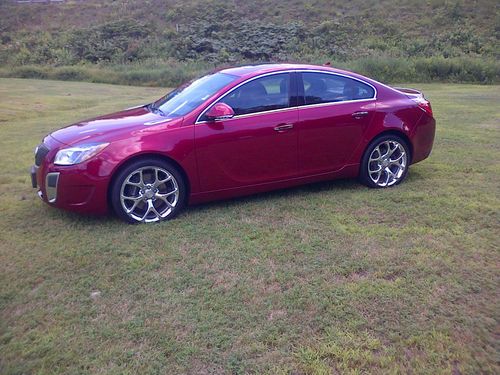

1981 Buick Regal Red Rare Low Miles 57400 Not Cutlass, Monte Carlo Collector on 2040-cars

White, South Dakota, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:V6

Fuel Type:Gasoline

For Sale By:Private Seller

Interior Color: Red

Make: Buick

Model: Regal

Trim: coupe

Power Options: Air Conditioning, Cruise Control

Drive Type: Rear wheel

Mileage: 57,400

Exterior Color: Red/Tan

Warranty: Vehicle does NOT have an existing warranty

Survivor! Rare collector 1981 Regal with 57400 original miles! Was owned by a little old lady, for real! Has a clean interior, no tears. no rust, has some blistering on the hood and deck lid, may show in pictures. The V6 has a fresh overhaul and ac was rebuilt and converted to 134. Has a new radiator and starter. Drives and rides great. The car could be driven anywhere, needs nothing. Buyer is responsible for shipping cost. sells as is no warranty.

Buick Regal for Sale

2011 buick regal cxl turbo sunroof nav htd seats 7k mi texas direct auto(US $23,980.00)

2011 buick regal cxl turbo sunroof nav htd seats 7k mi texas direct auto(US $23,980.00) 1987 buick turbo t, grand national, t-type

1987 buick turbo t, grand national, t-type 2012 buick regal demo only 231 miles! 6 spd manual turbo(US $26,995.00)

2012 buick regal demo only 231 miles! 6 spd manual turbo(US $26,995.00) 2001 buick regal ls sedan 4-door 3.8l *no reserve*

2001 buick regal ls sedan 4-door 3.8l *no reserve* No reserve - 3800 supercharged v6 - chrome wheels - leather - sunroof

No reserve - 3800 supercharged v6 - chrome wheels - leather - sunroof 1999 buick regal gs sedan 4-door 3.8l(US $2,750.00)

1999 buick regal gs sedan 4-door 3.8l(US $2,750.00)

Auto Services in South Dakota

tri-state ag ★★★★★

Auto Body Crafters ★★★★★

Auto Body Crafters ★★★★★

3J Oil Medics LLC & Towing ★★★★★

Rusty`s Truck & Auto Sales ★★★★

RK Auto ★★★★

Auto blog

Consumer Reports no longer recommends Honda Civic

Mon, Oct 24 2016Consumer Reports annual Car Reliability Survey is out, and yes, there are some big surprises. First and foremost? The venerable publication no longer recommends the Honda Civic. In fact, aside from the walking-dead CR-Z and limited-release Clarity fuel-cell car, the Civic is the only Honda to miss out on CR's prestigious nod. At the opposite end there's a surprise as well – Toyota and Lexus remain the most reliable brands on the market, but Buick cracked the top three. That's up from seventh last year, and the first time for an American brand to stand on the Consumer Reports podium. Mazda's entire lineup earned Recommended checks as well. Consumer Reports dinged the Civic for its "infuriating" touch-screen radio, lack of driver lumbar adjustability, the limited selection of cars on dealer lots fitted with Honda's popular Sensing system, and the company's decision to offer LaneWatch instead of a full-tilt blind-spot monitoring system. Its score? A lowly 58. The Civic isn't the only surprise drop from CR's Recommended ranks. The Audi A3, Ford F-150, Subaru WRX/STI, and Volkswagen Jetta, GTI, and Passat all lost the Consumer Reports' checkmark. On the flipside, a number of popular vehicles graduated to the Recommended ranks, including the BMW X5, Chevrolet Camaro, Corvette, and Cruze, Hyundai Santa Fe, Porsche Macan, and Tesla Model S. Perhaps the biggest surprise is the hilariously recall-prone Ford Escape getting a Recommended check – considering the popularity of Ford's small crossover, this is likely a coup for the brand, as it puts the Escape on a level playing field with the Recommended Toyota RAV4, Honda CR-V, and Nissan Rogue. While Ford is probably happy to see CR promote the Escape, the list wasn't as kind for every brand. For example, of the entire Fiat Chrysler Automobiles catalog, the ancient Chrysler 300 was the only car to score a check – there wasn't a single Dodge, Fiat, Jeep, Maserati, or Ram on the list. That hurts. FCA isn't alone at the low end, either. GMC, Jaguar Land Rover, Mini, and Mitsubishi don't have a vehicle on CR's list between them, while brands like Mercedes-Benz, Volvo, Nissan, Lincoln, Infiniti, and Cadillac only have a few models each. You can check out Consumer Reports entire reliability roundup, even without a subscription, here.

