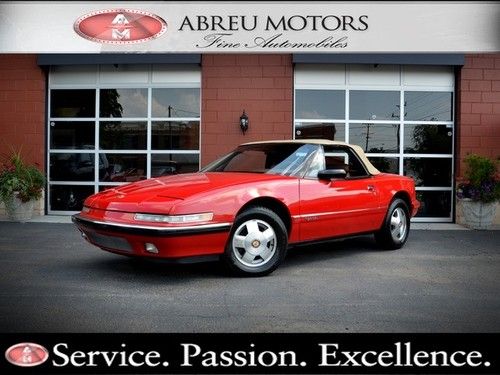

1990 Buick Reatta Automatic 2-door Convertible on 2040-cars

Carmel, Indiana, United States

For Sale By:Dealer

Engine:3.8L 3800CC 231Cu. In. V6 GAS OHV Naturally Aspirated

Body Type:Convertible

Fuel Type:GAS

Transmission:Automatic

Warranty: No

Make: Buick

Model: Reatta

Trim: Base Convertible 2-Door

Doors: 2

Fuel: Gasoline

Drive Type: FWD

Drivetrain: FWD

Mileage: 82,533

Exterior Color: Red

Number of Cylinders: 6

Interior Color: Tan

Buick Reatta for Sale

1990 buick reatta base coupe 2-door 3.8l

1990 buick reatta base coupe 2-door 3.8l 1990 buick reatta base coupe 2-door 3.8l(US $6,800.00)

1990 buick reatta base coupe 2-door 3.8l(US $6,800.00) 1990 buick reatta 2-door coupe with only 99k miles !!

1990 buick reatta 2-door coupe with only 99k miles !! 1989 buick reatta very rare and original! must see!(US $500.00)

1989 buick reatta very rare and original! must see!(US $500.00) 1990 red buick reatta

1990 red buick reatta 1990 buick reatta convertible 25,000 original miles very rare maui blue 1 of 153

1990 buick reatta convertible 25,000 original miles very rare maui blue 1 of 153

Auto Services in Indiana

USA Mufflers And Brakes ★★★★★

Total Auto Glass ★★★★★

Tieman Tire of Bloomington Inc ★★★★★

Stoops Buick GMC ★★★★★

Stephens Honda Hyundai ★★★★★

Southworth Ford Lincoln ★★★★★

Auto blog

2018 Kia Stinger vs. other luxury hatchbacks compared by the numbers

Sat, Nov 18 2017Ten years ago, if you had told us that one of the many new luxury segments to develop would be sedan-style hatchbacks, we'd have said you'd lost your mind. And yet, here we are today with not one, but four cars competing in just such a niche upscale segment: The Kia Stinger, Buick Regal Sportback, BMW 3 Series Gran Turismo and Audi A5. That's just in one size and price bracket. Two of the manufacturers listed here make larger versions of each luxury hatchback. We aren't entirely sure how it happened, but we're not going to complain, because we love the idea of a car with almost no compromise: luxury features, sporty performance, and plenty of practicality. Try Autoblog' s Car Finder to search for your next new vehicle. One of the reasons we're taking a look at these cars right now is that Kia has recently released pricing for its entry in the segment, the Stinger and Stinger GT. Buick wasn't far behind with the Regal Sportback and Regal GS, nor was Audi with the A5 and S5. So it seemed like an appropriate moment to look at the numbers and see which come out ahead or behind, with victors in each category highlighted with bold and underlined text. What we found when comparing these cars' statistics is that each one has a clear area of expertise. For performance, it's hard to beat the four-cylinder Kia Stinger and the V6 Stinger GT. The four-banger has the most horsepower of the four cars, and is just behind on torque. The V6 has the most power and torque among the six-cylinder versions. The Stingers are also the second lightest of the group when equipped with rear-wheel drive, though they fall to third with all-wheel drive. Space is a split between the Buick Regals and BMW 3 Series Gran Turismos. The Buicks have the most cargo space with the rear seats up or folded by a significant margin. The BMW on the other hand generally offers more space for passengers. It's up to you what's most important. Compare these and other potential new vehicle purchases using our tool. When it comes to cost, nothing can beat the four-cylinder Regal's base price of under $26,000. But if a V6 is what you're after, the Stinger GT is the cheapest. Neither matches the Audi A5 and S5 for fuel economy, though. Both Audis have the highest numbers for city, highway, and combined EPA estimates. Related Video:

Buick has best sales year ever, delivers over 1M cars globally

Wed, 08 Jan 2014If there are any lingering doubts why General Motors held onto Buick while killing Pontiac, Hummer and Saturn, one only has to look at the sales numbers from 2013 for the real answer. Thanks largely to strong sales in China, Buick set a global sales record last year by selling more than one million vehicles.

The lion's share of Buick sales came from China, which sold more than 809,000 units - about four times more Buicks than were sold in North America as a whole. In the US, the Buick Encore accounted for almost half of all US sales with 97,311 units as Buick spent the summer trying to keep up with demand of the subcompact crossover. Likewise, China-only models like the GL8 minivan and Excelle sedan (same as the US-spec Verano) were strong sellers in that market.

For good measure, Buick more than doubled its sales in Mexico with 2,319 units. Scroll down for the full press release.

Paul and Todd from Everyday Driver | Autoblog Podcast #477

Thu, May 26 2016Episode #477 of the Autoblog Podcast is here. This week, Dan Roth is joined by guests Paul Schmucker and Todd Deeken of Everyday Driver to talk cars, podcasting, and more. It's a freewheeling chat, and it all starts with the Autoblog Garage - check it out! Check out the rundown with times for topics, and thanks for listening! Autoblog Podcast #477 The video meant to be presented here is no longer available. Sorry for the inconvenience. Topics EveryDay Driver In The Autoblog Garage 2016 Buick Cascada Ford Mustang Boss 302 vs. Shelby GT350 Hosts: Dan Roth Guests: Paul Schmucker, Todd Deeken Total Duration: 01:08:20 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Feedback Email – Podcast at Autoblog dot com Review the show in iTunes Podcasts Buick Ford buick cascada cascada