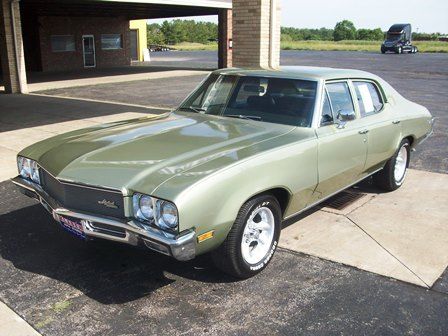

1971 Buick Skyarl 350 on 2040-cars

Grayslake, Illinois, United States

Body Type:Coupe

Engine:5.7L 350 V8

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Make: Buick

Model: Skylark

Trim: 2 door coupe

Warranty: Vehicle does NOT have an existing warranty

Drive Type: RWD

Options: CD Player, Aftermarket cd player

Mileage: 58,000

Sub Model: Coupe

Exterior Color: Silver

Disability Equipped: No

Interior Color: Black

1971 Buick Skylark, has 5.7L 350 V8. Engine is completely rebuilt to be much more badass. Has well over 300 horsepower. automatic transmission, center console shifter. Paint is amazing on here. has roughly 58000 miles, real good for a 1971. New seatbelts have just been put in it. IT NEEDS- rocker panels, new muffler (just 1 but does have dual exhaust), windshield wiper switch, no air or heat. Car has little things here and there that need fixin. mechanically speaking car is great and really fun to drive, you can feel all eyes on you when your on the road. car also has those cool windows that go down on both side so the car sits wide open HERES THE REAL FIND: this 1971 skylark has an aftermarket hood on it, from a buick gsx with the two ram air scoops. 1) you cant find these hoods anymore in this condition. 2) your looking to spend another 2000 on this hood if you find it anywhere else. ebay message me with questions and offers.

Buick Skylark for Sale

1971 buick skylark base sedan 4-door 5.7l(US $8,995.00)

1971 buick skylark base sedan 4-door 5.7l(US $8,995.00) 1967 buick skylark base coupe 2-door 4.9l(US $8,500.00)

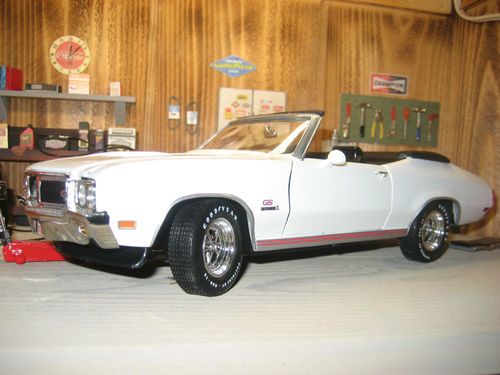

1967 buick skylark base coupe 2-door 4.9l(US $8,500.00) 1970 buick stage 1 gran sport convertible rare numbers matching car

1970 buick stage 1 gran sport convertible rare numbers matching car 1970 buick gs 95k original miles light restomod actual gs(US $10,000.00)

1970 buick gs 95k original miles light restomod actual gs(US $10,000.00) 1971 buick skylark excellent shape runs great(US $7,995.00)

1971 buick skylark excellent shape runs great(US $7,995.00) 1963 buick skylark convertible

