1957 Cadillac Coupe Deville - California Car on 2040-cars

Kitty Hawk, North Carolina, United States

Body Type:Coupe

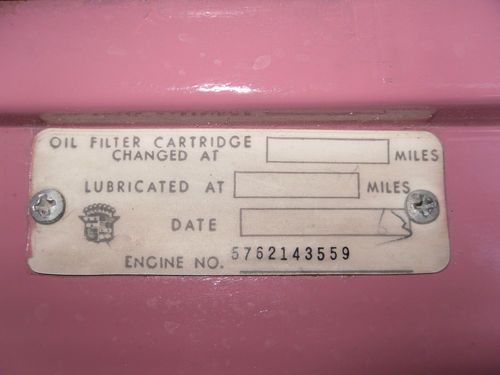

Engine:365 cubic inches

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Interior Color: Black and White

Make: Cadillac

Number of Cylinders: 8

Model: DeVille

Trim: leather and cloth

Drive Type: automatic

Power Options: Power Windows, Power Seats

Mileage: 128,401

Exterior Color: Dusty Rose

1957 Cadillac Coupe Deville, 2 Door, California Car - Location: Kitty Hawk, NC

This 1957 Cadillac Coupe Deville originally came from California, where it spent most of its life. The color is a beautiful Dusty Rose, which matches the codes. I purchased this car from the original owner in California 11 years ago. To the best of my knowledge, it appears to have never been in an accident, nor do I see any bondo on the car. The trunk has the original jack and jack instructions. The car has a wonderbar radio, which works with a working antenna. The mileage, which appears to be original is 128,401. The odometer and speedometer both work. It has the original interior, which is leather and cloth. All power options on the car work. Power windows work from all locations. This is a beautiful car, as can be seen from the photos. Power options include: power brakes, power steering, power windows and power seats. Rebuilt water pump and fuel pump available to successful bidder at an additional cost. Need valid U.S. driver's license.

Cadillac DeVille for Sale

We finance! 2007 cadillac dts professional fwd(US $10,000.00)

We finance! 2007 cadillac dts professional fwd(US $10,000.00) Rare air ride 1966 cadillac sedan deville customized must see drive great driver

Rare air ride 1966 cadillac sedan deville customized must see drive great driver 2006 cadillac dts sunroof heated/cooled seats onstar homelink

2006 cadillac dts sunroof heated/cooled seats onstar homelink 1996 cadillac deville only 49k

1996 cadillac deville only 49k 1964 cadillac convertible

1964 cadillac convertible 1979 cadillac deville cabriolet coupe 2-door 7.0l low miles

1979 cadillac deville cabriolet coupe 2-door 7.0l low miles

Auto Services in North Carolina

Xpress Lube ★★★★★

Wrightsboro Tire & Auto ★★★★★

Wilburn Auto Body Shop - Lake Norman ★★★★★

Wheeler Troy Honda Car Service ★★★★★

Truck Alterations ★★★★★

Troy`s Auto & Machine Shop ★★★★★

Auto blog

2016 Cadillac CTS-V arrives with 640 hp, 200-mph top speed

Mon, Dec 22 2014Ask the company's executive team, and they'll tell you "this is the maximum Cadillac V-Series." It's the 2016 CTS-V sedan, and it packs the very best of what's possible at Cadillac. And the company says it doesn't think "anyone thought it was possible that we could push [the CTS-V] this far." The big news is what's underhood: General Motors' supercharged, 6.2-liter LT4 V8, tuned to 640 horsepower and 630 pound-feet of torque. That's 10 hp and 20 lb-ft less than the monstrous Corvette Z06, and the result is the most powerful car Cadillac has ever produced. With rear-wheel drive, launch control and the eight-speed automatic transmission (sorry, folks – no more manual transmission here), Cadillac says the 2016 CTS-V will sprint to 60 miles per hour in just 3.7 seconds, on its way to a top speed of 200 miles per hour. Naturally, Cadillac's engineers say they have tuned the CTS-V to ensure it can put all that power to the ground with the most precision and poise possible. That starts with the excellent Magnetic Ride Control active damping system (with a claimed 40-percent increase in responsiveness)and a 25-percent increase in structural stiffness that should improve overall handling and steering. What's more, a high-performance Brembo brake package comes standard, as do 19-inch alloy wheels wrapped in seriously sticky Michelin Pilot Super Sport tires that will reportedly offer 1g in lateral acceleration. Cadillac also says that all changes to the bodywork are functional. That includes a carbon-fiber hood, front splitter, rear spoiler and diffuser that are super light and aid with aerodynamics and weight reduction – all of which will be available as an optional package for folks who like the exposed carbon look. Inside, it's more of what we're used to on lesser CTS models, but there's newly optional carbon fiber trim, microfiber suede upholstery trim, and some seriously awesome Recaro seats. Additionally, as we exclusively reported earlier, Cadillac will offer GM's Performance Data Recorder in the CTS-V. It records high-definition video with data overlays that's sharable via social media. Beyond that, Cadillac will offer the usual smattering of tech goodies, including Siri Eyes Free, OnStar with 4G LTE, CUE infotainment with navigation and Bose audio. The CTS-V will launch later next year, following the debut of the smaller ATS-V. In the meantime, the sedan will officially bow at the 2015 Detroit Auto Show in just a few weeks.

