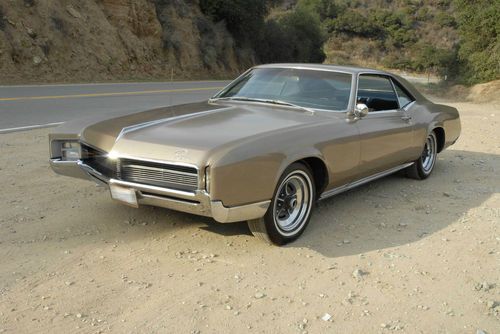

Classic 1967 Buick Riviera 2-door Hardtop on 2040-cars

Pomona, California, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:430 Wildcat

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Make: Buick

Model: Riviera

Trim: Cupe 2-door

Power Options: Air Conditioning, Power Windows, Power Seats

Drive Type: RWD

Mileage: 76,431

Sub Model: Base Model

Disability Equipped: No

Exterior Color: Gold

Number of Doors: 2

Interior Color: Black

Warranty: Vehicle does NOT have an existing warranty

Buick Riviera for Sale

1955 buick riviera super window sticker solid car runs great auto all original(US $13,800.00)

1955 buick riviera super window sticker solid car runs great auto all original(US $13,800.00) Harley earls designed original 1954 buick super riveria 2 door hardtop

Harley earls designed original 1954 buick super riveria 2 door hardtop 1990 buick riviera luxury coupe 2-door 3.8l

1990 buick riviera luxury coupe 2-door 3.8l 1982 buick riviera limited edition convertible 2-door 5.0l

1982 buick riviera limited edition convertible 2-door 5.0l The ultimate luxury performance coupe!(US $28,500.00)

The ultimate luxury performance coupe!(US $28,500.00) 2 door coupe cream color needs heater core ,valve cover gaskets

2 door coupe cream color needs heater core ,valve cover gaskets

Auto Services in California

ZD Autobody ★★★★★

Z Benz Company Inc ★★★★★

Www.Bumperking.Net ★★★★★

Working Class Auto ★★★★★

Whittier Collision Center #2 ★★★★★

West Tow & Roadside Servce ★★★★★

Auto blog

Woodward Dream Cruise Photo Gallery | Classics and American muscle

Sun, Aug 21 2022The 2022 running of the Woodward Dream Cruise just went down, and we were there from morning to evening drinking in the sweet sights and pre-emissions exhaust fumes. Yes, it’s a little smelly on Woodward Ave. this time of year. Just like always, the Dream Cruise invites all comers to cruise their machines on Woodward from Ferndale, MI to Pontiac, MI. Everybody is invited, but the original intent of the Dream Cruise was to highlight classic American muscle cars. YouÂ’ll see plenty of those in our mega gallery above, but weÂ’ve sprinkled it with a bunch of other vehicle types, such as modern muscle and other intriguing American vehicles. Similar to years past, though, sometimes the classics arenÂ’t the most entertaining thing to look at on Woodward. ThatÂ’s why weÂ’ll have other mega galleries coming soon, highlighting the weird cars and (great) dogs of the Cruise, all the imports and exotics you can imagine and a special one for all the trucks of Woodward — perhaps even more so than in years past, the truck population on Dream Cruise day was quite high. Click through above to see all the classics you wouldÂ’ve seen had you been roadside on the day of the cruise. And if you missed this yearÂ’s event, make sure you check out what happens next year. You wonÂ’t be alone, as itÂ’s estimated that over 1 million people attend the Dream Cruise to either watch from the side of the road or to sit in the most glorious traffic jam in the world. Related video Featured Gallery 2022 Woodward Dream Cruise classics and American muscle View 160 Photos Design/Style Buick Cadillac Chevrolet Chrysler Dodge Ford GM GMC Hummer Jeep Pontiac RAM Classics Woodward Dream Cruise

Opel Cascada close to getting green light for US

Fri, 13 Sep 2013For a company with a long tradition of grand touring convertibles, it's almost unseemly that General Motors doesn't offer a properly relaxed four-seat convertible in North America. There's the Chevrolet Camaro, of course, but it's not big on rear-seat space and it doesn't offer that sort of serene demeanor that many open-air buyers crave. We're thinking of something more refined and, dare we say, elegant. Something a bit closer to the Opel Cascada.

The General's front-wheel drive convertible went on sale in Europe this year, and while it seemed like a natural fit for its Buick brand in America, it's never been sold here. That may be about to change, however. Back in June, CEO Dan Akerson hinted he'd like to see the Cascada available in the US, and now there's word from Edmunds that importation "could happen soon." That's according to an unnamed insider at the company.

It's almost unseemly that GM doesn't offer a relaxed four-seat convertible.

Facelifted Buick LaCrosse caught in China

Tue, 01 Jan 2013Back in September, General Motors promised nine new or refreshed models for its Buick and GMC brands within 12 months, and while we've already seen what the updated 2014 GMC Sierra will look like, we're now getting our first look at what appears to be the facelifted 2014 Buick LaCrosse. Judging by a set of spy shots posted on Autohome showing a Chinese-market model, the updated sedan is getting a pretty big makeover, including a completely redesigned interior and a refreshed exterior.

From the outside, all of the usual midcycle updates have been made to the LaCrosse, including new lights and fascias. The new front end features a larger, reshaped seven-sided grille, LED-trimmed headlights and Buick's signature portholes are now mounted on the side edges of the hood to be more visible. The rear view has similarly small yet refined changes such as the new decklid with a chrome brow that stretches the full width of the car, to a more squared-off rear fascia with exhaust outlets pushed out to the corners. From the single shot we can see, the LaCrosse's new rump looks very similar to the Hyundai Equus.

The second-generation LaCrosse helped reestablish Buick as a near-premium automaker with its interior quality, and the next model could very well up the stakes even more. The new cabin design ditches the wraparound wood trim on the instrument panel and door panels for a smoother, more contemporary look. While it's hard to make out all of the changes, we can instantly see that the center stack is now more upright with fewer buttons, but the biggest news might be the cabin technology the 2014 LaCrosse might offer. Checking out the shot of the center console, we see what looks to be a pad similar to the handwriting recognition technology used by Audi, which would make this a first for GM.