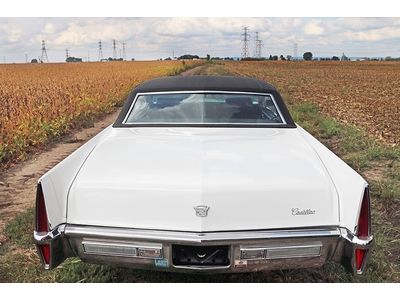

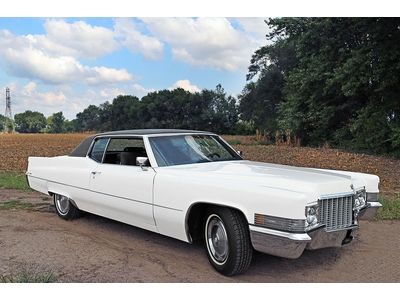

1970 Cadillac Coupe Deville 2 Door Hrdtp Very Nice Full Size Luxury Car on 2040-cars

Saint Charles, Missouri, United States

Body Type:Coupe

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Number of Cylinders: 8

Make: Cadillac

Model: DeVille

Mileage: 110,100

Warranty: Vehicle does NOT have an existing warranty

Sub Model: De Ville

Exterior Color: White

Interior Color: Black

Cadillac DeVille for Sale

429ci v8, recently rebuilt motor, a/c, white on white convertible, nice car!(US $25,995.00)

429ci v8, recently rebuilt motor, a/c, white on white convertible, nice car!(US $25,995.00) 1960 cadillac convertible, with eldorado tripower carbs, runs, good to restore

1960 cadillac convertible, with eldorado tripower carbs, runs, good to restore 1999 cadillac deville eureka hearse - shale exterior/burgundy interior

1999 cadillac deville eureka hearse - shale exterior/burgundy interior 1959 cadillac coupe

1959 cadillac coupe 2005 virginia cadillac deville vintage vogue edition 37,000 miles none nicer

2005 virginia cadillac deville vintage vogue edition 37,000 miles none nicer

Auto Services in Missouri

Xpert Auto Service ★★★★★

Wrench Teach GV ★★★★★

Twin City Toyota ★★★★★

Trux Unlimited Inc ★★★★★

The Tint Shop ★★★★★

The Automotive Shop of Melbourne ★★★★★

Auto blog

Cadillac launching crossover-heavy product offensive

Fri, 06 Sep 2013Utilizing information provided by Cadillac suppliers, Reuters says that Cadillac is preparing two more crossovers that will bow after its current product initiative is complete. According to the report, a year after the next SRX arrives in 2016, a pair of CUVs will be unveiled that will bracket it in size, and they'll be headed for the US and Chinese markets.

That is years away, though. For now, the company's attentions are on the nearly here CTS and ELR range-extended coupe, the next Escalade SUV (shown above), an ATS coupe, and the range-topper that will sit above the XTS. That, and possibly an even more impressive range-topper that promises to be the mean and majestic super-luxe unicorn Cadillac we've been dreaming about for more than a decade now.

In response to the issue of how German crossovers might be having an impact on Cadillac's future plans, a company source said - rightly, we think - "we don't need to duplicate the Germans." That doesn't mean, however, that it can't wade deeper into a market segment that the Germans are making a ton of money in. In fact, and since everyone is doing it, we'd be surprised if Cadillac didn't, even if it won't happen for another four years.

Weekly Recap: Cadillac's crossover blitz hinges on the 2017 XT5

Sat, Nov 14 2015Cadillac's aggressive new cadence of crossovers begins next spring with the arrival of the 2017 XT5, the first of four new utility vehicles that Cadillac will unleash in a bid to win more customers and revitalize its image. The XT5 replaces the aging SRX, and it's the first SUV to use the brand's new naming scheme (cars will use the corresponding CT prefix). Billed as the cornerstone of Cadillac's remade crossover lineup, the XT5 will join showrooms right after Caddy's new flagship, the CT6 sedan. It will be on display next week at the Los Angeles auto show after first appearing this month at the Dubai motor show. "It's pivotal to our ongoing growth, which is why we've developed XT5 from the inside out to provide customers more space, more technology, more luxury, and more efficiency," Cadillac president Johan de Nysschen said in a statement. "Pivotal" is almost understating the XT5 and the red-hot midsize crossover segment. The SRX is Cadillac's top seller in 2015, posting a 25-percent increase and its 56,732 units (up 25 percent) are more than one third of the brand's 141,090 sales this year. Yes, the totals have been partially incentive-fueled, and Cadillac put an average of $7,225 on the SRX's hood in October, according to TrueCar data. Still, it's an impressive performance for any vehicle, especially one that's had few major changes since the new generation launched as a 2010 model. "The SRX has been selling very well, given how late in the lifecycle it is," AutoPacific product analysis manager Dave Sullivan told Autoblog. It outsold the all-new MKX last month and really only trails the Lexus RX. This is the volume model for Cadillac and dealers need this to be a grand slam, not just a home run." Cadillac is adamant the XT5 isn't an SRX re-skin. It has a new chassis, more interior room, and adds features like Apple CarPlay and Android Auto. Thanks to a new structure, the XT5 sheds 278 pounds compared with its predecessor, which should improve fuel economy and driving character. The crossover uses General Motors' latest 3.6-liter V6 rated at 310 horsepower and 270 pound-feet of torque, and it is fortified with variable-valve timing, cylinder-deactivation, and stop-start features. The V6 will team with an eight-speed automatic transmission and a twin-clutch all-wheel-drive system than can summon all of the torque distribution to the front or rear axles. Cadillac will also sell a 2.0-liter turbo four-cylinder model in China.

GM recalling 2013 Buick LaCrosse, Cadillac SRX over transmission software

Thu, 21 Mar 2013The National Highway Traffic Safety Administration has issued recalls for the 2013 Buick LaCrosse and 2013 Cadillac SRX due to a problem with the software for the transmission controller. On about 27,000 SRX and LaCrosse models, the transmission could accidentally be shifted to Sport mode, which would reduce the amount of engine braking drivers experience.

NHTSA says this could increase the risk of a crash, but, fortunately, the required fix is simply an update to the software.

While we're on the subject of General Motors vehicle recalls, a small number (48) of compressed natural gas versions of the 2011 Chevrolet Express are also being recalled for a potential risk of fire or explosion. Yikes. Both official recall notices are posted below.