Medium Grey Metallic on 2040-cars

Woodbury, New Jersey, United States

|

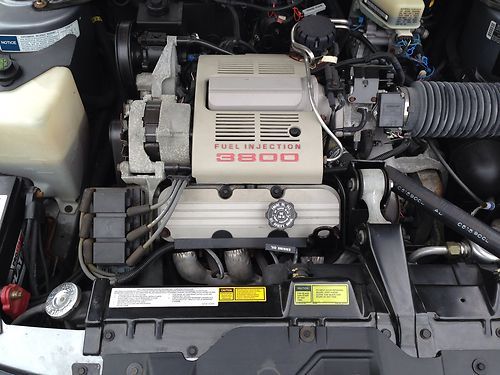

For your consideration , absolutely beautiful always garage kept 1990 Buick Reatta convertible with 25,293 Original miles 1 of only 2,132 made . This car is one of the finest examples you will find and it is in near mint condition and has only been driven to shows and parades. This car features the dependable 3.8L V6 , and runs excellent . All accessories and components work perfectly . ****Some minor flaws may exist due to the vehicles age****(minor paint nicks or scratches) . If anymore info is needed please feel free to message ..... thank you for looking

|

Buick Reatta for Sale

1990 original 50k miles car in rare maui blue with matching blue leather(US $15,500.00)

1990 original 50k miles car in rare maui blue with matching blue leather(US $15,500.00) 89 buick reatta clean carfax florida rare classic leather financing low reserve

89 buick reatta clean carfax florida rare classic leather financing low reserve 1990 white buick reatta convertible

1990 white buick reatta convertible 1991 buick reatta convertible

1991 buick reatta convertible 1990 buick reatta 2dr coupe 3.8l v6 auto low mileage 1 owner no accidents(US $5,900.00)

1990 buick reatta 2dr coupe 3.8l v6 auto low mileage 1 owner no accidents(US $5,900.00) 1990 buick reatta convertible 53k miles collector car(US $10,990.00)

1990 buick reatta convertible 53k miles collector car(US $10,990.00)

Auto Services in New Jersey

Zp Auto Inc ★★★★★

World Automotive Transmissions II ★★★★★

Voorhees Auto Body ★★★★★

Vip Honda ★★★★★

Total Performance Incorporated ★★★★★

Tony`s Auto Service ★★★★★

Auto blog

Junkyard Gem: 1992 Buick Century Woodie station wagon

Mon, Oct 9 2017The Detroit station wagon with fake-wood exterior paneling had a good long postwar run, but minivans and — increasingly — sport utility vehicles were giving such wagons quite a beating in the showrooms by 1992. Buick was down to just two woodies by 1992; here's a discarded example of the front-wheel-drive Century, spotted in a Northern California self-service yard. Buick sold big rear-wheel-drive Roadmaster wagons with Simu-Wood™ siding through the 1996 model year, but the smaller Century was fairly plush. American car shoppers didn't insist on real-looking "wood" on their wagons, although Chrysler went much more three-dimensional with their plastic wood that did GM during this era. This one has the 3.3-liter Buick V6 engine, rated at 160 horsepower. This is not to be confused with the unrelated GM 60° V6, which was available in earlier and later Centuries. If only these seats could talk, they'd tell many tales of sibling battles and spilled fast food. Related Video:

GM China President says automaker could export vehicles from China to US

Sat, 20 Apr 2013At a press conference on Saturday at the Shanghai Motor Show, General Motors announced plans to further expand its presence in the Chinese market. Among those commitments are plans to build four new plants by the end of 2015, giving the automaker the capacity to produce around five million vehicles a year in the country.

In order to make the most of that expansion, GM is adding 400 dealerships in China this year alone (for a total of 4,200 sales points), and it's eyeing 5,100 dealers by 2015. Yet not all of that production will stay in China - GM is planning to increase exports as well. Officials estimate the company will export somewhere between 100,000 and 130,000 Chinese-built vehicles this year - a record. And it's gunning for more.

Autoblog asked GM China president Bob Socia (above) if that means the company might eventually export new vehicles built in China to the United States, and he responded:

Buick Envision arrives in US next year

Fri, Jul 24 2015In a detailed piece on what General Motors has planned for the Buick brand stateside, Automotive News reports that the Envision will finally come to the US a little more than a year from now, in the latter half of 2016. The size gap between the small Encore and the large Enclave is a perfect fit for the Chevrolet Equinox-sized Envision. Assuming this actually happens, it should excite both customers and Buick dealers. In China, the Envision uses a 2.0-liter turbocharged four-cylinder with 256 horsepower and 260 pound-feet of torque, mated to a six-speed transmission. Before then, dealers sales forces will be preparing for the Cascada convertible, expected in Q1 next year. Later in 2016, around the same time as the Envision gets here, we can expect a redesigned Verano sedan. AN says it "should grow in length and interior roominess, similar to the Chevy Cruze," but the Verano already roughly matches or exceeds many Cruze dimensions. The Chinese-market Verano that premiered at the Shanghai Motor Show earlier this year probably holds some clues to what we'll see, but our version might not be an exact copy. A redesigned, lighter, and slightly larger LaCrosse will be right there with it. In 2017 the redesigned Regal appears. Following the trend, it also gets larger, but that's required because it needs to be more distinct from that larger Verano. AN suggests a new base engine will go in the Regal, perhaps something as small as the 1.5-liter turbo being lined up for the 2016 Chevy Malibu. At the other end, executives are said to be considering importing the diesel Opel Insignia wagon for the Regal lineup. If they bring the manual over, auto scribes will probably take the day off when the first one arrives, and make it an industry holiday.