2000 Cadillac Deville on 2040-cars

Colonial Beach, Virginia, United States

Transmission:Automatic

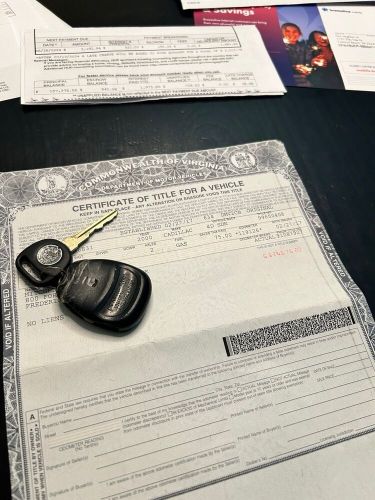

Vehicle Title:Clean

Engine:4.6L Gas V8

Fuel Type:Gasoline

Year: 2000

VIN (Vehicle Identification Number): 1G6KD54Y9YU336831

Mileage: 138000

Number of Cylinders: 8

Model: DeVille

Exterior Color: Brown

Make: Cadillac

Drive Type: FWD

Cadillac DeVille for Sale

1953 cadillac deville coupe(US $11,000.00)

1953 cadillac deville coupe(US $11,000.00) 1993 cadillac deville(US $16,000.00)

1993 cadillac deville(US $16,000.00) 1958 cadillac deville resto mod(US $176,998.00)

1958 cadillac deville resto mod(US $176,998.00) 1955 cadillac deville coupe(US $10,000.00)

1955 cadillac deville coupe(US $10,000.00) 1990 cadillac deville(US $10,500.00)

1990 cadillac deville(US $10,500.00) 1976 cadillac deville(US $15,995.00)

1976 cadillac deville(US $15,995.00)

Auto Services in Virginia

Unique Auto Sales ★★★★★

Tony`s Auto Body Shop ★★★★★

The Tire Shop ★★★★★

TC Mobile Detailing ★★★★★

Snow`s Auto Repair ★★★★★

Sherwood Hills Automotive ★★★★★

Auto blog

Why Cadillac needs a real truck in its lineup

Mon, Aug 31 2015Premium brands such as BMW, Mercedes-Benz, Lexus, and Cadillac sell vehicles that cover the spectrum from car to crossover to SUV. But trucks? They remain the last frontier when it comes to luxury brands. These days Chevy, GMC, Ford, and Ram sell cheap, bare-bones work trucks alongside loaded models that top $75,000. There is a reverse elitism that comes with this sales tactic. A brand gets to reflect a rugged working class lifestyle with the emblem up front, while what's behind it costs as much as a small house in middle America. But Americans who spend big money on cars and SUVs have always gradually tailed towards luxury nameplates over time. Everyone knows what an Escalade is, and thanks in large part to that image the Escalade is now the best-selling fullsize luxury SUV in the USA. Cadillac's flagship model, along with its midsize luxury crossover, the SRX, routinely outsell the competition from Audi, Mercedes, and BMW, not to mention Ford's Lincoln brand and most of the Japanese rivals. With trucks already dominating overall sales and headed into the pricing stratosphere, I believe it's time for Cadillac to consider a fullsize truck. And no, not a lipstick version that merely takes a Chevrolet Silverado pickup and throws in a few leather seats and some slight interior touches. That experiment already failed both for Cadillac (the Escalade EXT) and for Ford's Lincoln brand (Blackwood, Mark LT). Cadillac is an American brand that currently focuses a ridiculous amount of energy and resources trying to compete with European car offerings. The brand needs to create the Cadillac of trucks. Head honcho Johan de Nysschen has been blunt in his desire to "restore Cadillac to the pinnacle of global premium brands, not in sales but in aspirational brand character." This sounds well and wonderful. But the present problem in achieving this goal is that, on a global basis, Cadillac is a failed brand. Look at Europe, where Cadillac has sold so poorly in recent years that former Soviet manufacturer Lada managed more new registrations in 2014 by a factor of more than four to one. Cadillac is an American brand that currently focuses a ridiculous amount of energy and resources trying to compete with European car offerings. After more than 20 years of Cadillac models selling themselves as import killers, the only one with sustained success has been the CTS, and even that has been a marketplace loser for the last several years. The CTS-V?

2015 Cadillac ATS Coupe prepares to fight BMW 4 Series

Tue, 14 Jan 2014Cadillac introduced its new ATS Coupe at the 2014 Detroit Auto Show today, bringing customers an alternative to the growing range of sport luxury coupes typified by the BMW 4 Series, Audi A5 and Mercedes-Benz C-Class Coupe.

The ATS Coupe, as a slightly more premium offering, ditches the wheezy 2.5-liter engine found in the basic ATS Sedan, but retains the four-door's 2.0-liter, turbocharged four-cylinder and 3.6-liter V6. That four-pot turbo benefits from a fettling that has increased torque from 260 pound-feet to 295, although its peak is only available from 3,000 rpm to 4,600 rpm, unlike in the sedan, where peak twist arrives at just 1,700 rpm and sticks around until 5,500 rpm.

Power can be channeled to either the rear or all four wheels by the owner's choice of a Tremec six-speed manual or a six-speed automatic transmission. According to Cadillac, the new Coupe can get to 60 in 5.6 seconds when fitted with the 2.0-liter turbo.

On Broughams and Alfas | Autoblog Podcast #501

Fri, Jan 27 2017On this week's podcast, Mike Austin and David Gluckman discuss the odd history of the oft-recycled Brougham name. (Did you know some people pronounce it "broom" and they're not wrong?) There is of course discussion of what they've been driving lately, and things wrap up with Spend My (Your) Money buying advice to help you, our dear listeners. The rundown is below. Remember, if you have a car-related question you'd like us to answer or you want buying advice of your very own, send a message or a voice memo to podcast at autoblog dot com. (If you record audio of a question with your phone and get it to us, you could hear your very own voice on the podcast. Neat, right?) And if you have other questions or comments, please send those too. Autoblog Podcast #501 The video meant to be presented here is no longer available. Sorry for the inconvenience. Topics and stories we mention 2017 Honda CR-V 2017 Porsche Macan GTS 2018 Porsche Panamera 4 E-Hybrid 2017 Alfa Romeo Giulia Quadrifoglio Brougham the guy and Brougham cars Used cars! Rundown Intro - 00:00 What we're driving - 02:51 Brougham - 37:39 Spend My Money - 47:28 Total Duration: 01:07:02 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Feedback Email – Podcast at Autoblog dot com Review the show on iTunes Podcasts Alfa Romeo Cadillac Honda Porsche alfa romeo giulia alfa romeo giulia quadrifoglio porsche macan gts