compete with the Audi A3 will be built in the same plant, de Nysschen said. Cadillac will offer more SUVs, starting with a compact model called XT4, followed by a larger SUV with three rows of seats due by 2019 to compete with vehicles such as Volvo's current XC90 model. Volvo, owned by China's Zhejiang Geely Holding Group, scored a public relations coup by announcing plans earlier this month to power all its vehicles with either hybrid or all-electric technology starting in 2019. The move challenges Tesla, which has eclipsed more established brands with tech savvy luxury buyers. Cadillac has plans "not dissimilar to what Volvo has announced," with more electrified vehicles launching in the second half of the next decade, de Nysschen said.