1971 Real Buick Gs Convertible 455 Motor 44k Miles on 2040-cars

Oakland, California, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:455

Fuel Type:Gasoline

For Sale By:Private Seller

Interior Color: Black

Make: Buick

Model: Skylark

Trim: GS

Options: Leather Seats, Convertible

Drive Type: FWD

Mileage: 44,395

Exterior Color: Silver

Buick Skylark for Sale

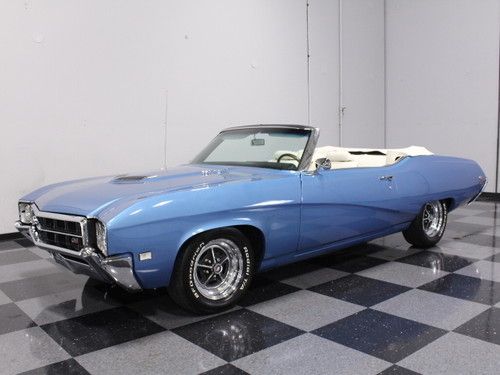

1967 buick skylark convertible

1967 buick skylark convertible Restored correct crystal blue, 350 cid, ps, power disc, a/c, posi, 700r4, wow!(US $25,995.00)

Restored correct crystal blue, 350 cid, ps, power disc, a/c, posi, 700r4, wow!(US $25,995.00) 1963 buick special convertible(US $11,000.00)

1963 buick special convertible(US $11,000.00) 455 ci v8, refinished in factory-correct paint & interior, fully sorted, ps!(US $15,995.00)

455 ci v8, refinished in factory-correct paint & interior, fully sorted, ps!(US $15,995.00) 67 buick skylark 2-door hard top

67 buick skylark 2-door hard top 1971 buick gs 455 tribute car. very straight and solid! all american muscle car!

1971 buick gs 455 tribute car. very straight and solid! all american muscle car!

Auto Services in California

Zip Auto Glass Repair ★★★★★

Woodland Motors Chevrolet Buick Cadillac GMC ★★★★★

Willy`s Auto Repair Shop ★★★★★

Westside Body & Paint ★★★★★

Westcoast Autobahn ★★★★★

Westcoast Auto Sales ★★★★★

Auto blog

May 2016: FCA wins, Ford and GM stumble on weak car volumes

Wed, Jun 1 2016The May 2016 sales numbers are in, and it looks as though FCA is getting some vindication for boldly cancelling two slow-selling car models. Meanwhile, Ford saw overall sales dip and GM's May volume took a big dive versus the same month in 2015. While Marchionne's decision to axe the Chrysler 200 and Dodge Dart has drawn criticism as being short-sighted, it's working for FCA so far. Although the Dart and 200 aren't out of production yet and no capacity has been shifted to crossover or trucks, May's numbers show that the emphasis on Jeep and Ram models makes sense right now. FCA's US sales rose 1 percent last month compared to May 2015, putting the year-to-date total at 955,186 vehicles, an increase of 6 percent compared to the same period last year. Standouts included the Jeep Renegade, Compass, and Patriot, and the Fiat 500X. Ram pickup sales were down 3 percent. And your fun fact is that Alfa Romeo sales were up precisely 10 percent, for a total of 44 4Cs sold versus 40 in the same month last year. At FoMoCo, the Ford brand took a hit to the tune of 6.4 percent from May 2015 to 2016, registering 226,190 sales last month. Lincoln showed improvement on its modest numbers, going from 9,174 to 9,807, a 6.9 percent increase. Overall, Ford was down 5.9 percent for the month to 235,997; despite the slump, year-to-date total Ford sales are up 4.2 percent to 1,112,939. Strong sellers included Escape, Expedition, F-Series, and Transit - big stuff. Most small and/or efficient models (Fiesta, Focus, Fusion, C-Max) saw sales slides. Fusion sales were also down, likely due to effects of model changeover to the freshened 2017 model. Ford has promised four new crossovers and SUVs by 2020 and if things keep trending this way the company will be able to sell them, but things could change in the next four years. GM saw the worst of it for domestic brands. Retail and fleet sales were down for each of the four divisions, with the May 2016 total dropping 18 percent to 240,450 vehicles. GM's year-to-date sales are down 5.0 percent in 2016 to 1,183,705. Both the Sierra and Silverado were down significantly, and the majority of Chevy, Buick, GMC, and Cadillac nameplates saw sales decreases, with both small cars and larger utilities included. Not even big stuff could help GM this month, it seems. We'll have more on the rest of the industry's May sales as those figures trickle in.

Buick picks top 11 highlights from first 11 decades

Sun, 21 Apr 2013Buick has taken the time to highlight some of the company's personal points of pride from the past 110 years. Those include everything from the automaker's very first vehicle, the 1904 Model B, to what Buick claims is the world's first concept car: The 1938 Y Job (above). That one also walked away with the worst name for a design study.

All told, the automaker has sold 43 million vehicles through the end of last year, and those include the lusty 1963 Riviera. That model celebrates its 50th anniversary in 2013, and remains one of the brand's most iconic designs.

Of course, Buick is rightfully proud of its quickest model, too. The 1987 GNX managed a 4.6-second bolt to 60 mph in tests by Car and Driver, and it also took the honor of being one of the automaker's rarest creations at just 547 units. You can check out all 10 in the gallery above.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.