2014 Cadillac Cts Premium on 2040-cars

9921 US HWY 19, Port Richey, Florida, United States

Engine:2.0L I4 16V GDI DOHC Turbo

Transmission:6-Speed Automatic

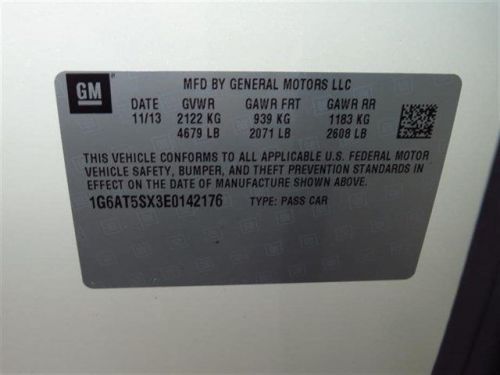

VIN (Vehicle Identification Number): 1G6AT5SX3E0142176

Stock Num: E0142176

Make: Cadillac

Model: CTS Premium

Year: 2014

Exterior Color: White Diamond Tri-Coat

Options: Drive Type: RWD

Number of Doors: 4 Doors

Mileage: 31

Call our Internet Sales Department and Save an additional $200 off the Internet Price listed above.

Cadillac CTS for Sale

2014 cadillac cts luxury(US $53,780.00)

2014 cadillac cts luxury(US $53,780.00) 2009 cadillac cts base(US $18,990.00)

2009 cadillac cts base(US $18,990.00) 2006 cadillac cts base(US $8,991.00)

2006 cadillac cts base(US $8,991.00) 2011 cadillac cts base(US $21,991.00)

2011 cadillac cts base(US $21,991.00) 2013 cadillac cts premium(US $37,988.00)

2013 cadillac cts premium(US $37,988.00) 2007 cadillac cts 3.6 l(US $13,444.00)

2007 cadillac cts 3.6 l(US $13,444.00)

Auto Services in Florida

Your Personal Mechanic ★★★★★

Xotic Dream Cars ★★★★★

Wilke`s General Automotive ★★★★★

Whitehead`s Automotive And Radiator Repairs ★★★★★

US Auto Body Shop ★★★★★

United Imports ★★★★★

Auto blog

GM will likely build PHEV batteries in China soon

Wed, Jul 27 2016It's a big week for batteries. Friday, Tesla will hold a big event at its Gigafactory in Reno, NV. But even in Michigan, there are things happening on the electrified automotive front. This was proven when GM invited journalists to its Brownstown Battery Assembly Plant today, highlighting the six different battery packs it makes for nine vehicles around the world (plus a tenth, coming to Asia, that has not yet been announced). During our tour, we learned a few interesting tidbits that we thought readers would like to hear: The Cadillac CT6 plug-in hybrid launches in China this fall before coming to the US next year. GM builds the battery packs in Michigan and ships them to China for final assembly in the PHEV. For now, this is all fine for GM to qualify for China's incentives for building green cars in the country. But, as Bill Wallace, GM's director of global battery systems, told AutoblogGreen, this could change thanks to the country's 'Made in China 2025' plan. The situation is "evolving," he said, and it's a safe assumption that GM will need to build packs in China some day. For the CT6 PHEVs that will be sold in the US, the batteries will make a round trip, since GM will only build the plug-in version in China. As for the range of the CT6 PHEV, that hasn't been announced, but since China offers incentives for vehicles that get at least 50 kilometers (31 miles), that's a likely target (the US range (UPDATE: GM did announce an expected range for the CT6 PHEV in the US at the LA Auto Show last fall, saying it would "travel approximately 30 miles on a full electric charge"). The battery pack in the CT6 is also a clunky box-type thing, totally unlike the near-elegant T-shape used in the Volt. This despite the fact that the guts of the two packs are similar. Both have 192 li-ion cells and weigh almost the same, but GM tuned the CT6 pack for acceleration instead of range, the way it did with the Volt's pack. Still, the main reason the packs are different is because the CT6 is a rear-wheel drive vehicle, and the tunnel that the Volt's pack uses is occupied by the driveshaft. Despite the highly touted second-gen Chevy Volt going on sale last year, GM still has the capacity to build battery packs for the old, first-gen model. This is because the company is legally required to be able to provide replacement packs for warrantied vehicles (for up to 10 years), and the second-gen packs don't fit into the first-gen vehicles.

