We Finance! 2006 Cadillac Cts Rwd Power Sunroof Power Driver Seat on 2040-cars

Bedford, Ohio, United States

Body Type:Sedan

Vehicle Title:Clear

Fuel Type:GAS

Engine:2.8L 2792CC 170Cu. In. V6 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Make: Cadillac

Model: CTS

Trim: Base Sedan 4-Door

Drive Type: RWD

Disability Equipped: No

Mileage: 85,498

Doors: 4

Exterior Color: Gray

Number of Doors: 4

Interior Color: Gray

Drivetrain: Rear Wheel Drive

Number of Cylinders: 6

Cadillac CTS for Sale

2008 cadillac cts base sedan 4-door 3.6l one owner, extra clean, 43k miles.(US $17,500.00)

2008 cadillac cts base sedan 4-door 3.6l one owner, extra clean, 43k miles.(US $17,500.00) 2013 cts-4.no reserve.awd.leather/navi/pano/heat/camera/r-start/salvage/rebuilt

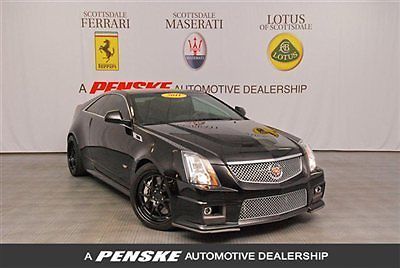

2013 cts-4.no reserve.awd.leather/navi/pano/heat/camera/r-start/salvage/rebuilt 2011 cadillac cts-v ~recaro sts~navigation~heated ventilated seats~rear camera(US $48,850.00)

2011 cadillac cts-v ~recaro sts~navigation~heated ventilated seats~rear camera(US $48,850.00) 09 cadillac cts-v sedan 17k auto bose navigation pdc keyless pano comfort alloys(US $39,995.00)

09 cadillac cts-v sedan 17k auto bose navigation pdc keyless pano comfort alloys(US $39,995.00) 2012 cadillac cts premium pkg 3.6l 2500 miles only like new htd\coold lthr seats(US $23,900.00)

2012 cadillac cts premium pkg 3.6l 2500 miles only like new htd\coold lthr seats(US $23,900.00) 2010 premium used 3.6l v6 24v automatic rear wheel drive sedan onstar bose

2010 premium used 3.6l v6 24v automatic rear wheel drive sedan onstar bose

Auto Services in Ohio

World Import Automotive Inc ★★★★★

Westerville Auto Group ★★★★★

W & W Auto Tech ★★★★★

Vendetta Towing Inc. ★★★★★

Van`s Tire ★★★★★

Tri County Tire Inc ★★★★★

Auto blog

GM's labor deal with UAW union on verge of ratification

Thu, Nov 16 2023Nov 15 (Reuters) - General Motors' tentative labor deal with the United Auto Workers (UAW) union closed in on ratification as the votes were counted on Wednesday. Following the approval earlier in the day by more than 60% of union members at the Detroit automaker's large Arlington, Texas, assembly plant, additional votes in favor have the deal close to clinching majority approval. The number of union locals, most of which are smaller, still to report vote totals is not large. After several large assembly plants voted against the deal earlier on Wednesday, some media had reported the deal was heading toward failure. But Arlington's support, followed by strong voting in favor by smaller warehouse and parts facilities, has put the deal on the brink of approval. This would mark the first ratification of a deal, which runs through April 2028, with one of the Detroit Three automakers. Ford and Stellantis voting is still under way, and workers at both companies were favoring ratification by comfortable margins. The UAW's GM vote tracking site currently shows approval of the contract leading by a 54% to 46% margin with almost 32,000 workers having cast votes out of about 46,000 UAW-represented GM workers. The Arlington plant, with about 5,000 UAW members, has the most of any GM plant. Voting officially ends on Thursday at 4 p.m. EST, although most votes will be cast on Wednesday. The UAW went on strike for more than six weeks against the Detroit Three, seeking better wages, working conditions and cost-of-living adjustments. All three companies agreed to tentative agreements about two weeks ago. Workers at other GM assembly plants voted against the deal, including 60% of workers at its Fort Wayne, Indiana, truck plant, 53% at its Wentzville, Missouri, plant, 58% of workers at GM's Lansing Grand River plant and 61% of workers at the Lansing Delta Township plant. Seven of GM's 11 assembly plants rejected the deal. In addition to Arlington, workers at plants in Detroit, Fairfax, Kansas; and Lake Orion, Michigan; approved the agreement. Only nine facilities are still listed without vote totals on the UAW vote tracker, including GM's Lockport, New York, components plant with about 1,200 members. Those voting in favor of the agreement have a lead of almost 2,500 and many of the facilities still to come include workers who stand to receive large pay increases upon ratification.

