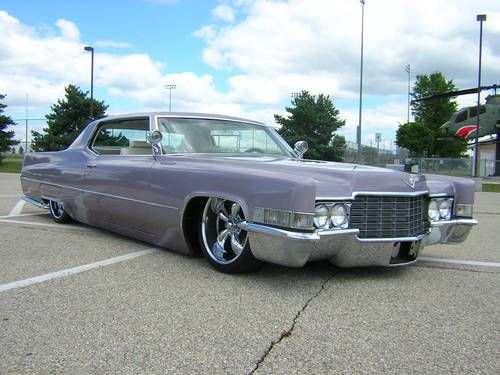

1969 Cadillac Coupe Deveille Custom Air Ride Sweet Car Bagged Cadi on 2040-cars

Lake Geneva, Wisconsin, United States

Vehicle Title:Clear

Engine:472

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Make: Cadillac

Model: DeVille

Options: Leather Seats, CD Player

Safety Features: Seat Belts, Power Disc Brakes

Drive Type: Rear Wheel Drive

Power Options: Air Conditioning, Power Windows, Power Seats

Mileage: 89,053

Sub Model: Coupe DeVille

Exterior Color: Silver/Purple Metallic

Disability Equipped: No

Interior Color: White

Trim: Fleetwood

Number of Cylinders: 8

Warranty: Vehicle does NOT have an existing warranty

1969 Custom Cadillac Coupe DeVille, 4 Wheel Air bag Suspension, 20" Coys C-5 Chrome Wheels, Custom Paint - Silver/Purple Metallic Color, Paint Looks Different In Different Light, The Interior Is An Off White Color, It Is In Pretty Good Shape For The Year - Not Perfect, There Is Some Cracking On The Rear Seat, This Cadillac Has 89.053 Miles, 472 V8, Automatic, Power Windows, Power Seat, Front And Rear Seat Belts, Power Disc Brakes, New Custom Exhaust, This Cadi Runs And Drives Great, Radio Added Under Dash With Speakers Behind The Rear Seat, Original Radio Still In The Car And It Works, This Is A California Car With A Clear California Title, The Weather Strips Are Cracked From The CA Sun And Could Be Replaced, The Blower Motor For Heat And A/C Doesn't Work At The Moment, I'm Going To Look Into Why, The A/C Compressor Kicks On, This Is Cadillac Is An Attention Getter, The Air Ride Gives The Car The Right Look, Feel Free To Call With Any Questions Or To Set Up A Time To Come Check Out This Sweet Ride, Call (262) 348-0220 Thanks For Looking And Good Luck!

Cadillac DeVille for Sale

1991 cadillac deville spring edition coupe 2-door 4.9l(US $2,500.00)

1991 cadillac deville spring edition coupe 2-door 4.9l(US $2,500.00) 2000 cadillac deville limousine, white pearl good condition(US $14,900.00)

2000 cadillac deville limousine, white pearl good condition(US $14,900.00) 1999 cadillac deville d'elegance sedan 4-door 4.6l(US $5,100.00)

1999 cadillac deville d'elegance sedan 4-door 4.6l(US $5,100.00) 1964 cadillac coupe de ville. *one owner,california car* all original & complete(US $12,900.00)

1964 cadillac coupe de ville. *one owner,california car* all original & complete(US $12,900.00) 2002 cadillac deville base sedan 4-door 4.6l(US $5,200.00)

2002 cadillac deville base sedan 4-door 4.6l(US $5,200.00) 1993 cadillac deville base sedan(US $3,500.00)

1993 cadillac deville base sedan(US $3,500.00)

Auto Services in Wisconsin

Wendt`s Auto Body ★★★★★

VIP Auto Sales ★★★★★

Stags Repair ★★★★★

South St Paul Automotive ★★★★★

Silver Spring Collision Center ★★★★★

Showroom Auto Detailing ★★★★★

Auto blog

GM recalling 8.4M cars, 8.2M related to ignition problems

Mon, 30 Jun 2014General Motors today announced a truly massive recall covering some 8.4 million vehicles in North America. Most significantly, 8.2 million examples of the affected vehicles are being called back due to "unintended ignition key rotation," though GM spokesperson Alan Adler tells Autoblog that this issue is not like the infamous Chevy Cobalt ignition switch fiasco.

For the sake of perspective, translated to US population, this total recall figure would equal a car for each resident of New Hampshire, Rhode Island, Montana, Delaware, South Dakota, Alaska, North Dakota, the District of Columbia, Vermont and Wyoming. Combined. Here's how it all breaks down:

7,610,862 vehicles in North America being recalled for unintended ignition key rotation. 6,805,679 are in the United States.

GM moving international sales HQ to Singapore from Shanghai

Wed, 13 Nov 2013General Motors has announced that it will be moving its international headquarters from Shanghai to Singapore, a move that will see 120 employees working from the city-state by the time business opens in 2014. Meanwhile, 250 to 300 of the employees at the Shanghai office will remain in China, according to a report from The Wall Street Journal.

The shuffle is part of a bigger reorganization that will see GM isolate its operations in the People's Republic from its broader international efforts. This sort of divide-and-conquer strategy will allow GM to still react to emerging markets while, according to the WSJ, providing a dedicated management team for the Chinese market. The team in Singapore will be responsible for operations in Africa, southeast Asia, Australia, India, South Korea and the Middle East, on top of managing Chevrolet and Cadillac in Europe, according to a statement from GM.

The shift to Singapore "will help us to create a renewed identity for CIO (Consolidated International Operations) and lead GM's umbrella strategy for the region," said GM Executive Vice President of CIO, Stefan Jacoby.

GM admits goal of 500,000 EVs by 2017 won't be met

Sat, May 9 2015After a little over four years of Chevy Volt sales, General Motors has a better handle on how many people it expects will buy cars with plugs. And it's less than the company thought back in 2012, when then-senior vice president of global product development, Mary Barra, said that GM expected to sell 500,000 "vehicles with electrification" by 2017. In a sustainability report released this week, GM says that half-million vehicle target will not be met but that it still, "believes the future is electric." In the report, GM says that, "For our commitment to electrification, our forecasted outlook currently projects us, along with the broader automotive industry, falling short of expectations for 2017. ... We continue to aspire to our stated goal." GM's electric lineup includes the Volt, the recently popular Spark EV, the slow-selling Cadillac ELR and upcoming Malibu Hybrid, CT6 plug-in hybrid and eAssist technology in the Buick LaCrosse and Regal. GM says it has 180,834 electrified vehicles on the road in the US today. In 2013, it had 153,034; 95,578 in 2012, and 39,843 in 2011. The company's next big plug-in vehicle will be the second-gen Chevy Volt, which is coming to market later this year, followed by the 200-mile Bolt EV coming, we think, in 2017. GM Employees on Mission to Transform Transportation Sustainability report outlines vehicle and manufacturing progress; sets new targets 2015-05-07 DETROIT – General Motors' just-released sustainability report chronicles efforts by the company's 216,000 employees to live out GM's newly defined purpose and values by earning customer loyalty, applying meaningful technology advances and improving the communities where it does business. These actions – led by CEO Mary Barra – further drive sustainability into the company's culture through building safer and smarter vehicles with less environmental impact. "GM will take a leading role in the auto industry's transformation as it undergoes an unprecedented period of change," said Bob Ferguson, senior vice president, GM Global Public Policy. "From GM's labs to its assembly lines, our people are driving the world to a better place through improved mobility." The company believes the future is electric, with billions of investment to support an all-in-house approach to the development and manufacturing of electrified vehicles. It now counts 180,834 on the road in the U.S – up from 153,034 in 2013.