1963 buick skylark convertible

Auto Services in Illinois

Z & J Auto Sales ★★★★★

Wright Automotive Inc ★★★★★

Wheatland Automotive Inc ★★★★★

Value Services ★★★★★

V & R Auto & Truck Repair ★★★★★

United Glass Co ★★★★★

Auto blog

GM's MPG overstatement could affect 2 million vehicles

Tue, May 17 2016Late last week, GM admitted that three of its large SUVs fuel economy window stickers did not match their actual efficiency ratings, and so the vehicles couldn't be sold. The stickers on the 2016 Chevy Traverse, GMC Acadia, and Buick Enclave said their ratings were one to two miles per gallon better than they should have been. Officially, the number of affected vehicles sits at about 60,000. But Consumer Reports makes a good point: what's up with all of the previous model year SUVs that are basically the same vehicle? To wit: the 2016 model year vehicles are not substantially different than the 2015 or the 2014, or even going all the way back to 2007. On the EPA's fuel economy website, all of these older models will "have better stated fuel economy numbers than the new vehicles in GM's dealerships," Consumer Reports noted. CR's best point, and the one that makes the 60,000 number potentially grow to 2 million if all of the vehicles built on this platform are affected, is that "[i]t seems unlikely that the company would change the powertrain on these carryover models so late in their model cycles in a way that would cause a dramatic, negative impact on fuel economy." GM says that earlier model year SUVs are not affected and the EPA did not respond to CR's question about the potential for more discrepancies. We've seen automakers reverse course before, so if GM has to come out with a mea culpa soon, don't be surprised. GM is rushing corrected stickers to dealers so that the SUVs can be sold again, but a fix for the already-sold vehicles could be trickier to solve. Related Video: Related Gallery 2013 GMC Acadia View 16 Photos News Source: Consumer Reports Government/Legal Green Buick Chevrolet GMC Fuel Efficiency mpg gmc acadia chevy traverse

Buick Enspire spied for the first time, loses concept's electric powertrain

Thu, Jun 13 2019About a year ago, Buick showed a high-performance electric crossover with wide, aggressive, curvy lines that was called the Buick Enspire. Now we have our first look at the production version. While it does seem to be styled like the crossover, it also seems to have lost its electric powertrain in favor of internal combustion. At the front of the crossover, we can clearly see it has the skinny, scowling headlights of the concept sitting high on the front fascia and flush with the hood. The main grille looks like it may be smaller, but it could also just be that the actual open section of the grille doesn't fill up the grille area of the fascia. In profile, the crossover has an attractive long nose, low roof and rising belt line. The rear shows the most change, as the rear pillars are much thicker, and the taillights don't appear to span the full width of the crossover. It's in the rear that we can also see the evidence that the Buick Enspire will actually be gasoline powered. Looking very closely under the rear bumper cover, we can see two exhaust tips turned to face the ground. Based on the size of the crossover, and the fact a Cadillac XT4 was being driven along with the prototype, the Enspire is probably using the XT4's platform, as well as its mechanical bits. That means it probably has a turbocharged 2.0-liter four-cylinder making 237 horsepower and 258 pound-feet of torque. Power will also probably go through a nine-speed automatic to either the front wheels or all four. This prototype looks to be pretty far along, so we'll probably see the production version in about a year. Considering the Enspire's size and likely powertrain, it may even replace the similar Buick Envision. And since the Envision is Buick's worst selling crossover (unless you count the Regal TourX as one), it would be ripe for replacement.

GM delivers best Q3 sales since 1980, 2.4M vehicles sold

Wed, 15 Oct 2014People are a weird sort. Even after registering over 70 recalls through the first three-quarters of 2014, General Motors saw its best Q3 results since Jimmy Carter was in the White House, registering over 2.4 million global sales between June and September on the back of strong results in the US and China.

US sales were marshaled by good results for GM's pickups, the Chevrolet Silverado and GMC Sierra, which bumped the manufacturer's truck market share to 35.6 percent, up nearly three points from Q1 2014. Buick has seen healthy growth as well, with the Encore dominating its segment for the sixth month running.

It was China, though, that really bolstered GM's sales, as the company's efforts to top last year's record-setting 3.16 million units continued apace. Small SUV sales saw massive growth, with Encore, Chevrolet Trax and Captiva figures jumping 90 percent in Q3. Brand-wise, Chevrolet, Cadillac and Buick all saw sales gains in the PRC, with each recording double-digit year-over-year jumps. Cadillac sales alone were up 63 percent compared to the first nine months of 2013.