What if the mid-engine Corvette is really a Cadillac?

Tue, Jun 28 2016Call me crazy, but I'm not convinced the mid-engine Corvette is the next Corvette. The rumor is strong, yes. And, contrary to some of the comments on our site, Car and Driver - leader of the mid-engine Corvette speculation brigade - has a pretty good record predicting future models. But it's another comment that got me thinking: or maybe it's a Cadillac. There is clearly something mid-engine going on at GM, and I think it makes sense for the car to be a Cadillac. First off, check out how sweet the 2002 Cadillac Cien concept car still looks in the photo above. Second, there are too many holes in the mid-engine Corvette theory. There are too many holes in the mid-engine Corvette theory. The C7 is relatively young in Corvette years, starting production almost three years ago as a 2014 model. Showing a 2019 model at the 2018 North American International Auto Show would kill sales of a strong-selling car before its time. Not to mention it would only mean a short run for the Grand Sport, which was the best-selling version of the previous generation. More stuff doesn't add up. Mid-engine cars are, in general, more expensive. Moving the Vette upmarket leaves a void that the Camaro does not fill. There's not much overlap between Camaro and Corvette customers. Corvette owners are older and enjoy features like a big trunk that holds golf clubs. Mid-engine means less trunk space and alienating a happy, loyal buyer. Also, more than 60 years of history. The Corvette is an icon along the likes of the Porsche 911 and Ford Mustang. I'm not sure the car-buying public wants a Corvette that abandons all previous conventions. And big changes bring uncertainty - I don't think GM would make such a risky bet. Chevrolet could build a mid-engine ZR1, you might say, and keep the other Corvettes front-engine. Yes they could, and it would cost a ton of money. And they still need to fund development of that front-engine car. I highly doubt the corporate accountants would go for that. But a Cadillac? Totally. Cadillac is in the middle of a brand repositioning. GM is throwing money at this effort. A mid-engine halo car is the just the splash the brand needs to shake off the ghosts of Fleetwoods past. And it's already in Cadillac President Johan De Nysschen's playbook. He was in charge of Audi's North America arm when the R8 came out. A Caddy sports car priced above $100,000 isn't that unreasonable when you can already price a CTS-V in that range.

2014 Cadillac ELR leases for $699 a month

Mon, Jan 20 2014Most Autoblog readers thought the $75,000 price tag on the 2014 Cadillac ELR was too high. If you can't swing the MSRP all in one go, how does a lease price of $699 a month sound? That's the amount that Cadillac is offering on the official ELR website, with some caveats, of course. First off, it appears that this lease price is for just for "current owners and lessees of all 1999 or newer GM vehicles." They will also have to pony up $4,999 at signing (all others will need $5,999). Second, the $699-a-month price is for a 39-month lease. Then, of course, "tax, title, license, dealer fees and optional equipment [are] extra" and "each dealer sets own price." Also, it appears that this lease deal is only good until the end of January. Cadillac started shipping the ELR plug-in hybrid coupe to dealers last month. There are two things to note in the fine print. The most surprising is that the payments are based on "a 2014 Cadillac ELR with an MSRP of $76,000." That's $1,000 more than the official MSRP announced in October. Then we get to the real kicker: The lease limits you to a mere 32,500 miles, which is just 833.3 miles a month. Well, 'limit' isn't the exact word, since you can certainly drive more. All you have to do is pay 25 cents per mile for each mile over 32,500. Drive the national average of 13,476 miles in a year? That comes to 43,797 miles over 39 months, which is 11,297 extra miles and an extra $2,824.25.