2001 Cadillac Deville White With Tan Low Low Miles 69k **mint** on 2040-cars

Northbrook, Illinois, United States

| |

| |

Cadillac DeVille for Sale

1970 cadillac coupe deville all original(US $2,000.00)

1970 cadillac coupe deville all original(US $2,000.00) 1988 cadillac coupe deville(US $5,000.00)

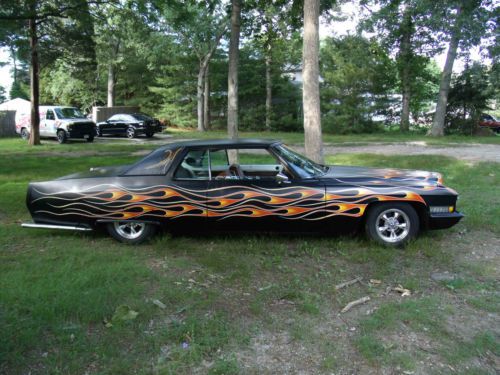

1988 cadillac coupe deville(US $5,000.00) 1972 caddy 2 door deville-full custom-hot rod black with flames.

1972 caddy 2 door deville-full custom-hot rod black with flames. 2003 cadillac de ville 130" stretch 5 door dabryan limousine(US $13,900.00)

2003 cadillac de ville 130" stretch 5 door dabryan limousine(US $13,900.00) 1968 cadillac deville convertible

1968 cadillac deville convertible 4 dr sedan automatic gasoline 4.6l 8 cyl light platinum(US $9,544.00)

4 dr sedan automatic gasoline 4.6l 8 cyl light platinum(US $9,544.00)

Auto Services in Illinois

Woodfield Nissan ★★★★★

West Side Tire and Alignment ★★★★★

U Pull It Auto Parts ★★★★★

Trailside Auto Repair ★★★★★

Tony`s Auto & Truck Repair ★★★★★

Tim`s Automotive ★★★★★

Auto blog

2020 Cadillac CT4 spied completely undisguised for the first time

Wed, Jun 19 2019A few weeks ago, Cadillac gave us our first look at its new small luxury sports sedan in the form of the CT4-V. This was a bit unusual considering the company hadn't shown us the regular one yet, and the reveal is still off in the not-too-distant future. But we were lucky enough to catch a normal 2020 Cadillac CT4 parked at a local gas station completely and totally undisguised. Based on what we know about other recent Cadillacs and their trim and design, this CT4 is probably a Luxury or Premium Luxury trim, since it has plenty of bright chrome and red taillights instead of dark gray ones. The differences from the CT4-V are subtle. The mesh grilles of the V are swapped for a main grille studded with small Cadillac badge shapes and the lower grille has simple slats. The little air intakes by the lower sections of the running lights are smaller than the ones on the V. This car also lacks the V's side skirts and wider canards on the edges of the front bumper. There doesn't appear to be a rear spoiler either. While we've had a good look at the exterior of the CT4, we'll have to wait until the car's full reveal later this year to know what's under the skin. We do know that it will continue to use the Alpha platform shared with the CT5, Camaro and the old ATS and CTS. We suspect the base engine will be the same 2.0-liter turbocharged inline-4 from the CT5, which makes 237 horsepower and 258 pound-feet of torque. Since the CT4-V uses a turbo 4-cylinder that makes 320 horsepower and 369 horsepower, there might not be a V6 option for the regular CT4. The CT5's twin-turbo 3.0-liter V6 makes more power and torque, so that's out, and the old ATS's naturally aspirated V6 made 335 horsepower and 285 pound-feet of torque, which would be uncomfortably close the CT4-V's specs. But we could see a V6 of some sort in an even more potent V iteration of the CT4 later.

Weekly Recap: Ford GT inspires guitar, foosball table, sailboat

Sat, Apr 18 2015Ford design vice president Moray Callum had just wrapped up a briefing on the interior of the Ford GT last month, but something seemed out of place. He grinned and pointed behind him, "You might be wondering why I have a boat behind me," he said mischievously. It was there because Ford set its designers on a mission to stretch and showcase their talents: design non-automotive objects inspired by the interior of the GT supercar. Callum received quite a response, too. His team produced a guitar, a foosball table (yeah bro!), a racing sailboat, a Wi-Fi speaker and some furniture. As the veteran design chief explained, "It's a really great exercise both to highlight our designers' talents, but also to really see how our design philosophy can work and how you can use it and get a common response back from a worldwide design team." Guitar View 25 Photos The objects have been on display this week at the Salone del Mobile furniture and fashion design fair in Milan, Italy, where Ford has had a presence for three years. There's also a light exhibition that apparently was inspired by the GT, as well. While this might seem a little far-fetched for the automaker, Ford said exhibitions like the Salone del Mobile give its designers another way to be creative and ultimately produce striking interior style. Ford wants this to be a differentiator, as research shows consumers are placing emphasis on the layout and features inside when they're making a decision about buying a new car. It's a little light hearted – but it's also potentially big business. Other News & Notes Cadillac CT6 platform could be used for Buick General Motors product chief Mark Reuss said the Cadillac CT6 platform could be used for a large Buick, though "not yet," Automotive News reported. The underpinnings can accommodate rear-wheel or all-wheel drive and would give Buick the large flagship it lacks. The report jibes with comments Reuss made at a roundtable with Autoblog and other reporters at the New York Auto Show. When asked if Buick had space for a large car on the CT6 chassis, he replied, "Yeah, I think it does. Yeah, I think we do." Buick has revamped its lineup in recent years with attractive crossovers and small and midsize sedans, but hasn't added the proverbial flagship that's yearned for by enthusiasts. Buick surprised industry observers with the stylish Avenir concept at the Detroit Auto Show earlier this year that raised the possibility of a halo sedan.

Cadillac introducing V2V communications on 2017 CTS sedans

Thu, Mar 9 2017While Audi has introduced vehicle-to-infrastructure technology in select cars in select cities, Cadillac is focusing on vehicle-to-vehicle (V2V) communications, and it all starts with the CTS sedan. Starting this month, the company will be adding V2V equipment to 2017 models. The feature will be standard on cars in the US and Canada. These V2V devices will allow these new Cadillacs to communicate with each other up to 980 feet away. The cars will be able to transmit and receive information on speed, direction, and location. An example of how this data can be used is in detecting a car coming up a side street that could pose a possible collision risk. The cars will also be able to transmit data about brake use, hazard lights, and low traction situations for advance warning of hazards. The warnings can be displayed on the instrument panel and heads-up display. Currently, the system only communicates with other CTS sedans equipped with the technology. According to Chris Bonelli at Cadillac part of the reason is that the CTS will be the only car with the equipment on US roads at the moment, but it also isn't currently set to communicate with other cars if they were to be offered right away. However, he said that the company is absolutely willing to work with other companies to make the system compatible if or when other cars are offered with the technology. This V2V system also doesn't send data to any sort of network, instead only communicating with nearby cars. For the time being, this precludes the possibility of receiving road condition information from cars that are farther away. But as Cadillac points out, it should work under any conditions with no delay since it isn't dependent on information from a network. As far as security is concerned, Bonelli told us that the Cadillac system does have firewalls and other security measures to keep it protected from interference. He also said the cars don't store any data they receive. In addition, none of the data could be used to identify a particular person. The cars use a radio frequency set aside by the government for this use. The introduction of this technology also puts Cadillac well ahead of proposed legislation by the Department of Transportation. The organization wants this type of short-range V2V communications equipment to be a standard feature by 2023, believing the technology could prevent many injuries and deaths due to crashes. Related Video: