1966 Buick Skylark 2dr on 2040-cars

Chico, California, United States

|

1966 Buick Skylark 2dr post. Car has 87,700 Original miles. Original Wildcat 375 - 340 CI, 4Bbl, auto 300 2spd. Very original and unmolested car. Has had a repaint several years ago. Straight, clean, shiny paint but does have a few blems. Original interior in great shape. Engine compartment very clean. Original chrome and trim in nice shape. Great running and driving car. A real head turner and has won several ribbons.

|

Buick Skylark for Sale

1972 buick skylark custom coupe 2-door 5.7l

1972 buick skylark custom coupe 2-door 5.7l 1965 buick skylark base sedan 2-door 4.9l

1965 buick skylark base sedan 2-door 4.9l 1965 buick skylark gs stage 1 hardtop 2-door 6.6l

1965 buick skylark gs stage 1 hardtop 2-door 6.6l 1968 buick skylark base coupe 2-door 5.7l

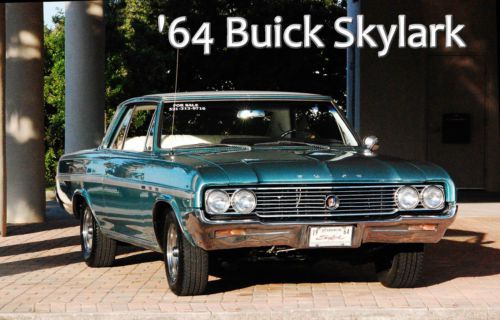

1968 buick skylark base coupe 2-door 5.7l 1964 buick skylark base hardtop 2-door 4.9l classic survivor wildcat 310

1964 buick skylark base hardtop 2-door 4.9l classic survivor wildcat 310 1969 buick gs400 convertible tribute auto show quality drive anywhere!!

1969 buick gs400 convertible tribute auto show quality drive anywhere!!

Auto Services in California

Z Best Auto Sales ★★★★★

Woodland Hills Imports ★★★★★

Woodcrest Auto Service ★★★★★

Western Tire Co ★★★★★

Western Muffler ★★★★★

Western Motors ★★★★★

Auto blog

PSA's purchase of Opel from GM is expected to be finalized soon

Sat, Mar 4 2017PSA's purchase of the Opel/Vauxhall division from General Motors is expected to be officially announced on Monday, according to The New York Times. PSA, the parent company of European automakers Peugeot and Citroen, will reportedly hold a joint press conference with GM in Paris to announce the deal. GM has worked as part of an alliance with PSA in Europe since 2012. The deal could be a big boon for both companies. For PSA, the addition of Opel and Vauxhall into its fold would catapult the automaker into second place behind Volkswagen for European marketshare, and would allow the company to spend research and development costs across a greater number of vehicles. And GM, which has struggled in recent years to turn a profit with its European division, would be able to focus more squarely on the areas where it's most profitable and to invest in future technologies like automation. But the deal isn't without its potential pitfalls, primarily for PSA. GM hasn't been able to make a success of Opel and Vauxhall, and it's not a sure bet that PSA will, either. What's more, the addition of Opel and Vauxhall doesn't expand PSA's reach any further into new markets, like China or India. The NYT cites data from Ferdinand Dudenhoffer, a professor at the University of Duisburg-Essen in Germany, showing that 70 percent of PSA and Opel business is done in Europe, a market that has been shrinking since 1999. We'll have to wait a few days to see exactly how the deal between PSA and GM will be structured. We're also curious to see how the loss of Opel may affect GM's lineup in the States, especially for Buick, since the company's Regal sedan is based on the European Opel Insignia. In other words, stay tuned. Related Video:

GM raises 2023 guidance on strong sales, higher profits

Tue, Apr 25 2023General Motors beat first-quarter profit estimates and raised its full-year earnings and cash-flow guidance after vehicle demand at the start of the year surpassed expectations. Its shares rose in premarket trading. GM made $2.21 a share in adjusted profit in the first quarter, compared to a consensus forecast of $1.72 a share. Revenue rose 11% to $39.99 billion, it said Tuesday, which was more than the $39.24 billion analysts expected. The stronger results stem from rising sales in the US, even in the face of higher interest rates and inflation. GM executives said demand was strong enough to revise 2023 guidance upward, boosting profit estimates for the year by $500 million to between $11 billion and $13 billion. “We did it with strong production and inventory discipline and consistent pricing,” GM Chief Financial Officer Paul Jacobson said on a call with journalists. “All in all, weÂ’re feeling confident about 2023.” The Detroit automaker raised per-share full-year guidance to between $6.35 and $7.35, up from $6 to $7 a share, and said free cash flow would also increase by $500 million to a range of $5.5 billion to $7.5 billion. GMÂ’s shares pared a gain of as much as 4.4% before the start of regular trading Tuesday, rising 3.5% to $35.50 as of 6:55 a.m. in New York. The stock was up 1.9% for the year as of the close on Monday. North American Strength The automakerÂ’s sales were particularly strong in North America, where first-quarter earnings rose before interest and taxes rose to $3.6 billion. Vehicle sales rose 18% to 707,000 in the region. Jacobson said the company originally expected to sell 15 million vehicles in the US this year, slightly less than the 15.5 million annualized rate automakers foresaw in the first quarter. North American demand was enough to offset a weak performance in China, GMÂ’s second-largest market. The automaker continues to struggle in the country, where its vehicle sales fell 25% to 462,000 vehicles in the quarter. Profits from its joint ventures in the market slumped 65% to $83 million. The market has struggled overall in the wake of Covid-19 restrictions and foreign automakers have had to overcome a growing preference for Chinese brands by competing on price, squeezing profit margins. The situation in China probably wonÂ’t significantly improve until the second half of the year, according to Jacobson. GM remains on target to sell 150,000 electric vehicles this year, the CFO said.

The Chevrolet Bolt is headed to China as a Buick SUV

Thu, Jan 16 2020When spy photos of what appeared to be Chevrolet Bolt EV with some minor front- and rear-end updates circulated last week, Autoblog surmised that GM was working on some sort of Bolt-based vehicle — potentially a crossover — to be sold in China as a Buick. We may just have corroboration for that theory. On Thursday, Motor1.com spotted a story published earlier this week on the Chinese site Auto Home which claims that GM has applied to sell an all-electric SUV under the Velite 7 nameplate in China. There's little differentiating the Velite 7's exterior from the Bolt EV's, apart from bumpers, badges, and a little extra ground clearance. Up front, the bowtie is replaced by a round Buick badge, and the bumper picks up an almost Prius-like appearance thanks to contrasting vertical elements and a thin grille bleeding into the head lights to give it a full-width appearance. Chevy Bolt-based prototype View 16 Photos If the Chinese report is accurate, there is one significant difference under the skin. Per the application, the Buick crossover variant is to be powered by a 174-horsepower electric powertrain. That's down 26 horsepower from the Bolt EV's powertrain, and we can't help but think that a lifted Buick variant might just need every pony it can get. The needs of the Chinese market are unique, and we're certain GM knows what it's doing if these figures are accurate. We have no reason to believe Buick plans to sell the Velite 7 EV here in the States, though we expect an updated Chevy Bolt eventually, and we wouldn't be surprised if Buick brings something along shortly to fill the void left by the departure of the Regal sedan and its variants. Related Video: