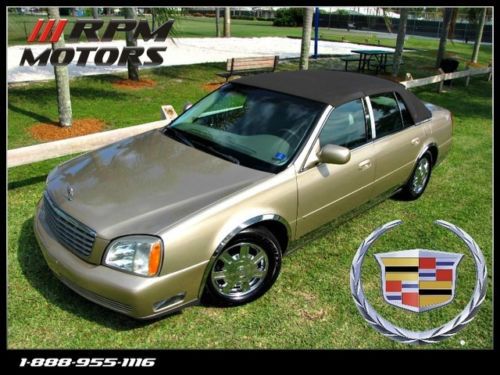

Stunning 2005 Cadillac Deville W/black Carriage Top Heated/cooled Seats on 2040-cars

Pompano Beach, Florida, United States

Cadillac DeVille for Sale

1966 cadillac deville base convertible 2-door 7.0l

1966 cadillac deville base convertible 2-door 7.0l 1959 cadillac cdv nevada car without eldorado hubcaps california titled

1959 cadillac cdv nevada car without eldorado hubcaps california titled 1959 cadillac coupe deville - california girl

1959 cadillac coupe deville - california girl 1978 cadillac coupe deville black/tan leather 19k original miles !!!

1978 cadillac coupe deville black/tan leather 19k original miles !!! 1968 cadillac coupe deville convertible 84k original miles survivor w/paint

1968 cadillac coupe deville convertible 84k original miles survivor w/paint 1966 cadillac deville base convertible 2-door 7.0l(US $17,000.00)

1966 cadillac deville base convertible 2-door 7.0l(US $17,000.00)

Auto Services in Florida

Zephyrhills Auto Repair ★★★★★

Yimmy`s Body Shop & Auto Repair ★★★★★

WRD Auto Tints ★★★★★

Wray`s Auto Service Inc ★★★★★

Wheaton`s Service Center ★★★★★

Waltronics Auto Care ★★★★★

Auto blog

Cadillac introducing V2V communications on 2017 CTS sedans

Thu, Mar 9 2017While Audi has introduced vehicle-to-infrastructure technology in select cars in select cities, Cadillac is focusing on vehicle-to-vehicle (V2V) communications, and it all starts with the CTS sedan. Starting this month, the company will be adding V2V equipment to 2017 models. The feature will be standard on cars in the US and Canada. These V2V devices will allow these new Cadillacs to communicate with each other up to 980 feet away. The cars will be able to transmit and receive information on speed, direction, and location. An example of how this data can be used is in detecting a car coming up a side street that could pose a possible collision risk. The cars will also be able to transmit data about brake use, hazard lights, and low traction situations for advance warning of hazards. The warnings can be displayed on the instrument panel and heads-up display. Currently, the system only communicates with other CTS sedans equipped with the technology. According to Chris Bonelli at Cadillac part of the reason is that the CTS will be the only car with the equipment on US roads at the moment, but it also isn't currently set to communicate with other cars if they were to be offered right away. However, he said that the company is absolutely willing to work with other companies to make the system compatible if or when other cars are offered with the technology. This V2V system also doesn't send data to any sort of network, instead only communicating with nearby cars. For the time being, this precludes the possibility of receiving road condition information from cars that are farther away. But as Cadillac points out, it should work under any conditions with no delay since it isn't dependent on information from a network. As far as security is concerned, Bonelli told us that the Cadillac system does have firewalls and other security measures to keep it protected from interference. He also said the cars don't store any data they receive. In addition, none of the data could be used to identify a particular person. The cars use a radio frequency set aside by the government for this use. The introduction of this technology also puts Cadillac well ahead of proposed legislation by the Department of Transportation. The organization wants this type of short-range V2V communications equipment to be a standard feature by 2023, believing the technology could prevent many injuries and deaths due to crashes. Related Video:

Reuss says Cadillac CT6-based Buick could happen

Wed, Apr 15 2015Could the upcoming Cadillac CT6 and its Omega platform spawn a Buick variant? According to General Motors' product chief Mark Reuss, it could potentially be in the cards, but "not yet." "We're working on that," Reuss told Automotive News at the 2015 New York Auto Show. While there hasn't been a large, rear-drive Buick on dealerships since the Roadmaster in 1996, the company gave a big hint that it could head in that direction with the Avenir Concept, shown earlier this year at the Detroit Auto Show. As Automotive News explains, a rear-drive Omega-platform Buick could be a real hit in China, where consumers buy 13 Buicks for every one Cadillac. That move would be a big help to GM's bottom line, too, as it'd significantly increase the Omega platform's economy of scale. If a large Buick based on the CT6 were to head to China, though, it likely wouldn't be a simple case of badge engineering (thank God). Reuss hinted to Automotive News that while the mixed-material construction of the CT6 platform "is very flexible," doing an "identical version of that platform or not is a different conversation." What are your thoughts? Should Buick adopt the Omega platform for an Avenir-based sedan? Should that vehicle be sold here in the US, or should it be a China-only offering? Have your say in Comments. Related Video:

Cadillac to augment dealers with 700 'boutique' stores

Thu, Jan 22 2015Johan de Nysschen is on a mission to revitalize Cadillac. Since taking over as chief executive of the American luxury brand, the former Audi and Infiniti exec has set about moving the brand's headquarters to New York, switched advertising firms, launched a completely new naming scheme for its model line, and has a whole raft of new products planned. And now he's working on changing how its dealer network operates. Speaking at both the Washington Auto Show and the NADA dealers' convention in San Francisco this week, de Nysschen has outlined a new plan for its US dealers. The network presently consists of over 900 stores – some 200 of which are stand-alone Cadillac dealers, with the remaining 700 attached to other GM brand showrooms. Contrary to earlier fears, de Nysschen notes that the dealer network is larger and covers more territory than those of import brands, and has no intention of cutting that number down. But he is asking those 700 mixed-brand dealers to create a new showroom experience for Cadillac customers. In this latest announcement, Cadillac refers to a new model of "boutique" showrooms that will encompass new technologies, higher-trained staff and luxury amenities to give those attached Cadillac showrooms a more unique feel. The plan includes installing "virtual showroom" systems that will allow potential customers to configure a new car using interactive displays and "potentially even holograms." The plan also calls for "new standards for compensation... with more precise alignment of local sales and potential for each dealer" in order to make sure that the requisite investment in the infrastructure and staff training are worthwhile for the dealers. Just what form these new systems will take, we don't know at this point. Nor are we sure why Cadillac isn't including its 200 stand-alone "flagship" dealers in the initiative. But we're sure we'll be finding out more about de Nysschen's plans on the dealer front in due course. Cadillac Discusses U.S. Dealer Network Development 2015-01-22 WASHINGTON, D.C. – As part of Cadillac's overall mission to expand and elevate within the premium automotive sector, the brand today outlined its strategy to upgrade its U.S. dealer network. Speaking at both the Washington, D.C. Auto Show today, and this weekend's annual National Auto Dealers Association convention in San Francisco, Cadillac President Johan de Nysschen will outline how the brand will target enhancements in the customer experience.