1971 Cadillac Eldorado Base Convertible 2-door 8.2l on 2040-cars

Doylestown, Pennsylvania, United States

Body Type:Convertible

Engine:8.2L 8193CC 500Cu. In. V8 GAS OHV Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Number of Cylinders: 8

Make: Cadillac

Model: Eldorado

Trim: Base Convertible 2-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: U/K

Options: Convertible

Mileage: 28,982

Power Options: Air Conditioning, Power Windows

Exterior Color: Blue

Interior Color: White

Cadillac Eldorado for Sale

Auto Services in Pennsylvania

Valley Tire Co Inc ★★★★★

Trinity Automotive ★★★★★

Total Lube Center Plus ★★★★★

Tim Howard Auto Repair ★★★★★

Terry`s Auto Glass ★★★★★

Spina & Adams Collision Svc ★★★★★

Auto blog

Cadillac Elmiraj Concept slinks in Leno's Garage

Wed, 28 Aug 2013Jay Leno's Garage has moved to Pebble Beach for the week. This time around, the affable comedian is taking a look at the Cadillac Elmiraj Concept that debuted during the Monterey car week, and is talking to General Motors vice president of global design, Ed Welburn.

There's plenty of reminiscing about what concept cars were like when these two were kids, before a fairly deep dive into the striking Elmiraj Concept itself. Welburn shares a few anecdotes about the design process behind the two-door concept, including how his designers changed his mind on the grille design.

After bringing up the Cimarron, Leno makes a solid point that the Elmiraj would be a solid production car that could even spawn a four-door variant. We couldn't agree more. Take a look below for the full video from Jay Leno's Garage.

GM may kill 6 car models as it works with UAW to tackle sales slump

Fri, Jul 21 2017The president of the United Auto Workers union said on Thursday the union is talking with General Motors about the potential threat to plants and jobs from slumping U.S. car sales. GM's response will be more trucks and SUVs, and sources say at least six slow-selling car models may be killed off. "We are talking to (GM) right now about the products that they currently have" at underused car plants such as Hamtramck in Michigan and Lordstown in Ohio, and whether they might be replaced with newer, more popular vehicles such as crossovers, Dennis Williams told reporters. "We are tracking it (and) we are addressing it," Williams added. GM has cut shifts at several U.S. plants this year as inventories of unsold cars have ballooned. Industry analysts said more jobs could be at risk as the automaker wrestles with permanently shrinking production of small and midsized sedans. GM is reviewing whether to cancel at least six passenger cars in the U.S. market after 2020, including the Chevrolet Volt hybrid, which could be replaced in 2022 with a new gasoline-electric crossover model, Reuters has learned from people familiar with the plans. Other GM cars at risk include the Buick LaCrosse, Cadillac CT6, Cadillac XTS, Chevrolet Impala and Chevrolet Sonic, sources said. Some analysts have singled out GM's Hamtramck plant in Detroit as one of the most vulnerable because of plummeting car sales. The plant, which opened in 1985, builds four slow-selling models: Buick LaCrosse, Chevrolet Impala, Cadillac CT6 and Chevrolet Volt. In the first half, it built fewer than 35,000 cars, down 32 percent from the same period in 2016, according to suppliers familiar with GM's U.S. production schedule. The typical GM assembly plant builds 200,000-300,000 vehicles a year.COMING ATTRACTIONS: TRUCKS AND SUVS GM must "create some innovative new products" to replace slow-selling sedans "or start closing plants," said Sam Fiorani, vice president of AutoForecast Solutions. The auto maker already has begun to shift future production plans from cars to trucks, according to Morgan Stanley auto analyst John Murphy. He estimates that fewer than 10 percent of the new vehicle models that GM will introduce over the next four years will be passenger cars, with the rest divided among trucks, SUVs and crossovers. GM plans to add production of the new Cadillac XT4 crossover next year to its Malibu sedan plant in Fairfax, Kansas.

Cadillac to bolster CT sedans with XT crossovers

Wed, 01 Oct 2014Cadillac is moving swiftly to change up its naming scheme. Barely over a week ago we received our first indication that it was considering a different name its the upcoming flagship sedan previously known as LTS. Then Cadillac not only revealed the model would be called CT6, but announced that it would set the stage with a massive overhaul of its model nomenclature. And now we have another piece of the puzzle.

According to Forbes, Cadillac will not only rename its sedans with the letters CT, but will realign its utility vehicles under the banner of XT - both to be followed by a number indicating its place in the lineup. The one exception will be the Escalade, whose nameplate has such a strong following that it would be foolish for Cadillac to cast it aside. That leaves only the SRX (pictured above), but makes room for a new crop of crossovers said to be in the works.

It's a similar approach which Cadillac's new boss Johan de Nysschen took in revising the naming scheme at Infiniti. While it's bound to ruffle some feathers and scratch some heads in the beginning - especially since the company's current flagship sedan is called XTS - it's equally sure to make sense of it all in the long run. All we need to know now is what Nysschen and his marketing chief Uwe Ellinghaus plan to call the coupes.

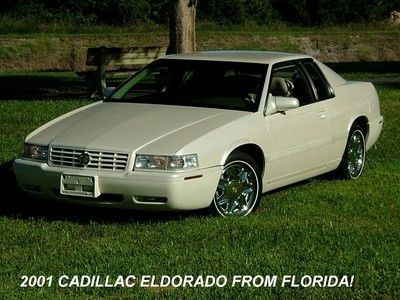

2001 cadillac eldorado in pearl white from florida! 1 owner and like new no rust

2001 cadillac eldorado in pearl white from florida! 1 owner and like new no rust Eldorado trio 1967 1976 1984 low mileage cadillac classics

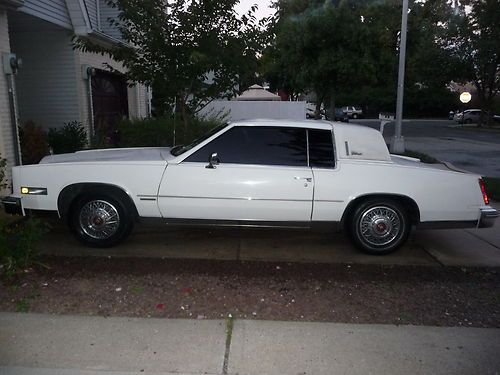

Eldorado trio 1967 1976 1984 low mileage cadillac classics 1981 cadillac eldorado

1981 cadillac eldorado

1984 cadillac eldorado biarritz convertible no reserve!

1984 cadillac eldorado biarritz convertible no reserve! 1992 cadillac eldorado base coupe 2-door 4.9l

1992 cadillac eldorado base coupe 2-door 4.9l