2014 Cadillac Cts Premium Awd on 2040-cars

15110 Manchester Rd, Ballwin, Missouri, United States

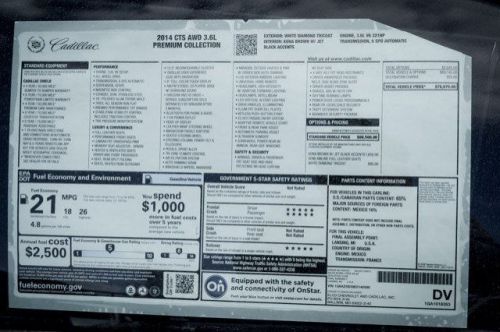

Engine:Gas/Ethanol V6 3.6L/220

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 1G6AZ5S39E0140590

Stock Num: C452480

Make: Cadillac

Model: CTS Premium AWD

Year: 2014

Exterior Color: White Diamond Tricoat

Interior Color: Kona Brown w/Jet Black Accents

Options: Drive Type: AWD

Number of Doors: 4 Doors

Mileage: 5

You will be completely satisfied with the whole deal start to finish. Call 877-238-2164 or live chat to speak with our internet department for assistance.

Cadillac CTS for Sale

2014 cadillac cts premium awd(US $71,045.00)

2014 cadillac cts premium awd(US $71,045.00) 2014 cadillac cts performance awd(US $63,775.00)

2014 cadillac cts performance awd(US $63,775.00) 2014 cadillac cts performance awd(US $61,215.00)

2014 cadillac cts performance awd(US $61,215.00) 2014 cadillac cts performance awd(US $62,210.00)

2014 cadillac cts performance awd(US $62,210.00) 2012 cadillac cts(US $49,995.00)

2012 cadillac cts(US $49,995.00) 2006 cadillac cts sport(US $9,988.00)

2006 cadillac cts sport(US $9,988.00)

Auto Services in Missouri

Wright Automotive ★★★★★

Wilson auto repair & 24-HR towing ★★★★★

Waggoner Motor Co ★★★★★

Vanzandt?ˆ™s Auto Repair ★★★★★

Valvoline Instant Oil Change ★★★★★

Todd`s & Mark`s Auto Repair ★★★★★

Auto blog

The Beast 2.0: What the 2016 presidential election winner will ride in

Thu, Aug 11 2016The current presidential limousine, which is referred to as "The Beast," will be altered for the next President of the United States. Our photographers managed to capture the vehicle testing. " The Beast 2.0" will follow closely behind the current presidential limousine that's built upon a rugged commercial truck chassis and has a sedan-like body. Instead of wearing styling details from the now-retired Cadillac STS, the new presidential limo appears to borrow looks from the latest Escalade and the CT6 sedan. The bomb-proof prototype is wearing LED headlights, has a more angular grille that features Cadillac's wreathless crest, and ditches regular antennas for a shark fin unit. Other than these changes, the Beast 2.0 should still be able to house seven passengers and have enough protection to be one of the safest vehicles on the planet. The prototype looks like it's higher off the ground, as well, which should help the next president to avoid an embarrassing moment. There's no word on whether the Beast 2.0 will be ready in time for the next president presidential inauguration in January, but our photographers report that GM recently stepped up its testing for the limousine at its Milford Proving Grounds. Related Video: Featured Gallery The Beast 2.0 Spy Shots Image Credit: KGP Photography Government/Legal Spy Photos Cadillac Truck Sedan president Hillary Clinton the beast

Submit your questions for Autoblog Podcast #326 LIVE!

Mon, 25 Mar 2013We're set to record Autoblog Podcast #326 tonight, and you can drop us your questions and comments via our Q&A module below. Subscribe to the Autoblog Podcast in iTunes if you haven't already done so, and if you want to take it all in live, tune in to our UStream (audio only) channel at 10:00 PM Eastern tonight.

Discussion Topics for Autoblog Podcast Episode #326

Jeep Moab concepts

South Dakota dealer filled to brim with classic cars

Wed, 12 Mar 2014Other than the Sturgis Motorcycle Rally and Mount Rushmore, South Dakota isn't generally a hot topic, but that just means that cool stuff can hide in the open waiting to be discovered. Case in point: the classic car dealer Frankman Motor Company that operates three locations in Sioux Falls, SD.

Unearthed by the folks at Bring a Trailer, Frankman is a treasure trove of vintage, American iron. Their collection is full of the type of vehicles your irresponsible but cool uncle would show up with when you were a kid. Even better, these cars are priced at a level a working man can afford.

If you are lusting about a cruiser then Frankman has a 1956 Cadillac Deville Hard Top Sedan (pictured right) with 82,896 miles for $12,975. It's painted a color called Cascade Grey, but looks more like a pastel purple in pictures. While it needs some repairs to the accessories, the Caddy runs and drives, which is all you really need.