Volvo and GM team with Amazon for in-car deliveries

Tue, Apr 24 2018Volvo and GM are the first automakers to pair their vehicles with a new service from Amazon that lets owners have their packages delivered inside their cars, without them having to be there. The service will initially be rolled out in 37 U.S. cities at no extra charge to Amazon Prime members with a Volvo On Call or OnStar account, and it works with same-day, two-day and standard shipping. It's intended as an alternative for people who don't want to risk having their package stolen from their front porch or receive deliveries at their workplace, and both automakers say it's an example of how they're embracing innovation as a way to make their customers' lives easier. Volvo released a video (above) showing how the service works. Users download the Amazon Key App (or " Ama-zin," as the narrator pronounces it) and link their Amazon Prime account with their Volvo On Call account — or OnStar, in the case of GM-branded vehicles. Once they register their delivery location in a publicly accessible location, users can select the "In-Car" option at checkout. They get a notification when the delivery is en route and once it's completed and the car is relocked. Volvo has been offering in-car delivery in certain European countries since 2015 through its Volvo On Call platform, which enables services like the ability to send calendar-based navigation destinations directly to the vehicle, find nearby gas stations and help locate the vehicle when you forget where you parked it. Volvo says the platform is now available in roughly 50 countries and covers more than 90 percent of its global sales. The service is compatible with 2015 or newer Volvo, Buick, Cadillac, Chevrolet and GMC vehicles. Volvo says it's available to the majority of Volvo owners, while GM says more than 7 million vehicle owners can qualify. The service is expected to roll out to more cities later. You can check eligibility at amazon.com/keyincar. Related Video: Buick Cadillac Chevrolet GM GMC Volvo Technology Infotainment Amazon connected car volvo on call e-commerce

GM raises 2023 guidance on strong sales, higher profits

Tue, Apr 25 2023General Motors beat first-quarter profit estimates and raised its full-year earnings and cash-flow guidance after vehicle demand at the start of the year surpassed expectations. Its shares rose in premarket trading. GM made $2.21 a share in adjusted profit in the first quarter, compared to a consensus forecast of $1.72 a share. Revenue rose 11% to $39.99 billion, it said Tuesday, which was more than the $39.24 billion analysts expected. The stronger results stem from rising sales in the US, even in the face of higher interest rates and inflation. GM executives said demand was strong enough to revise 2023 guidance upward, boosting profit estimates for the year by $500 million to between $11 billion and $13 billion. “We did it with strong production and inventory discipline and consistent pricing,” GM Chief Financial Officer Paul Jacobson said on a call with journalists. “All in all, weÂ’re feeling confident about 2023.” The Detroit automaker raised per-share full-year guidance to between $6.35 and $7.35, up from $6 to $7 a share, and said free cash flow would also increase by $500 million to a range of $5.5 billion to $7.5 billion. GMÂ’s shares pared a gain of as much as 4.4% before the start of regular trading Tuesday, rising 3.5% to $35.50 as of 6:55 a.m. in New York. The stock was up 1.9% for the year as of the close on Monday. North American Strength The automakerÂ’s sales were particularly strong in North America, where first-quarter earnings rose before interest and taxes rose to $3.6 billion. Vehicle sales rose 18% to 707,000 in the region. Jacobson said the company originally expected to sell 15 million vehicles in the US this year, slightly less than the 15.5 million annualized rate automakers foresaw in the first quarter. North American demand was enough to offset a weak performance in China, GMÂ’s second-largest market. The automaker continues to struggle in the country, where its vehicle sales fell 25% to 462,000 vehicles in the quarter. Profits from its joint ventures in the market slumped 65% to $83 million. The market has struggled overall in the wake of Covid-19 restrictions and foreign automakers have had to overcome a growing preference for Chinese brands by competing on price, squeezing profit margins. The situation in China probably wonÂ’t significantly improve until the second half of the year, according to Jacobson. GM remains on target to sell 150,000 electric vehicles this year, the CFO said.