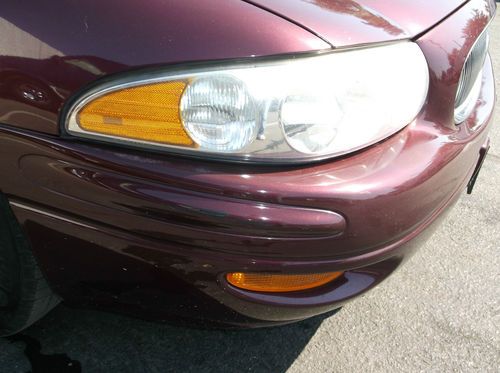

2004 Buick Lesabre, No Reserve on 2040-cars

Orange, California, United States

Body Type:Sedan

Engine:6Cyl

Vehicle Title:Clear

Fuel Type:Gasoline

Interior Color: Gray

Make: Buick

Number of Cylinders: 6

Model: LeSabre

Trim: Sedan

Warranty: Vehicle does NOT have an existing warranty

Drive Type: unknown

Mileage: 145,202

Exterior Color: Red

Buick LeSabre for Sale

2002 buick lesabre custom 6-passenger alloy wheels 39k texas direct auto(US $7,980.00)

2002 buick lesabre custom 6-passenger alloy wheels 39k texas direct auto(US $7,980.00) 1963 buick lesabre 2dr sedan wildcat 410 nailhead hot rat street rod gasser 62(US $2,500.00)

1963 buick lesabre 2dr sedan wildcat 410 nailhead hot rat street rod gasser 62(US $2,500.00) 1999 buick le sabre nr(US $3,300.00)

1999 buick le sabre nr(US $3,300.00) 1 owner new car trade low miles 78000miles 78000miles 78000miles warrantee(US $3,950.00)

1 owner new car trade low miles 78000miles 78000miles 78000miles warrantee(US $3,950.00) No reserve! buick lesabre v6 sedan

No reserve! buick lesabre v6 sedan 2005 buick lesabre custom sedan 4-door 3.8l

2005 buick lesabre custom sedan 4-door 3.8l

Auto Services in California

Z Best Auto Sales ★★★★★

Woodland Hills Imports ★★★★★

Woodcrest Auto Service ★★★★★

Western Tire Co ★★★★★

Western Muffler ★★★★★

Western Motors ★★★★★

Auto blog

1969 Chevrolet Chevelle vs 1987 Buick GNX in Generation Gap showdown

Wed, 15 Oct 2014Generation Gap generally tries to adhere to a theme for each episode, and for the final video from the Lingenfelter collection, the series might have its best idea yet - limited-production muscle cars from General Motors.

On one side you get a 1969 Chevrolet Chevelle COPO, and it's an absolute sleeper. Other than the SS wheels, this classic coupe looks practically bone stock, at least until the engine fires up. Under the hood is a 427-cubic-inch (7.0-liter) V8 making a claimed 425 horsepower and 460 pound-feet of torque. This was the sole year for the COPO package on the Chevelle, and Chevy only made about 323 of them.

The Chevelle's challenger is almost as rare and arguably just as cool. The 1987 Buick Grand National GNX looks just as mean today as when new. It eschews a traditional muscular V8 in favor of a 3.8-liter turbo V6 making a claimed 276 hp and 360 lb-ft, although that number is supposedly a bit underrated. Also, just 547 examples of the GNX version were ever built making it quite a collector's item too.

Buick Enspire EV crossover concept claims 370 miles of range

Tue, Apr 17 2018For the Beijing Auto Show, Buick is showing yet another crossover, this one in concept form. It's called the Buick Enspire, and unlike the rest of the brand's crossovers, this one is all electric. It's more than just a repurposed Bolt EV, too. Instead of the Bolt's 150 kW and 200-horsepower motor, the Buick has a 410 kW motor, which equates to 550 horsepower. Buick claims the motor will get the crossover to 60 mph in just 4 seconds. The Enspire isn't all about performance, though. It would also have a very healthy claimed range of 370 miles, topping that of the longest-range Tesla. Fast charging is supported, with Buick saying it can recover 80 percent of its charge within 40 minutes, though the company doesn't say how potent the charger used for that number is. It also apparently has support for wireless charging. This Enspire concept is rather pleasant looking, too. It has smooth, elegant curves draped on a body with a very wide, aggressive stance. The grille is an interesting evolution of Buick's current design, exaggerating the current crossbar into large wings that spread into the lights, and trading the vertical slats of the main grille for a solid illuminated insert. The rear taillights are also distinctive in how they comprise one long, slender line that form a pseudo spoiler in the rear hatch. The interior is plenty swoopy, too, with a number of futuristic touches. It has an OLED touchscreen for infotainment, and the windshield features augmented reality capabilities displaying road information and navigation routes. Luxury touches include real wood arm rests and center console. Whether we'll see a production Buick with the capabilities of the Enspire is anyone's guess. Surely to have that level of power and range would make it immensely expensive, similar to or surpassing the Tesla Model S and the Jaguar I-Pace. That would be rarefied air for Buick. But we wouldn't be surprised to see either an all-new crossover, or a redesigned current model, sporting the designs seen on this concept. And many of the cues will likely spill over to other Buick products. And while the performance seen in this concept might not reach production, we also wouldn't rule out an electric Buick of some sort, probably a crossover in the near future. General Motors has made it very clear it's going to push electric vehicle development, and a Buick crossover would be a good choice for a few reasons.

Paul and Todd from Everyday Driver | Autoblog Podcast #477

Thu, May 26 2016Episode #477 of the Autoblog Podcast is here. This week, Dan Roth is joined by guests Paul Schmucker and Todd Deeken of Everyday Driver to talk cars, podcasting, and more. It's a freewheeling chat, and it all starts with the Autoblog Garage - check it out! Check out the rundown with times for topics, and thanks for listening! Autoblog Podcast #477 The video meant to be presented here is no longer available. Sorry for the inconvenience. Topics EveryDay Driver In The Autoblog Garage 2016 Buick Cascada Ford Mustang Boss 302 vs. Shelby GT350 Hosts: Dan Roth Guests: Paul Schmucker, Todd Deeken Total Duration: 01:08:20 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Feedback Email – Podcast at Autoblog dot com Review the show in iTunes Podcasts Buick Ford buick cascada cascada