Lincoln Aviator vs Cadillac XT6 | How they compare on paper

Thu, Sep 5 2019There have been big, three-row family crossovers for quite a while now, but until recently the luxury market hasn't fully embraced them. Sure, you could literally get one with a third row, but unless you were a kid, chances are the term "dungeon-like" was going to be tossed around. Things are changing now, however, as new and redesigned entries are starting to hit the market. We've recently had a chance to get our first drives of the 2020 Lincoln Aviator and 2020 Cadillac XT6, two all-new three-row crossovers from American luxury brands. We also got a turn behind the wheel of the updated 2020 Volvo XC90. However, since none of our editors have yet to drive to drive them all, we wanted to see how they compare on paper, examining their engine specs and interior dimensions. We also included the 2020 Acura MDX, the original three-row luxury crossover, which continues to sell well despite approaching the end of its current generation. That it offers a hybrid model makes it that much more applicable given the Aviator and XC90 also offer gasoline-electric powertrains, albeit of the plug-in variety. 3 Row Luxury Crossovers Powertrains View 1 Photos Non-hybrid MDX has a 5,000-pound max tow rating. How do their performance and fuel economy compare? This one is absolutely no contest. The 400-horsepower Lincoln blows away its competitors despite having a price tag that's similar to the 310-horsepower Cadillac and in between the XC90's T5 and T6 models. At least the Acura is considerably cheaper. Besides the eye-popping output, the estimated 0-60-mph time of 5.5 seconds (gleaned from the mechanically similar Ford Explorer ST) is appreciably quicker than the others. Now, fuel economy is a bit lower, but the efficiency of Volvo's four-cylinder engines are likely more susceptible to varying due to driver differences. It should also be noted that the Cadillac gets the same combined fuel economy estimate as the Aviator despite having 90 fewer horses and 144 fewer pound-feet of torque. Just one of the ways where the XT6's prospects dim in the presence of its cross-Michigan rival. The Cadillac is also not available as a hybrid model. The others are, but are disparate. The Lincoln Aviator Grand Touring and Volvo XC90 T8 are similar in concept: range-topping models that are as much about adding performance as they are fuel economy. Their hefty price tags certainly reflect that as well.

General Motors posts record earnings, but global sales fall

Thu, Apr 21 2016General Motors started the year with record success. The automaker's $2.7 billion in adjusted earnings before interest and taxes was its highest ever in in the first quarter of 2016, up from $2.1 billion in from the same time period a year earlier. Net income grew to $1.95 billion, which was more than double the $953 million in the same period last year. The company's figures also beat analysts' predictions, according to the Detroit Free Press. Despite the financial growth, global sales actually decreased by 2.5 percent to 2.36 million vehicles. "We're growing where it counts, gaining retail share in the US, outpacing the industry in Europe and capitalizing on robust growth in SUV and luxury segments in China," CEO Mary Barra said in the company's financial announcement. GM did well in North America with an adjusted EBIT of $2.3 billion, up from $2.2 billion last year. Sales in the region also grew 1.2 percent to 800,000 vehicles. According to The Detroit Free Press, the company has been especially successful at selling more expensive models in the US. The company's average vehicle was $34,600 in Q1, about $3,000 more than the industry average. Elsewhere in the world, GM also showed improvement. Europe practically broke even after losing about $200 million last year, and Opel and Vauxhall sales grew 8.4 percent to more than 300,000 vehicles for the quarter. South America only lost $100 million, which was half as much as Q1 2015's $200 million loss. China remained flat at $500 million of income. Cadillac volume jumped 6.1 percent there, and Buick's deliveries increased 22 percent, thanks to the Envision crossover's success. GM Reports First-Quarter Net Income of $2.0 Billion 2016-04-21 EPS diluted of $1.24; First-quarter record EPS diluted-adjusted of $1.26 First-quarter record EBIT-adjusted of $2.7 billion GM Europe posts break-even performance DETROIT – General Motors Co. (NYSE: GM) today announced first-quarter net income to common stockholders of $2.0 billion or $1.24 per diluted share, compared to $0.9 billion or $0.56 per diluted share a year ago. Earnings per share diluted-adjusted for special items was a first-quarter record at $1.26, up 47 percent compared to the first quarter of 2015. The company set first-quarter records for earnings and margin, with earnings before interest and tax (EBIT) adjusted of $2.7 billion and EBIT-adjusted margin of 7.1 percent.