Cadillac prices new ATS-V from $61,460*

Tue, Feb 10 2015It's official, Art & Science students: Cadillac has opened the order books for the new ATS-V, and while it was at it, has told us how much we should expect to shell out for the privilege. Pricing starts at $61,460 for the 2016 Cadillac ATS-V sedan (*plus tax, title, license, dealer fees and any optional equipment). Go for the sleeker (but less practical) ATS-V coupe and you'll be looking at $63,660 (with the same conditions). For all that scratch, you'll be looking at a 3.6-liter twin-turbo V6 driving 455 horsepower and 445 pound-feet of torque through a six-speed manual or eight-speed automatic transmission, for a 0-60 time of 3.9 seconds and a top speed of 189 miles per hour. The ATS-V also features Brembo brakes, magnetorheological dampers, launch control and rev-matching with no-lift shifting. Cadillac has still yet to tell us how much gas its new performance model will guzzle, but it's got time before production gears up in the spring and the online configuration tool launches in April. Cadillac Opens Ordering for 2016 ATS-V Dual-purpose performance luxury compact designed for the track, touring 2015-02-10 DETROIT – Cadillac dealers have begun accepting orders for the 2016 ATS-V – the brand's inaugural luxury compact performance car starting production this spring. Available in sedan and coupe forms, the twin-turbocharged ATS-V offers a dual-purpose luxury performance experience: a car with true track capability straight from the factory with sophisticated road manners. Powered by the segment's highest-output six-cylinder engine – the Cadillac Twin Turbo rated at 455 horsepower (339 kW) and 445 lb-ft of torque (603 Nm) – the ATS-V achieves 0-60 performance in 3.9 seconds and a top speed of 189 mph. The Cadillac Twin Turbo engine is backed by a six-speed manual – with Active Rev Match, no-lift shifting and launch control – or a paddle-shift eight-speed automatic transmission featuring launch control and Performance Algorithm Shift. "The V-Series is the ultimate expression of Cadillac's re-ignited product substance and the passion at the core of our brand," said Johan de Nysschen, Cadillac president. "The ATS-V expands the V-Series lineup, bringing a new kind of performance character to Cadillac. Lightweight, agile and potent, the ATS-V will make an ideal pairing with the larger and even more powerful all-new 2016 CTS-V midsize sedan, which arrives later this summer," he said.

NHTSA approves hybrid rearview mirror display in Cadillac CT6, Bolt EV

Tue, Feb 23 2016The Chevy Bolt EV prototype doesn't just have a fancy new all-electric powertrain. Just outside the driver's line of sight is a newfangled rearview mirror, one that can turn into a screen that shows a moving image from the rear-facing camera. Speaking to NPR's Robert Siegel yesterday, Department of Transportation secretary Anthony Foxx said that NHTSA has now approved this type of mirror/screen for use in vehicles. According to a letter from NHTSA to General Motors, GM will likely use this Full Display Mirror first in the 2016 Cadillac CT6 before coming to the Bolt. In its letter to GM, NHTSA said that the Full Display Mirror will only qualify as a standard rearview mirror as long as there are normal side mirrors in place. In other words, don't expect to see cameras and screens replacing all the mirrors in a motor vehicle just yet. @AutoblogGreen @NPR - #NHTSA has OK'd GM rear-view system that can switch between mirror & camera views. pic.twitter.com/6CBeIit10v — Anthony Foxx (@SecretaryFoxx) February 22, 2016 The Full Display Mirror was developed by Gentex, which has long worked with GM. The FDM debuted in 2014 and some people hoped it would also make its way into the Tesla Model X. Gentex, which also makes auto-dimming mirrors, says that it has "set out to develop the technologies and core competencies necessary to manage this evolution of the rearview mirror." The Chevy Bolt EV will start at $37,500, before incentives. The 200-mile EV will go into production late this year for likely sale in early 2017. Related Video: