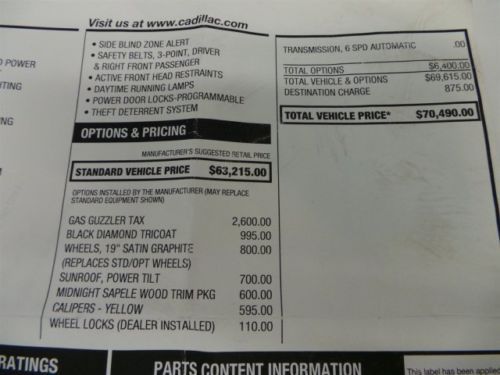

6.2l Navigation Black Diamond Tricoat Yellow Calipers Leather Bose Backup Cam on 2040-cars

Sanford, Florida, United States

Engine:6.2L 376Cu. In. V8 GAS OHV Supercharged

For Sale By:Dealer

Body Type:Coupe

Fuel Type:GAS

Transmission:Automatic

Year: 2012

Warranty: Unspecified

Make: Cadillac

Model: CTS

Options: Leather Seats

Trim: V Coupe 2-Door

Power Options: Power Windows

Drive Type: RWD

Number of Doors: 2

Mileage: 6,750

Exterior Color: Black

Number of Cylinders: 8

Interior Color: Black

Cadillac CTS for Sale

2012 black!

2012 black! 6.2l nav power everything heated seat(s) leather

6.2l nav power everything heated seat(s) leather 2008 cadillac cts4 direct inject navigation panorama top no reserve

2008 cadillac cts4 direct inject navigation panorama top no reserve Performance 3.6l navigation awd cd leather good rubber heated seats one owner

Performance 3.6l navigation awd cd leather good rubber heated seats one owner 2009 cadillac cts 4dr convertible performance edition, 26k, red, loaded l@@k!(US $24,995.00)

2009 cadillac cts 4dr convertible performance edition, 26k, red, loaded l@@k!(US $24,995.00) 2007 cadillac sandstone beige, 82k miles, beautiful

2007 cadillac sandstone beige, 82k miles, beautiful

Auto Services in Florida

Yokley`s Acdelco Car Care Ctr ★★★★★

Wing Motors Inc ★★★★★

Whitt Rentals ★★★★★

Weston Towing Co ★★★★★

VIP Car Wash ★★★★★

Vargas Tire Super Center ★★★★★

Auto blog

Infiniti Q50 Red Sport 400 priced at $48,855, AWD at $50,855

Fri, Apr 8 2016Infiniti's most powerful production model, the new Q50 Red Sport 400, now has a starting price. You'll need at least $48,855 for the rear-drive model or $50,855 for all-wheel drive. (Both figures include the $905 destination charge.) A fully loaded, rear-drive Q50 RS400 with Direct Adaptive Steering, navigation, adaptive cruise control, a heated steering wheel, and Infiniti's entire alphabet soup of safety equipment, tops out at $57,045. (Again, add $2,000 for AWD). When it comes to rear-drive competition, the closest base price to the Q50 is the 320-hp BMW 340i. This German undercuts the Infiniti by two grand, $46,795 to $48,855. But the BMW outprices the Q50 as soon as you start selecting options. A 340i with similar equipment to a loaded Q50 Red Sport 400 costs just under $60,000. All-wheel-drive German competitors also lose out in the price war. Like with the rear-drive models, the BMW 340i xDrive undercuts the Q50 RS400 by around $2,000. Add the options, and the Infiniti becomes a better value. The other two big German rivals, the Audi S4 and Mercedes-Benz C450 AMG start at a higher price and only get more expensive. Technically the S4 starts cheaper than the Q50, but only with the standard manual transmission. Selecting the S-Tronic dual-clutch model kicks the price from $50,125 to $51,125, and going for the top-end Prestige trim will bump potential Audi owners up to $57,025. Throw on must-have S4 options, including adaptive cruise control, adaptive dampers, and a sport differential and you'll be shell out $64,425 for the Audi. The Mercedes-Benz C450 AMG is the priciest choice in this group, starting at $51,725, or roughly $900 more than a base Q50 RS400 with AWD. Options, again, are the downfall here. Building a C450 to match a loaded Infiniti will drive the Mercedes' price up to $64,315. While it occupies something of a weird space relative to these vehicles, it's also worth mentioning the Cadillac CTS VSport. It's the only car in this impromptu pricing comparo that can outgun the Q50, with its 3.6-liter, twin-turbo V6 good for 420 hp and 430 lb-ft of torque. It also starts at $60,950, although that includes plenty of standard equipment. All this means that the Q50 Red Sport 400 represents a relative value. It packs more power than the Germans – 80 more than the 340i, 67 more than the S4, and 38 more than the C450 – and a more comprehensive list of options, too.

Mark Reuss: GM can't afford product 'misses,' has 'thought about' CT6 V-Series

Thu, Apr 9 2015Mark Reuss is a busy man. He oversees General Motors' global product portfolio, an all-encompassing task for a company that sold more than 9.9 million cars and trucks last year. When GM launches a well-received product, like the road-going rocket ship that is the Chevrolet Corvette Z06 – he gets credit. When the company stumbles with the slow-selling Chevy Malibu or grapples with fallout from the decade-old Saturn Ion and its flawed ignition switch, he gets blamed. GM owners, the press and sometimes the federal government, demand answers. Bob Lutz famously held the job before Reuss. So did Mary Barra, who's now GM's chief executive. There's a New GM, but the lineage is connected to a long history. When he's not thinking product, Reuss, an executive vice president, also runs the purchasing and supply chain for the company, which is still one of the largest industrial empires in the world. We caught up with Reuss on the floor of the New York Auto Show, where GM had just rolled out two crucial new products: the 2016 Cadillac CT6 and the 2016 Chevrolet Malibu. Speaking with a small group of reporters, Reuss delved into a variety of subjects, including the new Malibu, Cadillac's future (he thinks the ATS-V is going to "flame the M3 and M4"), and other topics. On fixing the Malibu: "We can't miss. We can't have those kinds of misses [like the previous generation] on our cars and crossovers and trucks. We can't do that. If we do that, we give a reason for someone to go buy something else. It's that simple. "On a car like the Malibu we have a chance to really fix all of that, which we have, and then lead. Then you've got a real opportunity there. So that's what we've really been focused on here – to fix those things." He later added: "We need that car here to transform Chevrolet desperately because it's the heart of the market. And when you think of Chevrolet, people will come back and think about what we did with the [new] Malibu and the Cruze... It's hugely important to us." On Cadillac: "If we go out and try and out-German the Germans, it's probably not going to work. We've got an opportunity here generationally where there's a lot of people younger than me that have parents that drove BMWs and Mercedes, and I think there's an opportunity there for those people to drive something different than what their parents did, and I think that's always been an opportunity in the auto industry if you look at the history of it.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.044 s, 7841 u