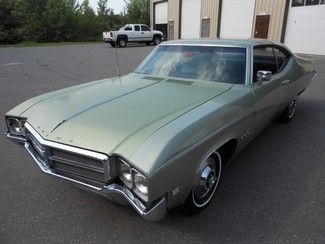

1971 Buick Skylark Custom Hardtop 2-door 5.7l on 2040-cars

Richland, Oregon, United States

Fuel Type:GAS

For Sale By:Private Seller

Engine:350

Transmission:Automatic

Body Type:Hardtop

Model: Skylark

Mileage: 844,021

Exterior Color: Red

Year: 1971

Interior Color: White

Trim: basic

Number of Cylinders: 8

Drive Type: automatic

Bid starts at $3000.00. Buyer must drive or haul.

Buick Skylark for Sale

1966 buick skylark base convertible 2-door 5.6l(US $11,000.00)

1966 buick skylark base convertible 2-door 5.6l(US $11,000.00) 1972 buick skylark custom convertible

1972 buick skylark custom convertible 1964 buick skylark base hardtop 2-door 4.9l(US $2,250.00)

1964 buick skylark base hardtop 2-door 4.9l(US $2,250.00) 1965 buick skylark base hardtop 2-door 6.6l(US $10,000.00)

1965 buick skylark base hardtop 2-door 6.6l(US $10,000.00) 1969 green 1 owner original car 350/2brl drives nicely!

1969 green 1 owner original car 350/2brl drives nicely! 1976 buick skylark base coupe 2-door 5.7l

1976 buick skylark base coupe 2-door 5.7l

Auto Services in Oregon

Vo`s Auto Repair Inc ★★★★★

Tru Autobody & Collision Repair LLC ★★★★★

Transmission Exchange Co ★★★★★

Toy Doctor ★★★★★

T & M Towing ★★★★★

Sun Scape Window ★★★★★

Auto blog

NFL QB Cam Newton and supermodel Miranda Kerr star in Buick's Super Bowl ad

Wed, Feb 1 2017Buick's Super Bowl LI ad is another demonstration that its cars aren't frumpy anymore. The ad opens with parents watching their children play football, with one of the dads, we'll call him "Dad No. 1," shouting encouraging words to his son. In the background, a bright red Buick Cascada pulls up, and another dad, "Dad No. 2," points it out. Dad 1 doesn't believe him, and says, "If that's a Buick, then my kid's Cam Newton." All of sudden, his son transmogrifies into Carolina Panthers quarterback Cam Newton. As expected, he quickly dominates the game, with some amusing results. At the end, when a Buick Encore shows up, the referee inadvertently turns himself into supermodel Miranda Kerr, based on apparent disbelief over what constitutes a Buick. You can see all of the shenanigans in the video above. Plus, if you'd like to see what goes into making a Super Bowl commercial, Buick produced a short video with Newton and Kerr showing what happens behind the scenes. You can check it out below. Related Video:

U.S. denies GM tariff relief request for China-made Buick SUV

Wed, Jun 5 2019WASHINGTON — The Trump administration has denied a General Motors Co request for an exemption to a 25 percent U.S. tariff on its Chinese-made Buick Envision sport utility vehicle. The denial of the nearly year-old petition came in a May 29 letter from the U.S. Trade Representative's office saying the request concerns "a product strategically important or related to 'Made in China 2025' or other Chinese industrial programs." The midsize SUV, priced starting at about $35,000, has become a target for critics of Chinese-made goods, including leaders of the United Auto Workers union and members in key political swing states such as Michigan and Ohio. GM said on Tuesday it was aware of the denial and has been paying the tariff since July. GM has not raised the sticker price to account for the tariff. Buick Envision sales fell in the United States by nearly 27% to 30,000 last year and fell another 21% in the first three months of 2019. Only a small number of vehicles are built in China and sold in the United States. Last month, the U.S. Trade Representative's Office also denied a request by Chinese-owned Volvo Cars for tariff exemptions for mid-size SUVs assembled in China after the automaker sought an exemption for the XC60, its top selling U.S. vehicle. GM, the largest U.S. automaker, argued in its request that Envision sales in China and the United States would generate funds "to invest in our U.S. manufacturing facilities and to develop the next generation of automotive technology in the United States." GM said last year the "vast majority" of Envisions, about 200,000 a year, are sold in China. Because of the lower U.S. sales volume, "assembly in our home market is not an option" for the Envision, which competes with such mid-size crossover vehicles as the Jeep Grand Cherokee and the Cadillac XT5. Ahead of the July 2018 start for higher import tariffs, GM shipped in a six-month supply of Envisions at the much lower 2.5 percent tariff rate, Reuters reported in August 2018.

2020 Buick LaCrosse images leaked on Chinese website

Fri, Nov 16 2018Buick is planning a refreshed version of its LaCrosse full-size sedan for the Chinese market, judging by these photos discovered by the site Auto Verdict on a Chinese government site used to certify upcoming new models. We can only see exterior cosmetic changes, but they bring the LaCrosse more in line with the styling of the new Regal and Enclave models, leading to speculation that it won't be long until the changes show up in the U.S. The front three-quarters photo shows off a redesigned front fascia, with slimmed-down headlights that are now tied to the grille instead of set apart by body-color surround, thanks to some new chrome treatment. There's also a chrome wing on the grille, similar to what's seen on the 2019 Enclave and new Regal. The lower front fascia is also different, with new L-shaped fog lamps. On the rear, there's a new chrome wing connecting and intersecting the taillights and surrounding the badge. There's no word about any interior changes, but they'd likely be minor in keeping with the exterior updates. Buick most recently debuted a 2019 LaCrosse Sport Touring version, while a mild hybrid model arrived for 2018. China, of course, has become Buick's largest market, but the picture is less rosy stateside amid dimming prospects for sedans, as consumers flock to crossovers and SUVs. In the third quarter, U.S. sales of the LaCrosse fell 31.1 percent from the prior-year period. Between January and the end of September, GM had sold 13,409, which was a decline of 14.2 percent. Its full-year 2017 sales totaled 20,161, which was down almost 27 percent from 2016. For perspective, Buick sold more than twice that number — 42,035 — as recently as 2015. The current generation launched in 2017. Related Video: Featured Gallery 2020 Buick LaCrosse China Image Credit: Buick Design/Style Buick Luxury Sedan