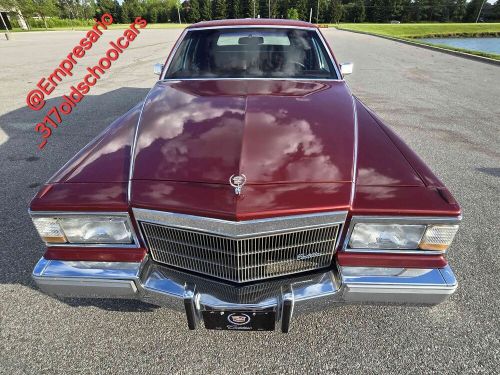

1991 Cadillac Brougham on 2040-cars

New York Mills, New York, United States

Transmission:Automatic

Vehicle Title:Clean

Engine:5.0L Gas V8

Fuel Type:Gasoline

Year: 1991

VIN (Vehicle Identification Number): 1G6DW54EXMR712152

Mileage: 52649

Number of Cylinders: 8

Model: Brougham

Exterior Color: Brown

Make: Cadillac

Drive Type: RWD

Cadillac Brougham for Sale

1992 cadillac brougham(US $13,500.00)

1992 cadillac brougham(US $13,500.00) 1957 cadillac brougham 1957 cadillac eldorado brougham northstar v8(US $190,000.00)

1957 cadillac brougham 1957 cadillac eldorado brougham northstar v8(US $190,000.00) 1987 cadillac brougham(US $11,500.00)

1987 cadillac brougham(US $11,500.00) 1990 cadillac brougham(US $7,000.00)

1990 cadillac brougham(US $7,000.00) 1988 cadillac brougham only 45k original miles-see video(US $19,900.00)

1988 cadillac brougham only 45k original miles-see video(US $19,900.00) 1990 cadillac brougham(US $10,000.00)

1990 cadillac brougham(US $10,000.00)

Auto Services in New York

X-Treme Auto Glass ★★★★★

Wheelright Auto Sale ★★★★★

Wheatley Hills Auto Service ★★★★★

Village Automotive Center ★★★★★

Tim Voorhees Auto Repair ★★★★★

Ted`s Body Shop ★★★★★

Auto blog

Liberace's gilded Cadillac could be yours

Tue, 27 Aug 2013With their chrome grilles and oversized wheels, it's hard not to notice a Cadillac these days. But this one is even more blingtastic on account of the 23.75-karat gold-leaf bodywork.

The 1931 Cadillac Golfer's Drop Head Coupé is said to have belonged to the inimitable performer Liberace, who didn't just have it covered in gold - he also had the exterior door handles plated in silver and the inside handles in 24-karat gold as well. It's also got a white leather interior and headlights that - well ahead of their time (if you'll pardon us, Mr. Tucker) - pivot with the steering wheel. All that bling is powered by a 5.7-liter V8 mated to a three-speed automatic transmission that pales in comparison to the seven, eight and even nine-speed gearboxes appearing on luxury sedans today.

The project was undertaken over the course of three years in the 1970s by one Jack Smith from Kansas. Smith (if that was his real name) sold it at auction in 1975, and it was most recently displayed for 12 years at a museum in Germany which claimed it was Liberace's own. The car is now going up for sale by Barons' at the Sandown Park horse racing track in Surrey, England, on September 17, when bidding starts at 85,000 pounds - equivalent to over $130,000 at today's rates.

Cadillac flagship, possible production Elimiraj, caught testing

Fri, 30 Aug 2013One of the biggest debuts at the Monterey car week, both literally and figuratively, was the Cadillac Elmiraj Concept. The massive coupe made quite a splash with the show's well-heeled guests. Now, we have what might be the very first images of the Elmiraj, or whatever it may be called when it reaches production, out testing.

Don't let that modified Chevrolet Caprice body fool you, this car is about four to six inches longer than Chevy's US-spec cop car, from the A-pillar forward. According to our spy, with the Caprice at 203 inches and the concept at 205, adding a few extra inches here and there fits the bill for the four-door Elmiraj that was hinted at in Jay Leno's Garage.

There are a number of other classic mule signs on this car, including a cover over the fuel door and heavily modified front and rear fascias, each of which serves to hide some significant change from the standard Caprice. Using a Caprice for development also, hopefully, hints at something that big Cadillacs like the XTS have lacked - rear-wheel drive.

Cadillac LTS flagship to bow at NY Auto Show

Wed, 06 Aug 2014There is widespread agreement across the industry that Cadillac needs a proper, rear-drive flagship sedan that completes legitimately with the Mercedes-Benz S-Class, Audi A8 and BMW 7 Series.

Fortunately, the same view is held within the company, and just such a car - possibly dubbed LTS - is under development. According to a high-level source at Cadillac, the new four-door, which is said to incorporate design cues from the marque's celebrated Elmiraj coupe concept, will debut at the New York Auto Show next April.

If the car needs a cheerleader, surely incoming president Johan de Nysschen is just such a person. De Nysschen doesn't arrive at Cadillac until late in the month, but certainly he will want a proper flagship to do battle with his old foes at Mercedes-Benz and BMW and old friends at Audi and Infiniti.