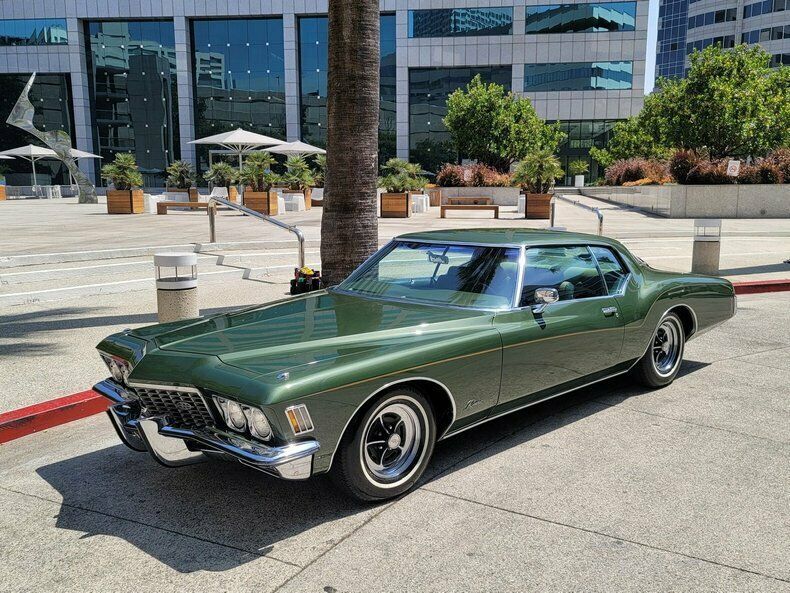

1967 Buick Riviera on 2040-cars

Middleburg, Florida, United States

Transmission:Automatic

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

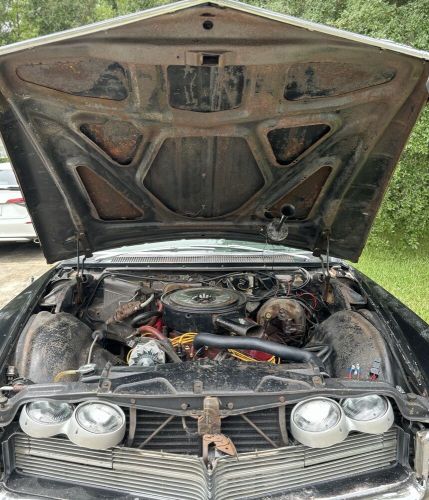

Engine:430 BB

Year: 1967

VIN (Vehicle Identification Number): 494877H940004

Mileage: 69460

Number of Cylinders: 8

Make: Buick

Drive Type: RWD

Model: Riviera

Exterior Color: Black

Buick Riviera for Sale

1982 buick riviera(US $21,995.00)

1982 buick riviera(US $21,995.00) 1973 buick riviera gs stage i(US $10,000.00)

1973 buick riviera gs stage i(US $10,000.00) 1965 buick riviera gran sport(US $27,900.00)

1965 buick riviera gran sport(US $27,900.00) 1972 buick riviera(US $16,800.00)

1972 buick riviera(US $16,800.00) 1973 buick riviera boat tail(US $14,700.00)

1973 buick riviera boat tail(US $14,700.00) 1972 buick riviera restored 1972 buick riviera(US $18,200.00)

1972 buick riviera restored 1972 buick riviera(US $18,200.00)

Auto Services in Florida

Zych`s Certified Auto Svc ★★★★★

Yachty Rentals, Inc. ★★★★★

www.orlando.nflcarsworldwide.com ★★★★★

Westbrook Paint And Body ★★★★★

Westbrook Paint & Body ★★★★★

Ulmerton Road Automotive ★★★★★

Auto blog

The 2020 Buick LaCrosse we won't get looks exceptional

Thu, Mar 7 2019GM is killing off the Buick LaCrosse in the United States after the 2019 model year, but elsewhere it lives on. Buried by all the Geneva news this week, GM quietly took the wraps off a 2020 Buick LaCrosse facelift for China. It only makes sense to keep selling the big Buick in the popular Chinese market (now Buick's largest), but we're a tad jealous of what we can't have stateside. The changes Buick has implemented make the LaCrosse into a far more handsome option. Both the front and rear get massaged here. A new horizontal patterned grille, slimmer headlights with a neat LED design, plus new lower bumper surround all work together to provide a more upscale look. The view out back is an even larger departure from the old and somewhat awkward rear end on the 2019 LaCrosse. Smaller, flowing taillights mesh well with the chrome strip on the trunk lid, then dual exhaust outlets offer a sporty flair to the squat rear end. The Buick badge looks cohesive with the look as a whole now, instead of just chilling out alone on the expansive trunk lid. An updated powertrain package goes along with the new looks, too. GM is snagging its new 2.0-liter turbocharged four-cylinder LSY engine it uses in the Cadillac XT4 for duty here. It makes 237 horsepower and 258 pound-feet of torque, and is mated to GM's nine-speed automatic transmission. China will be the only market to see this generation of LaCrosse as GM plans to exclusively produce it in its Shanghai facility. The Detroit-Hamtramck plant that previously made it for all North American markets was among those facilities GM announced would close, bringing with it the LaCrosse and other vehicles. Related video:

