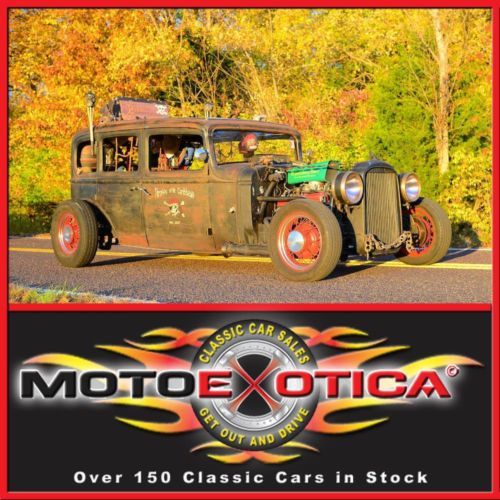

1931 Buick Rat Rod-pirate Theme-v8-hudson Headlamps-wire Wheels-auto Trans on 2040-cars

Saint Louis, Missouri, United States

Buick Rainier for Sale

1939 buick special 4-door convertible phaeton. very rare. suicide doors.

1939 buick special 4-door convertible phaeton. very rare. suicide doors. Vintage series 116 4 door touring - collector classic car- no reserve

Vintage series 116 4 door touring - collector classic car- no reserve 1916 buick d-45 6 cylinder touring, museum quality

1916 buick d-45 6 cylinder touring, museum quality 2004 buick rendezvous cx sport utility 4-door 3.4l no reserve

2004 buick rendezvous cx sport utility 4-door 3.4l no reserve 1942 buick super eight, for restoration,rat rod,parts car(US $2,500.00)

1942 buick super eight, for restoration,rat rod,parts car(US $2,500.00) 1972 buick gs350 convertible (#'s matching)

1972 buick gs350 convertible (#'s matching)

Auto Services in Missouri

Total Tinting & Total Customs ★★★★★

The Auto Body Shop Inc. ★★★★★

Tanners Paint And Body ★★★★★

Tac Transmissions & Custom Exhaust ★★★★★

Square Deal Transmission ★★★★★

Sports Car Centre Inc ★★★★★

Auto blog

Buick Avista concept is 'buildable', but not a priority

Tue, Mar 22 2016Buick could build the striking Avista concept that debuted at the Detroit Auto Show, though it's not a top priority, the brand's top executive said Tuesday in New York. "The reaction's been so great, we'll try to run the numbers and see if there's a business case," said Duncan Aldred, Buick vice president of sales, service, and marketing. Buick will show the Avista in red this week at the New York Auto Show as a followup to its Detroit debut. Buick actually built two prototypes, which are being used to promote the brand's performance potential at auto shows around the world this year. "It's very buildable," Aldred told reporters after the reveal of the reveal of the 2017 Encore small crossover before the New York Auto Show. "Ultimately, it comes down to priorities." He added, "We'd love to do it. We could do it, but [there's] lots of things we'd love to do... Nothing to confirm or deny." The Avista concept suggests a sports car with a twin-turbo V6 with 400 horsepower put to the rear wheels. The two-door followed another impressive Buick concept, the Avenir, which was four-door styling exercise from the 2015 Detroit show. Though the Avista remains on the minds of enthusiasts – helped in part by Buick – the priorities for the brand are crossovers. The Avista offers style, but the freshened Encore is the substance for Buick in New York, which along with the Envision, launches this year into the red-hot utility segment. The new Cascada convertible and redesigned LaCrosse also are joining Buick's lineup this year. While the Avista is doable, the brand clearly has other priorities ahead of it. Related Video:

GM promises to add 20 EVs and fuel-cell cars to lineup, paid for by SUVs

Mon, Oct 2 2017DETROIT — General Motors outlined plans on Monday to add 20 new battery electric and fuel-cell vehicles to its global product lineup by 2023, financed by robust profits from sales of gasoline-fueled trucks and sport utility vehicles in the United States and China. "General Motors believes in an all-electric future," GM global product development chief Mark Reuss said on Monday during a briefing at the company's suburban Detroit technical center. Future generations of GM electric vehicles "will be profitable," Reuss said, but added it was not clear when GM could make all its new vehicle offerings zero-emission electric cars. Regulators in China and some European countries have floated proposals to ban internal combustion engines by 2030 or 2040. "We will continue to make sure our internal combustion engines will get more and more efficient," Reuss said. GM shares were up more than 4 percent in midday New York trading on positive comments from Rod Lache, auto analyst at Deutsche Bank. Automakers, including electric vehicle market leader Tesla, lose money on electric cars because battery costs are still higher than comparable internal combustion engines. The company offered sneak peeks of three EV prototypes: a Buick SUV, a sporty Cadillac wagon and a futuristic pod car wearing a Bolt badge. GM funds its forays into new technology using a river of cash generated by old-technology vehicles popular with its core customer base in the United States heartland. In comparison, Tesla has burned through an estimated $10 billion in cash and has yet to show a full year profit. GM earned more than 90 percent of its $12.5 billion in pretax profits last year in North America, amid robust demand for its lineup of large sport utility vehicles and pickup trucks. The company's profitable operations in China rely on consumer demand for an expanding lineup of gasoline powered SUVs. GM has previously announced plans to make some of its future electric vehicles capable of driving themselves in robot taxi fleets. The company offered sneak peeks of three electric vehicle prototypes: a Buick brand sport utility vehicle, a sporty Cadillac wagon and a futuristic pod car wearing a Bolt badge. GM collaborated with Korean battery maker LG Chem to build the Bolt battery system. Company officials did not say what companies would supply batteries for the larger fleet of vehicles promised by 2023. Fuel-cell vehicles will also play a role in GM's future, the company said.

Buick Adam a reality after all... but only in China

Mon, 03 Mar 2014General Motors may have parred down its brand portfolio, but it still has more under its umbrella than most. That's why, while a company like Ford might market the same vehicle under its own name in markets around the world, GM uses different brands in different markets. But no two are aligned quite as closely as Opel in Europe and Buick in the United States and China.

What we know here as the Buick Regal is sold overseas as the Opel Insignia. Our Encore is their Mokka. Verano? Astra sedan. But one thing we don't get here is the Opel Adam. The diminutive city car is GM's take on the Mini Cooper, Fiat 500, Citroën DS3 et al. Launched at the 2012 Paris Motor Show, the Opel Adam is named after the company's founder (like an ironic thumbing of the nose to the Ferrari Enzo). But while it's sold, like most Opels, in the UK as a Vauxhall, the prospect of it porting over to Buick seems slim to none. Right?

Sorta. While the Adam isn't likely to come Stateside, the latest reports (as yet unconfirmed by GM) suggest that The General is planning to sell the Adam in China where the Buick brand is also a strong seller. Local production could ensue, with prices targeting the Fiat 500 and engines - according to CarNewsChina.com - to include inline-fours displacing 1.2 and 1.4 liters with 69 and 100 horsepower, respectively.