Junkyard Gem: 1978 Buick Skylark Sedan

Sat, Feb 20 2021Around the time that OPEC shut off the oil taps, The General realized that it was time to sell more small cars from GM divisions not previously known for such machines. The logical candidate for this project was the Chevrolet Nova, a rear-wheel-drive compact that shared much of its chassis design with the Chevrolet Camaro and Pontiac Firebird. The Nova-based Pontiac Ventura came out in the 1971 model year, and the Buick and Oldsmobile Divisions began producing their own badge-engineered Nova siblings for 1973 (Cadillac was late to the party, but eventually created the Nova-based Seville for 1976). At first, the Buickized Nova got Apollo badges, but the better-known Skylark name was applied to these cars for the 1975 through 1979 model years. Today's Junkyard Gem is one of those Nova-based Skylarks, found in a Denver self-serve yard. From the 1964 through 1972 model years, the Skylark lived on the A-Body chassis and was sibling to the Chevrolet Chevelle/Malibu, Pontiac LeMans/Tempest/GTO, and Oldsmobile Cutlass/442. After the 1975-1979 rear-wheel-drive X-Body phase, the Skylark name then went onto the unrelated front-wheel-dive X-Body chassis developed for the Chevrolet Citation. It's a Nova, sure, but Buick made sure that it had a bit more swank than its Chevy counterpart. Checked seat fabric with big square buttons! The base engine in the '78 Skylark was the 3.8-liter Buick V6, rated at 110 horsepower. GM had invested in a new crankshaft design for this engine the year before, so it no longer had the "odd-fire" cut-down V8 crankshaft that shook the fillings out of so many drivers' teeth in earlier years. An assortment of low-compression V8s from Oldsmobile, Chevrolet, Pontiac, and Buick were available as optional equipment as well, eventually leading to the "Chevymobile" lawsuits of a few years later. The base transmission in this car was a three-speed manual (I'm not sure if you could still get a three-on-the-tree column-shift manual Skylark in 1978, but a three-on-the-floor manual was available for sure). The very last three-on-the-tree car Americans could buy was the '79 Nova and its Olds Omega/Pontiac Phoenix siblings, while the final three-on-the-floor cars were the '81 Malibu and siblings. This car has the optional three-speed automatic.

Next-gen LaCrosse, Cascada convertible coming to Buick showrooms in 2016

Thu, Jul 24 2014It's difficult to overstate how significant the post-bankruptcy years have been for General Motors' Buick brand. Arguably the most improved American automaker, Buick has rounded out its range with an excellent compact in the Verano, a well-balanced midsizer in the Regal and a segment-busting mini-CUV, with the Encore. Seeking to keep that momentum going, the next several years will see the brand address a trio of its most obvious issues. First and foremost will be a replacement for the aging LaCrosse, a vehicle whose only bit of attention since its 2009 debut was a very light refresh in 2013. According to Automotive News, we should expect the next-generation LaCrosse to arrive late next year or early in 2016, as a 2016 model. AN expects big design changes, as Buick attempts to further the LaCrosse from its popular platform-mate, the Chevrolet Impala. The changes won't be so radical, though, as to do away with its front-drive architecture, as the latest version of the Epsilon platform will underpin the next LaCrosse. The 3.6-liter V6 is likely to carry on, although a smaller, budget-minded offering is also extremely likely (we'll eat our hat if it's not the 2.0-liter, turbocharged four-cylinder from the Regal, Verano and Cadillac CTS et al.). The other issue plaguing Buick's lineup is a lack of a midsize crossover. This is particularly damning for the brand as most of its showrooms are shared with GMC, which boasts its own midsizer in the form of the Terrain. With the upcoming Envision (see here for teasers), that problem should be addressed. Like the LaCrosse, the Envision will likely be a 2016 model. It will debut and launch in China early next year, while we can expect it to arrive stateside later next year, or even early in 2016. For American consumers, both a 2.5-liter four-cylinder and the aforementioned 2.0T could see action in the Envision. Finally, while Buick can boast a pair of vehicles available with manual transmissions, it's still far from what we'd call a brand for fun driving experiences. Of course, one way of solving that problem is with a two-door convertible. Yes, it's extremely likely that the Euro-market Opel Cascada convertible will be sold in the US early in 2016. Whether it keeps the Cascada name is unclear (all in favor of Skylark, say "aye"). Regardless, adding a reasonably priced, relaxed, two-door droptop to the Buick range to fill the space left by the not-so-dearly departed Chrysler 200 Convertible seems like a no brainer.